This Week’s Economic Indicators - Monday, September 16

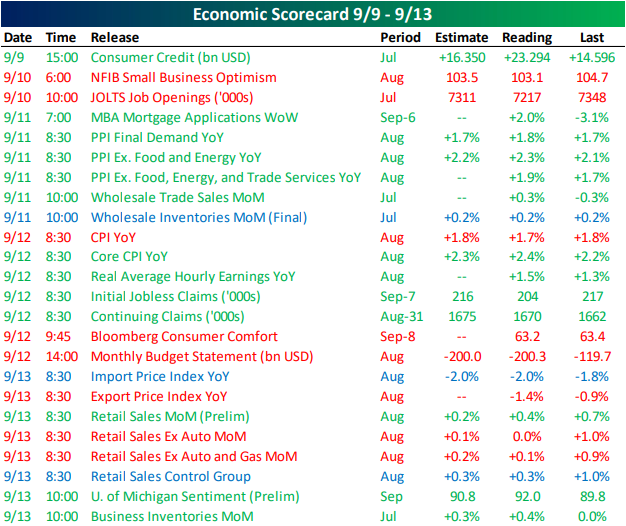

Last week was a solid one in economic data as a majority of US releases improved from the previous period or were better than forecasts were predicting. The only release on Monday was data on consumer credit for July which was much stronger than expected thanks to credit card spending. Tuesday’s JOLTS report and NFIB Small Business Optimism were both forecasted to weaken from the prior month’s release. Actual results were even weaker than these expectations. Despite the weaker JOLTS report, other labor data improved with NFIB data showing a record percentage of businesses reporting quality labor hard to find and NSA jobless claims at a 50-year low. Last week also saw multiple inflation releases including PPI, CPI, and export/import prices. While PPI was stronger than expected across the board, headline CPI was 0.1% below expectations, but core CPI remains solid at 2.4% (above forecasts of 2.3%). Export and import prices, on the other hand, remain in negative territory. Retail sales, released Friday, beat on the headline number but missed when removing auto and gas sales.

(Click on image to enlarge)

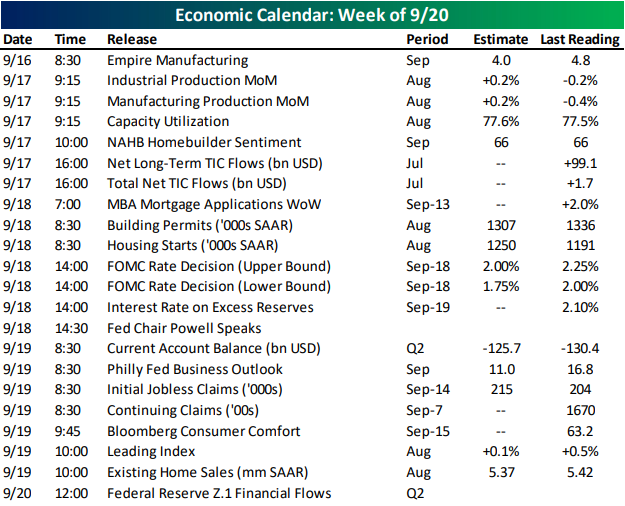

Turning to this week, it is another light start to the week with only Empire Manufacturing released today. The gauge on New York state manufacturing fell to 2.0 which is below both expectations (4.0) and the August reading (4.8). Still to come in manufacturing data this week is the Philadelphia Fed’s index (scheduled for Thursday) and Industrial Production tomorrow. As with the New York Fed’s index, the Philly Fed’s data is also expected to show weaker manufacturing activity in September which contrasts the stronger forecasts for Tuesday’s manufacturing data. A number of housing data points are also penciled in for this week including NAHB Homebuilder Sentiment, weekly mortgage applications, starts and permits, and existing home sales.

Following last week’s rate decision from the ECB, which saw rates cut in addition to a resumption of quantitative easing, on Wednesday markets will get an update on US monetary policy with the FOMC’s rate decision. The market is anticipating a second straight 25 bps cut to the lower and upper bound. Fed Chair Powell will also have a presser half an hour after the release of this rate decision. Although these Fed developments are likely to overshadow economic data, this week will also see the release of the Leading Index for August as well as the second quarter’s current account and the Fed’s Z.1 Financial Flows Report.

(Click on image to enlarge)

Disclaimer: Read our full disclaimer here.