Thoughts For Thursday: Lift Me Higher

Jerome Powell's remarks on Wednesday that the Fed would consider entertaining a slower pace to interest rate hikes was music to investors' ears and lifted the market higher.

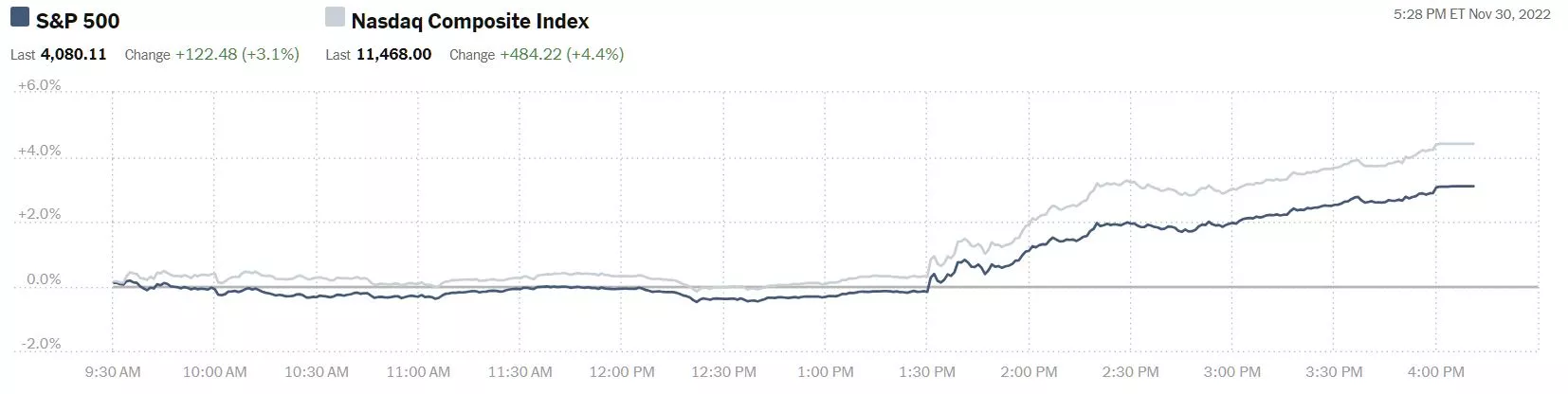

The S&P 500 climbed 3.1% yesterday, closing at 4,080, up 122 points, the Dow rose 2.2% to close at 34,590, up 737 points and the Nasdaq Composite traversed upwards 4.4% to close 484 points north at 11,468.

Chart: The New York Times

The top gainers for the day were led by Estee Lauder (EL), + 9.7%, Netflix (NFLX), + 8.7%, and Hewlett Packard Enterprise (HPE), + 8.5%.

Chart: The New York Times

Morning trading has S&P 500 market futures down 2 points, Dow market futures down 48 points and Nasdaq 100 market futures down 18 points.

In an Editor's Choice column for TalkMarkets, contributor Dr. Duru writes the Stock Market Loves Powell Moving From “Keep At It” To “Stay The Course” On Fighting Inflation.

"Taking on the toughest inflation-fighting tone he could muster, Powell concluded by proclaiming “we will keep at it until we are confident the job is done.” The S&P 500 (SPY) promptly dropped 3.4% on the day. The message was so harsh that it almost took two months for the stock market to bottom out.

Fast-forward to Powell’s speech November 30th titled “Inflation and the Labor Market” at the Hutchins Center on Fiscal and Monetary Policy, Brookings Institution in Washington, D.C. Powell concluded by proclaiming “we will stay the course until the job is done.” The S&P 500 promptly rallied 3.1% on the day. The move was bullish enough to close the index above its 200-day moving average (DMA) for the first time in almost 8 months. The S&P 500 also closed above the May, 2021 low. Something about the difference between “keep at it” and “stay the course” significantly mattered to traders!"

"If not for the stock market’s reaction, I would have interpreted Powell’s speech to land somewhere between hawkish as ever and no new information. In fact, there were several key points from the speech which should have told the market the Fed is as serious as ever about sustaining an extended fight against inflation (the following are direct quotes unless otherwise indicated; particularly important quotes in bold):

- It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high.

- So when will inflation come down? I could answer this question by pointing to the inflation forecasts of private-sector forecasters or of FOMC participant…But forecasts have been predicting just such…a decline for more than a year, while inflation has moved stubbornly sideways.

- It seems to me likely that the ultimate level of rates will need to be somewhat higher than thought at the time of the September meeting and Summary of Economic Projections. (a reiteration from the November monetary policy meeting)

- Restoring [supply and demand] balance is likely to require a sustained period of below-trend growth. (another reiteration)

- Despite the tighter policy and slower growth over the past year, we have not seen clear progress on slowing inflation.

- It is far too early to declare goods inflation vanquished, but if current trends continue, goods prices should begin to exert downward pressure on overall inflation in coming months. (the stock market must have focused on this claim)

- As long as new lease inflation keeps falling, we would expect housing services inflation to begin falling sometime next year. Indeed, a decline in this inflation underlies most forecasts of declining inflation. (in other words, this claim is old news)

- We can see that a significant and persistent labor supply shortfall opened up during the pandemic—a shortfall that appears unlikely to fully close anytime soon. (the stock market clearly did not hear this)

- The labor market, which is especially important for inflation in core services ex housing, shows only tentative signs of rebalancing, and wage growth remains well above levels that would be consistent with 2 percent inflation over time. (in other words the job market is at risk of sustaining high rates of inflation)

- Despite some promising developments, we have a long way to go in restoring price stability.

- It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting. (this is another reiteration, but the stock market seemed to treat this as welcome new news)"

See Duru's full article for additional insights.

Contributor Joe Perry looks at the Fed Chair's remarks from a Forex perspective in Powell's Brooking Institute Speech Is A Dovish Version Of His November 2nd FOMC Press Conference.

"Powell repeated many of the same comments from November 2nd while adding that “the time for moderating the pace of rate hike increases may come as soon as the December meeting”. This was now seen as dovish, as Powell is basically telling the markets that the FOMC will “only” hike by 50bps in December. This was the unofficial pivot the markets have been waiting for. "

"In addition, Powell added that “relying less on forecasts means doing more risk management and slowing down rate rises at this point is a good way to balance the risks of overdoing hikes.” He added, “ we don’t want to overtighten, which is why we are slowing down.” But “cutting rates is not something we want to do soon.”

As a result of Powell’s dovishness, the US Dollar Index sold off aggressively. Before Powell began speaking, the DXY was trading near 107. An hour and a half later, the DXY was trading below 106."

Getting technical, contributor Jesse Felder rhetorically asks Who Says ‘You Can’t Time The Market’?

"...there is one market timing tool in particular that long-term investors should pay close attention to and that is the Coppock Curve...

the Coppock Curve (sometimes called the Coppock Guide) really shines, in helping long-term investors determine when it is an opportune time to get aggressive in the equity market. My friend Jim Stack of InvesTech Research recently wrote about its usefulness:

This indicator has a remarkable 100+ year track record when it comes to signaling the start of a new bull market for stocks. And it is one of the few technical tools that would have kept anxious investors from stepping prematurely into the middle of the 1929-1932 record stock market decline… Coppock Guide buy signals are marked by upturns from readings at or below zero. And often the more negative the reading when it turns upward, the more impressive the profits ahead. Using these guidelines has confirmed practically every major bull market run since 1920, with just two false signals given in 1941 and November 2001.

While it is true that timing stock market peaks may be more difficult, once a bear market has begun, investors using the Coppock Curve at almost any point in time over the past century would have largely been successful in timing major stock market bottoms.

For this reason, it is noteworthy that the Coppock Curve broke below the zero line back in September. Moreover, it is unlikely to form a bottom and curl higher for at least a few more months. Even if the current rally were to continue higher the Coppock Curve likely wouldn’t itself reverse higher before February. And if the rally rolls over once again, it will push the upturn in the indicator out even further. In short, the grieving process for Mr. Market (over the loss of massive monetary stimulus) may take a bit longer than bullish investors today might hope."

That last comment is a fine segue to TM contributor Moe Zulfiqar's column, U.S. Economy Outlook For 2023: Severe Recession Could Be Looming.

"Warning: the U.S. economy is in dangerous territory. A severe recession could be just around the corner. Don’t be shocked if 2023 goes down in the books as a year with one of the sharpest declines in growth that the U.S. economy has ever seen. Obviously, this is bad news for investors, so later I’ll discuss how to protect your savings."

"(The) one economic indicator that shouldn’t be overlooked: yield curve. This indicator essentially shows us how the yields on long-term and short-term bonds look...

The difference in yield between the 10-year bond and the three-month bond is the lowest it has been since the early 2000s. This yield curve is extremely inverted, and since this type of indicator has a very good track record in forecasting recessions, it would be foolish to overlook it.

Chart courtesy of Stockcharts.com

The yield curve says an economic slowdown like the Great Recession of 2007–2009 could become a reality for the U.S. economy in 2023.

In 2022, the U.S. economy saw lots of deceleration. In 2023, the economy could enter a deterioration stage. This stage is when we would see mass layoffs, dismal consumer spending, pessimistic businesses, and so on. This is essentially what the Federal Reserve could be wishing for. Why? Because it could be the only way to curb the inflation that’s been sticking around. When demand is destroyed, inflation eventually gets under control...

For the fourth quarter of 2022, Wall Street analysts expect the earnings of S&P 500 companies to decline by 2.1%. For the entire year of 2023, analysts expect S&P 500 companies to report earnings growth of just 1.6%. (Source: “Earnings Insight,” Factset Research Systems Inc., November 18, 2022.)

Note that Wall Street analysts tend to be optimistic with their estimates, so these estimates could go down within a few months.

Moreover, the bond market could become an interesting place. Bond investors seem to be running with the idea that interest rates won’t remain high for long. But short-term interest rates are seeing black swan event-like activity.

As all this materializes, it’s important that investors don’t get complacent. They should continue to focus on preserving capital, be selective when it comes to picking investments, and have stop-losses in place to protect against bigger losses."

Before closing out the column for today, there's time for a stop in the "Where To Invest Department", where we find contributor Keith Park discussing his Recent Stock Purchase November 2022.

"As you know by now I make a stock purchase every single month no matter what is going on in the world and despite the doom and gloom headlines...I know the only thing in my power is to dollar cost average into my positions buying at near all-time highs while also buying during big-time swoons and staying diversified to mitigate those dividend cuts we have all become familiar with. With that being said, and sticking to my November 2022 stock considerations, I continued to nibble and add to my portfolio:

| Date | Symbol | Description | Quantity | Price | Amount |

|---|---|---|---|---|---|

| 11/28/2022 | VZ | VERIZON COMMUNICATIONS | 13.0514 | $38.31 | -$500.00 |

Clearly, I went very small in November. First, I’m trying to build up a larger cash position for future potential buys, and second, the market has really roared back over the last thirty days making some stocks on my November watch list like Starbucks Corporation (SBUX) and Microsoft Corporation (MSFT) look less appealing. Going into December it looks like I’ll continue to nibble on VZ and maybe some T as well."

Caveat Emptor.

I'll be back on Tuesday.

Have a good one.

More By This Author:

TalkMarkets Image Library

Tuesday Talk: Kryptonite and Cannabis

Thoughts For Thursday: Gobble And Squawk From The Fed