This Week’s Economic Indicators - Monday, Jan. 14

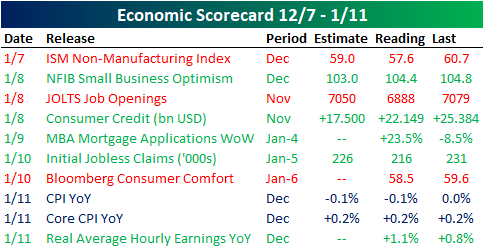

Last week was pretty quiet for economic data with only 10 releases scattered throughout. ISM Non-Manufacturing kicked off the week with a decline and a miss that was actually fairly benign on its own but added to the significant decline in the composite ISM index. Tuesday saw small business optimism beat while the JOLTS report saw a modest pullback. Consumer credit also released later that day lower than the previous period but above expectations. The weekly mortgage applications data from the Mortgage Bankers Association was the sole release on Wednesday which showed a significant expansion. Thursday was again a light day with just two weekly indicators (jobless claims and consumer comfort). CPI capped off the week with a release in line with forecasts for both the headline and core numbers.

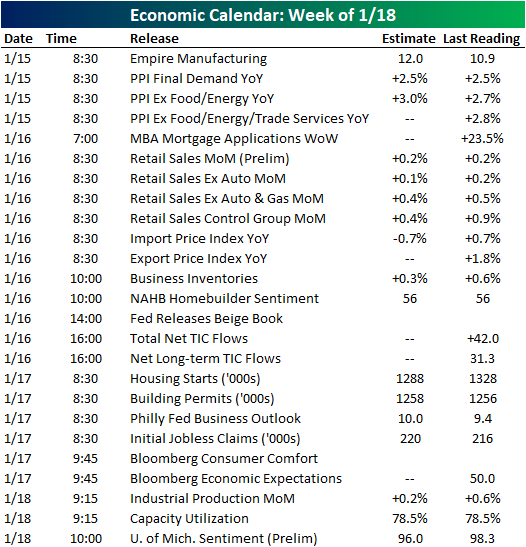

Turing to this week, activity picks back up with the heaviest week so far this year. Granted, that is assuming the government reopens and allows all of these indicators to see the light of day. If all goes as scheduled, there will be no releases today but tomorrow morning we will get Empire Manufacturing and further inflation data with PPI for December. Despite weak ISM and regional Fed data recently, Empire Manufacturing is expecting an uptick. Wednesday will be the busiest day of the week with 12 releases scheduled. Retail sales will be a widely watched indicator to get a read on this year’s holiday sales; though this too will likely be delayed due to the government shutdown. Continuing Wednesday’s slew of data will be import/export prices, the NAHB homebuilder sentiment, Fed’s Beige Book, and Treasury TIC flows. Thursday we will get further housing data with housing starts and permits. Whereas starts are expected to decline, permits are forecast to come in slightly higher from last month. The Philly Fed’s Business Outlook will also release that morning, and much like Empire Manufacturing is expecting a slight increase in activity. The week will end with industrial production data and preliminary University of Michigan sentiment; both looking to come in lower.

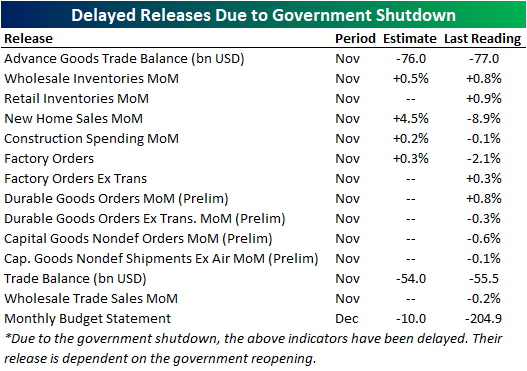

If you haven’t been able to tell yet, one of the areas the government shutdown has hit has been economic data. The current government shutdown is now the longest in history, and since it began on December 22nd, there have been 14 economic releases that have been delayed. Below we list out all of the indicators that were scheduled to come out since the shutdown began but have been delayed due to a lack of funding for the agencies in charge of the release. The shutdown of the Census Bureau has had the largest impact. With the exception of the monthly budget statement, which comes out of the Treasury, all of the below indicators are products of the Census Bureau.

As we previously mentioned, the shutdown has reached historic lengths, and as a result, has now gone on long enough to affect both preliminary and final data points. That is the case for trade balance, wholesale inventories, and factory orders/goods orders which were supposed to have their final versions released last week. As for this week, retail sales, business inventories, TIC flows, housing starts, and permits could all have the potential to join this list. Fortunately, government-independent agencies (such as the Fed and Bloomberg) along with some government organizations that have secured funding will continue to provide investors with data. For example, the Bureau of Labor Statistics is funded through September—which is why we have seen inflation data—so government data is not completely absent for the time being.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more