This Formerly Private Lender Just Went Public To Pay You A 10% Yield

A high current yield and monthly dividends are two hot buttons for income focused investors.

In the U.S. most companies pay dividends every quarter, while most of us pay our bills each month. Thus, the three dozen or so stocks that pay monthly dividends get a lot of attention. And of course, with income stocks, the yield is very often your total return, so assuming the dividend is secure, the higher the yield the better. It has been quite a while since I have found a new company that meets both criteria.

Before I tell you about this new monthly dividend income stock, let’s talk about income investing. I work with my Dividend Hunter subscribers to develop what we call the Dividend Hunter mindset. I find that investors buy stocks because of the dividend yields, and then get too wrapped up in the share price action. If you are buying stocks for the dividend income then measuring your income results should be the primary focus, not share price fluctuations.

I recommend having some sort of income tracking system. It may be a spreadsheet, a notebook or an online dividend tracking tool. With an income tracking system, if you see that your income is stable to growing from quarter to quarter, your income stock investments are performing as they should. With this approach, share prices take care of themselves.

In fact, once you start focusing on building your income stream (that you track religiously), it becomes natural to want to buy low and sell high. This is the opposite of what most investors who are pushed by fear and greed do.

The primary analysis metric for dividend paying stocks is to understand how a company generates free cash flow and to check each quarter than enough cash has been generated to support the dividend. This takes some practice, and a different way of looking at income statements.

I know you have read this far to get to the point where I reveal the new high-yield stock. I appreciate your reading through and hope you picked up some new ideas. This is a stock I am adding to my watch list and will be reviewing its earnings results and dividend payments for my subscribers.

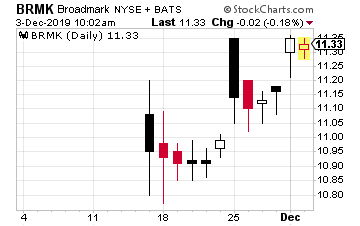

Broadmark Realty Capital Inc. (BRMK) started trading on the stock exchange on November 15, 2019. The company is the result of the merger of Trinity Merger Corp. and the privately held Broadmark real estate lending companies.

Broadmark Realty is an internally managed, commercial finance, real estate investment trust (REIT). At the time of listing on the stock exchange, the company had a $1.5 billion market cap.

Compared to other commercial finance REITs, Broadmark Realty focuses on a different lending niche. It provides shorter term lending for construction loans, rehab/redevelopment loans, land development loans, bridge financing and construction completion loans.

Compared to commercial mortgages, these loan types have much higher interest rates for the borrowers. That means the REIT needs to take on little or no debt to be able to generate a high return on equity and pay dividends to generate an attractive stock yield.

It is also a high loan turnover business. Since its inception in 2010 through June 30, 2019 (as a private lender), Broadmark Realty Capital has originated over 1,000 loans with an aggregate face amount of approximately $2.0 billion. Going public will allow the company to raise more capital and increase its amount of lending.

Management has stated they estimate 2020 dividends to total $1.14 per share. On the current share price, that is right at an 10% yield. They have yet to declare the first monthly dividend, so I suggest waiting to verify the monthly rate is close to 9.5 cents per share before you start to accumulate shares of BRMK.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more