This Week In Cryptocurrency - Friday, May 17

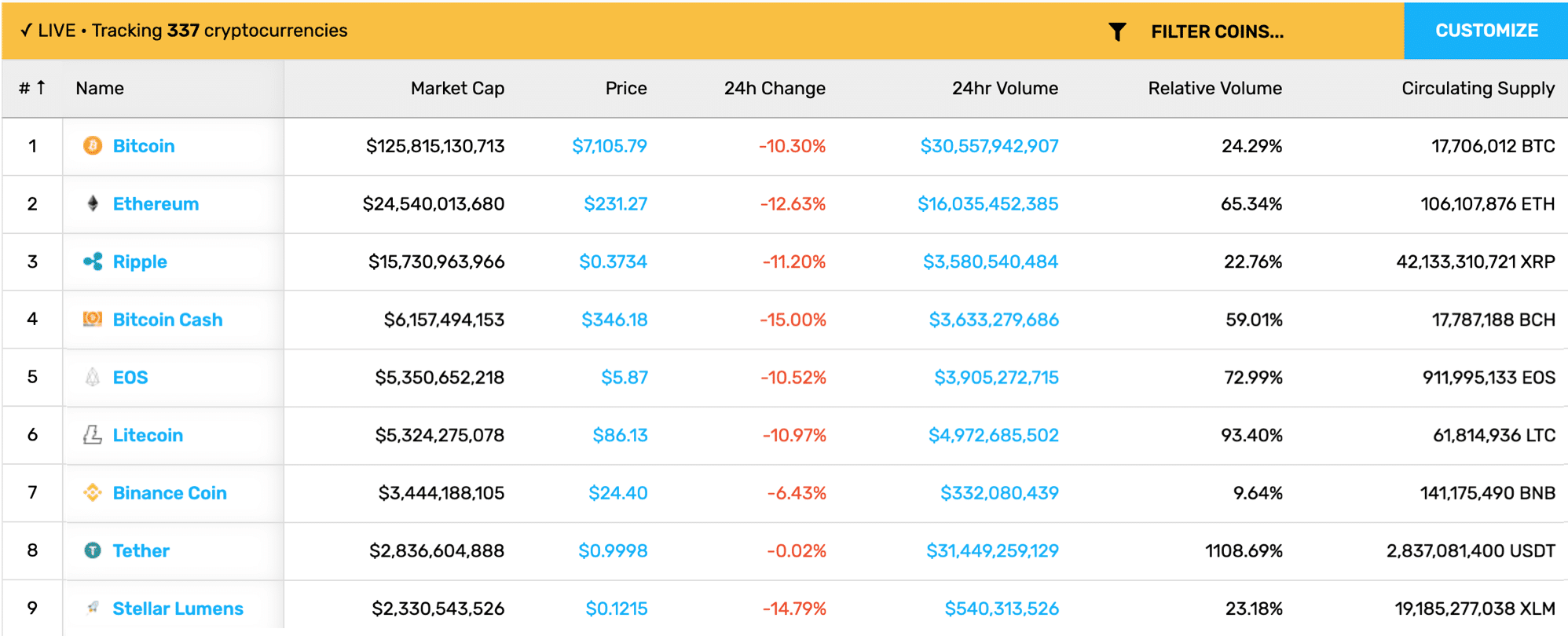

Outside of a substantial pullback in the past 24 hours, cryptocurrency markets experienced considerable gains over the last week.

On the week, Bitcoin is up 13%, Ethereum up 34%, XRP up 24%, Binance Coin up 27%, Stellar up 31%, Monero up 18%, IOTA up 35%, NEM exploded 72%, Verge up 38%, and most other tokens were up double-digit percentages.

The cause of growth, however, isn’t certain. Some hypothesize the spike was due to the traditional New York Blockchain Week spike, others put on their make-believe economist hat and argued it was due to the escalating trade war between the United States and China, whereas some credited Facebook’s potential stablecoin.

(Click on image to enlarge)

Bitcoin ETFs on the Horizon?: On Monday, SEC Commissioner Hester Peirce spoke about the current regulatory climate for Bitcoin ETFs, highlighting her dissatisfaction with the SEC’s lack of regulatory frameworks for cryptocurrency. SHe was quoted saying “I thought the time was right a year ago — even longer than that … My first chance to comment on it was a year ago … Certainly, the time is right, but there are still questions floating around the SEC that need to be answered as much as possible by you all.” There are currently three ETFs at the top of the food chain:

- Bitwise Bitcoin ETF (August 14) filed by NYSE Arca Inc.

- Vaneck Solidx Bitcoin ETF (May 21) filed by Cboe BZX Exchange Inc.

- Crescent Crypto Index Fund (no review date) just filed by United States Commodity Index Funds Trust.

Amazon’s Crypto Patent Spurs Whispers of Integration: Amazon recently filed a patent that has to do with cryptographic proof-of-work, and some of the crypto community is riled up in what might be too preliminary excitement. Although many people are hoping (*praying*) Amazon will integrate Bitcoin for its over 100 million shoppers, the patent seems to focus on mitigating malicious denial-of-service attacks using some sort of proof-of-stake mechanism to disincentivize the attack.

Coinbase CEO Waxes Optimism on Institutional Crypto Investing: Brian Armstrong, CEO of Coinbase, stated his beliefs that investments in the cryptocurrency space will grow due to a surge of institutional. He utilized the example of how his company Coinbase Custody was able to gather $1 billion in assets under management in twelve months since its launch. As for the top of the digital asset lists? Armstrong points to BTC.