Thoughts For Thursday: A Day For Gratitude And Rest (And Activism)

Today is Thanksgiving in America. It is a day of gratitude, family time, reflection and rest; take time to attend to all four. US markets are closed.

Wednesday the markets ended only slightly changed from the open. The S&P 500 closed at 4,701, up 11 points, the Dow closed at 35,804, down 9 points, and the Nasdaq Composite closed at 15,845, up 70 points. In the past month the S&P has gained 113 points, the Dow has gained 63 points, and the Nasdaq Composite has gained 459 points.

Yesterday's top gainers were in tech, equipment, bio-tech, online retail, and energy.

Chart: The New York Times

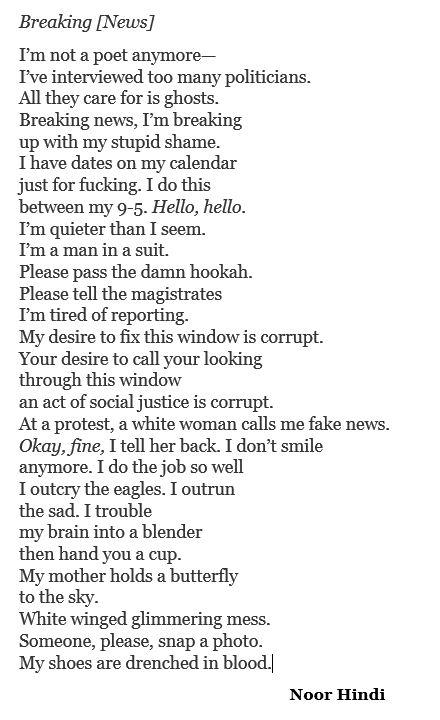

TalkMarkets contributor James Picerno writing in an Editor's Choice piece about the stock market, The US Stock Market’s Epic Recovery Is A Sight To Behold, is in a festive mood.

"Economic recoveries routinely fuel bull markets in stocks, but almost no one expected this. The S&P 500 Index’s rebound since the economy began to emerge from recession in May 2020 has been, well, epic. To be precise, the current bounce has so far outpaced the previous seven market recoveries during economic expansions since 1970."

"It’s anyone’s guess how long this bull can run, but at the moment it’s unusually strong. Equities are up more than 61% in the current expansion. The next-strongest rise at this stage in the recovery (19 months and counting) is a distant 39.9% (posted during the recovery following the 2008-2009 recession). The astonishing gain to date in the stock market is an upside outlier in the extreme, but it’s not unusual relative to gains in employment, retail sales and industrial production to date in the current expansion."

"(Still)...the first (and last) question: Is there a recession on the horizon? (The answer is) No, although saying so with a high level of confidence restricts us to look only a few months into the future, at most. Beyond that, we’re flying blind, as always. For what it’s worth, Mr. Market isn’t worried, at least not as of yesterday’s close."

Jill Mislinski taking note of the latest Michigan Consumer Sentiment (Survey): Less Optimism In November finds that data, though close to forecast, is lower than October.

"The November Final Report came in at 67.4, down 4.3 (6%) from the October Final. Investing.com had forecast 66.8."

"For the sake of comparison, here is a chart of the Conference Board's Consumer Confidence Index (monthly update here). The Conference Board Index is the more volatile of the two, but the broad pattern and general trends have been remarkably similar to the Michigan Index."

"(In addition) the prevailing mood of the Michigan survey is also similar to the mood of small business owners, as captured by the NFIB Business Optimism Index (monthly update here)."

So no recession signals, but some hesitation going into the holiday shopping season.

The US Dollar, Crypto and Gold have all become more intertwined in 2021 for better or for worse.

Contributor Benson Toti writing in an article entitled Dollar Strengthens As FOMC Minutes Show A More Hawkish Fed, notes that the dollar continues to be strong against it major sister currencies.

"The dollar has been strong over the past few weeks, regaining the upper hand against its peers as inflation concerns slackened risk-on appetite (UUP). On Wednesday, the currency hit highs last seen in 2017 against the yen and firmed to a mark last seen in 2020 against the euro. The dollar is largely unchanged against the yen at 115.360 and remains close to the peak of 115.525 reached on Wednesday and which highlights the yen’s weakest point against the greenback since January 2017 (FXY).

The euro is slightly up against the US dollar, currently poised around $1.122. However, the eurozone currency needs to add to the upside to avoid a retest of overnight lows of $1.118, which is the lowest the currency has reached in the past 17 months (FXE). The sterling meanwhile saw an uptick in early exchanges on Thursday after also dipping against the US dollar on Wednesday. The GBP was up 0.17% at 0830 GMT to $1.355, away from an 11-month low of $1.332 the previous day. (FXB)"

Image Source: Pixabay

During the past month there has been a lot of attention paid to the new Bitcoin (BITCOMP) ETFs which have started trading in the U.S., however contributor Andrew Throuvalas notes that while there are currently no Ethereum (ETH-X) ETFs available in the U.S., there are several operating in foreign markets. In his article Is There An Ethereum ETF?, Throuvalas presents investors with three opportunities.

"Here are some options for investors looking to add Ether to their portfolio as easily as they would a stock.

CI Galaxy Ethereum ETF

- Location: Canada

Ticker: ETHX

CI Global Asset Management launched the world’s first Ether ETF in Canada on April 20th, 2021. This was just two months after the launch of the world’s first Bitcoin ETF in the same country. It currently trades on the Toronto Stock Exchange.

The ETF is backed by direct Ether holdings, held by Galaxy Digital Asset Management. The price of each share readjusts at the end of each day, based on the Bloomberg Galaxy Ethereum Index. This makes Galaxy’s product a “spot” ETF, which is generally preferred by investors over futures products.

WisdomTree Ethereum ETP

- Location: Europe

- Ticker: WETH GY / ETHW SW

WisdomTree launched a spot-based Ethereum ETF for European investors, shortly after Evolve launched in Canada. It is listed in Euros on the Deutsche Börse Xetra (WETH GY), and in Euros + USD on SIX Swiss Exchange (ETHW SW).

Each share is backed by exactly 0.01 ETH, held by Swiss bank Quote and Coinbase Custody. It comes with an expense fee of less than 0.95%.

Evolve Cryptocurrencies ETF

- Location: Canada

Ticker: ETC

Evolve launched a unique multi-crypto investment vehicle in July of this year. Their multi-crypto ETF gives holders exposure to a combination of both Bitcoin and Ethereum. Trading on the Toronto Stock Exchange, it backs its holdings using shares of Evolve’s existing Bitcoin and Ethereum spot ETFs.

The product doesn’t provide a 50/50 split, but rather weighs its BTC/ ETH holdings based on each crypto’s current market cap weightings. Ethereum currently has slightly less than half of Bitcoin’s market cap, so the ETF is backed by roughly one-third Ethereum, and two-thirds Bitcoin."

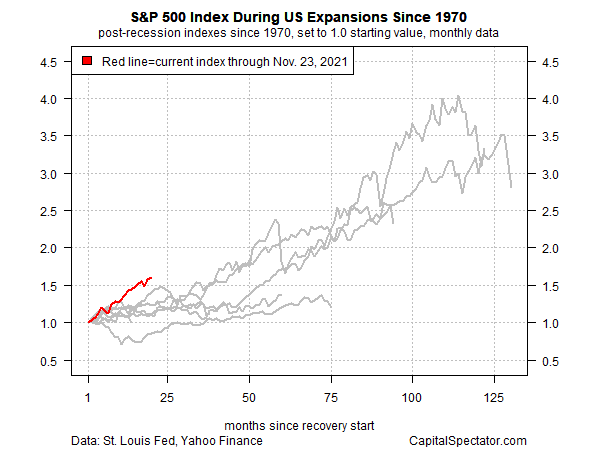

In a TalkMarkets exclusive contributor Taki Tsaklanos details 3 Reasons Why Gold Will Be Shining Soon.

Image Source: Pixabay

"If anything, the 2021 gold market was characterized by a heavy pushback of the US Dollar. It might be that the USD has ‘only’ risen 6% this year but it appeared to be more than enough to hold gold ‘down’."

"...We conclude that the USD will continue to push back precious metals until it decelerates or turns flat...We expect this to start in the first half of 2022... That’s when we expect gold to finally take off...We expect this to start in the first half of 2022."

"Driver #1: USD

First, as said, the US Dollar needs to calm down. It has a very bullish setup as seen on the daily chart.

The USD is likely on a mission to move to 100 points (approx.) where it should start decelerating. We expect a similar outcome as in 2019: after a fast rise of the USD it started decelerating its uptrend. That’s when precious metals started shining, but not before.

Driver #2: Gold chart patterns

Second, the gold chart itself has lots of valuable information.

The daily gold chart on one year shows a trendless gold market. There is nothing exciting to see here. Right?

Well, not too fast, we like the higher lows on this chart. This sets the stage for exciting things to happen in the future provided the series of higher lows continues.

There is still work to do (by the market, not by us) before a bull run can start. It will take a few months is our best guess. But everything is lined up for a gold bull run in 2022.

Do we see a huge cup and handle formation on the monthly chart? Yes, we do!

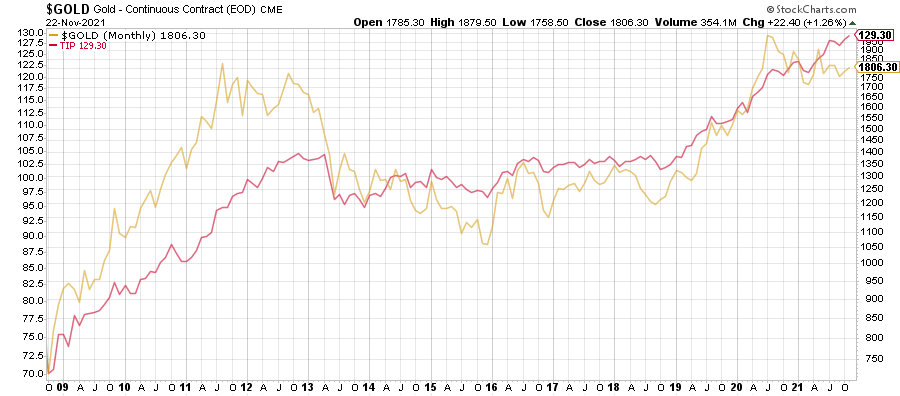

Driver #3: Monetary inflation

Third, other than the gold chart patterns and the influence of the USD we also see a driver for gold in the field of inflation. We do realize that ‘inflation‘ is a very loaded word. Moreover, it can be interpreted in different ways.

We look at the correlation between inflation expectations (as per TIP) and the gold price. Both are set to move higher as per the current chart readings on the long-term chart.

More importantly, according to us, is monetary inflation. We depict M2 on the next chart which got a serious boost last year and continues to rise. Gold is positively correlated to M2. Any divergence between M2 and the price of gold over the long term was short-lived. We expect this correlation to drive gold higher in 2022.

Tsaklanos has several additional back-up charts in the article as well as an analysis of the gold and silver mining sector.

As always, Caveat Emptor.

Image via Bing

In addition to Thanksgiving, this November 25 is also, the International Day for the Elimination of Violence against Women. Many cities and local communities around the world are holding activities to "raise awareness of the fact that women around the world are subject to rape, domestic violence and other forms of violence; furthermore, one of the aims of the day is to highlight that the scale and true nature of the issue is often hidden." If family members invite you to participate, please consider doing so.

In the spirit of this day I leave you with this poem from Poet Noor Hindi.