This Was No Depression

The economy is being faced with doubly good news. First, uncertainty over COVID-19 is falling as Pfizer’s vaccines will start going out to workers on the frontlines (in hospitals) in December. The possibility of COVID-19 being a problem for several years is minimal. Furthermore, the bear case isn’t that bearish. The worst possibility is we get lockdowns for a couple of months and COVID-19 vaccines don’t stop the virus until late in the spring. That’s an order of magnitude better than the fears earlier this year.

U.S. GDP shortfall from GFC vs. estimated loss from the Covid shock - @SoberLook @blackrock pic.twitter.com/A6y7EOyX7m

— Rob Hager (@Rob_Hager) November 23, 2020

As you can see from the chart above, the GDP shortfall under consensus estimates and renewed lockdowns are almost the same. Lockdowns would hurt in the short term, but become a blip once the vaccines are administered. Some feared there would be a depression because of the virus, but instead the lost GDP ground will be less than the prior three recessions. That’s partially because growth is slower now. In recessions, less ground is lost because growth was low anyway. Specifically, the 3-year lost growth ground in the prior three recessions was 5% (early 1990s), 6% (early 2000s), and 8.4% (great financial crisis). The current trend growth is only 2.3%. That being said, losing 2.6% growth ground isn’t bad. That’s because the initial recovery was so strong. We could have another vertical leg up when the economy reopens after the vaccines are given out.

GDP Trajectory vs. Pre-Recession Trends - @SoberLook @TCosterg pic.twitter.com/sERnwScvDl

— Rob Hager (@Rob_Hager) November 23, 2020

Update On The Consumer

According to the National Retail Federation, holiday retail sales growth will be from 3.6% to 5.2%. Obviously, that growth will be driven by online sales. The retail trade group usually makes this forecast at the start of October, but it instead made it this week because of COVID-19 related uncertainty. We think the NRF saw reason to be optimistic in early October, but it didn’t want to be caught being very wrong because the virus caused consumer weakness. It seems the consumer has modestly weakened, but nothing major has happened yet. This won’t be a great holiday season, but it might be considered great considering the headwinds.

Redbook same store sales growth in the week of November 21st was 2.8% which was up from 1.7%. It has been bouncing around in the low single digits for a few weeks. This increase is nothing to get excited about. According to Mastercard, switched volume growth in the US was 7% and 6% in the past 2 weeks. From October 7th to November 21st, growth has pinged between 2% and 8%. There is no clear downtrend in spite of the spike in COVID-19 cases. Further good news is case growth has slowed recently which could mean December won’t be as bad as many feared.

(Click on image to enlarge)

Source: Twitter @LizAnnSonders

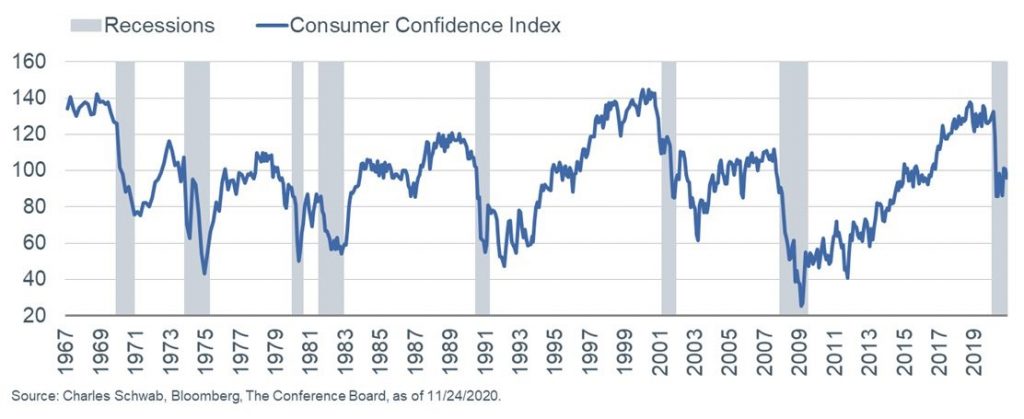

Consumer confidence fell in November because of expectations, but this wasn’t a major decline. It certainly didn’t stop the retail stocks from hitting another record high. Traders don’t care about potential weakness because they are looking at the vaccines. The market will fully price in the vaccines saving the day when they start going out to the general public.

The consumer confidence index fell from 101.4 to 96.1 which missed estimates for 98. The present situation index fell slightly from 106.2 to 105.9. The expectations index fell sharply from 98.2 to 89.5. Consumers don’t have the luxury of looking past the virus-like investors do because they face potential job losses and could lose their pandemic benefits. The net percentage of consumers expecting business conditions to improve in the next 6 months fell from 20.1% to 7.6%. They might be right about the next 2 months because we won’t get to herd immunity by then, but 6 months from now business conditions will be better because COVID-19 will likely be gone.

Working Off Site Isn’t Perfect

For most of 2020, we have heard about the wonders of working from home because avoiding commuting saves time and you can live in a cheaper city since you don’t need to live close to work. If some people leave big cities, it will also be cheaper for the people who stay. Unfortunately, this new normal isn’t perfect.

Pandemic has allowed many workers to relocate, but that doesn’t necessarily mean they keep same paycheck ... as many as 1/3 of those who have moved to less expensive areas may face pay cuts, as per @WTWCorporate survey of hundreds of North American executives @Bloomberg pic.twitter.com/ttyI7P9fqa

— Liz Ann Sonders (@LizAnnSonders) November 23, 2020

As you can see from the chart above, only 61% of employers won’t change pay if the worker moves to a cheaper city. Getting a pay cut after moving away doesn’t make moving away sound as glamourous. Furthermore, it’s possible it will be tougher to compete with in-person colleagues for promotions once the economy reopens. It’s much easier to make personal connections while on location than working remotely. Working from home will be more popular in 2021 than it was in 2019, but this isn’t the paradigm shift some predicted. It was a 1-year adaptation due to an emergency.

Consumers Win Big

The housing market is on fire because of lower rates. That is also providing a big savings boost to homeowners. The K shaped recovery is alive and well as homeowners do well, while renters stay in trouble. Specifically, the chart below shows the median rate of borrowers who refinanced in Q3 fell from 4% to 2.88% which is a 28% decline. That’s about $2,000 in interest savings to U.S. households in the first year and $10,000 over the life of the loan.

Recent refinance borrowers in the US have on average cut their interest rate 28% (e.g. going from 4% to 2.88%) pic.twitter.com/3XfzniS2Ta

— 📈 Len Kiefer 📊 (@lenkiefer) November 23, 2020

These savings are locked in. Even as rates rise next year due to the cyclical recovery, these savings will be maintained. When most people have their jobs back and are earning regular wages, we will see this lower fixed cost shine. Once renters get back on their feet as the leisure and hospitality industry reopens, the consumer will be in great shape. The one worry we have is some retail speculators losing their shirt on bubble stocks.

Conclusion

The COVID-19 recession caused less growth to be lost than in the prior 3 recessions. Consumer expectations fell, but so far spending seems okay. Mastercard growth is solid. Redbook growth is weak, but not faltering. The NRF is downright optimistic about this holiday shopping season. Working remotely could lead to lower pay. Homeowners who refinanced this year won big as their costs are $10,000 lower for the life of their mortgages.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be ...

more