This (Completely Reasonable) Change In Investor Behavior Would Send Gold To The Moon

Mark Mobius took over for the legendary John Templeton at Franklin Templeton’s Emerging Markets Fund back in the 1980s, and filled those big shoes well for three decades. Now running his own shop, he recently made what seems like a completely reasonable suggestion about gold — one that if adopted by the broader investment community would send the metal’s price to the moon:

Gold Bull Mobius Says Every Portfolio Needs at Least 10%

(Bloomberg) — Veteran investor Mark Mobius says that gold’s set to push higher, potentially topping $1,500 an ounce, as interest rates head lower, central banks extend purchases, and uncertainty surrounding geopolitics and cryptocurrencies fans demand.“I love gold,” Mobius, who set up Mobius Capital Partners LLP last year after three decades at Franklin Templeton Investments, said in an interview in Singapore, adding bullion should always form part of a portfolio, with a holding of at least 10%. “As these interest rates come down, where do you go?”

Gold has rallied in 2019, rising to the highest level in six years, as investors contemplate slowing economic growth, prospects for easier monetary policy in the U.S. and Europe and festering trade frictions.

The upswing has been given added momentum as central banks, including authorities in Russia and China, step up purchases. A revival in cryptocurrencies may lead to spillover demand from investors for the older haven, according to Mobius. “Interest rates are going so low, particularly now in Europe,” he said. “What’s the sense of holding euro when you get a negative rate? You might as well put it into gold, because gold is a much better currency.”

Two points about Mobius’ suggestion that most portfolios should be 10% allocated to gold:

First, the idea of replacing dollar cash with a historically better-performing store of wealth seems like a no-brainer in a world of soaring fiat currency debt and plunging interest rates.

Second and vastly more interesting, the current allocation to gold in the financial world is about 1% of total investable capital, so moving from here to 10% would produce spectacular price gains for gold. If it’s even possible, which it might not be: Most current demand for physical metal is from the Chinese and Russian central banks, which presumably won’t be selling their reserves to investors anytime soon.

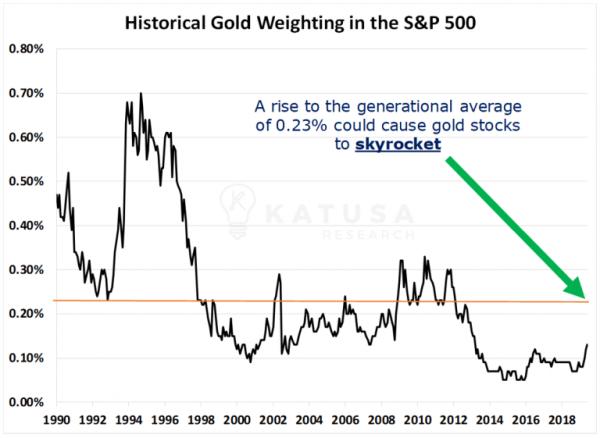

As for gold mining stocks, here’s a chart from Marin Katusa showing their weighting within the S&P 500. Note that it’s both minuscule and historically low. A reversion to just the average would send the miners up dramatically.