This Apocalypse Stock Shot Up 70% Last Week On Coronavirus Fears

When Everyone Panics, Alpha Pro Tech Shines

Whenever there’s a virus outbreak like we’re having now, the stock to look at is Alpha Pro Tech (APT).

Honestly, the company isn’t that impressive except for one important fact. When panic spreads, their stock soars.

So what do they do?

According to Hoover’s Alpha Pro Tech “makes and sells protective apparel and related products used in the cleanrooms of drugmakers, lab researchers, and semiconductor makers, as well as in hospitals, nursing homes, and dentists’ offices. Its disposable products include coveralls, gowns, lab coats, and shoe covers. Its infection control products include face masks, eye shields, and medical bed pads.”

In other words, Alpha Pro Tech is your perfect Apocalypse stock. Whenever there’s a danger of a public health crisis (SARS, bird flu), interest in APT goes through the roof.

Actually, through the roof and then some.

I’m not exaggerating. Last week, shares of APT shot up 70%. That was for one week. From Friday to Friday, trading volume increased by more than 600-fold.

The exact same thing happened during previous panics. In 2003, APT tripled in a few weeks. Then in 2009, APT shot up an amazing 10-fold in just six months. But after every surge, APT soon comes back to earth. It always has, and it probably always will.

Perhaps the best run came in 2014 when APT tripled in three days. Yet once again, the bubble soon burst, and APT went back to its traditional home of $1 to $3 per share.

As I said, the company isn’t that impressive. If not for its role at an Apocalypse stock, I doubt anyone would know of them.

Look, I won’t pretend that I’m an expert on the coronavirus (unlike half the people on social media), but I do know human nature. I suspect that the fears are greatly outrunning the real dangers.

Check out this long-term chart APT. You can see a definite pattern — big price spikes surrounded by lots of nothing.

In many ways, I think the APT chart could serve as a proxy for the public’s panic. I won’t venture a guess on what APT will do. However, I will note that on several previous occasions, the last person lost a lot of money.

That’s what happens when you invest in the Apocalypse. Oh well, it’s not the end of the world.

The Gold Bubble 40 Years On

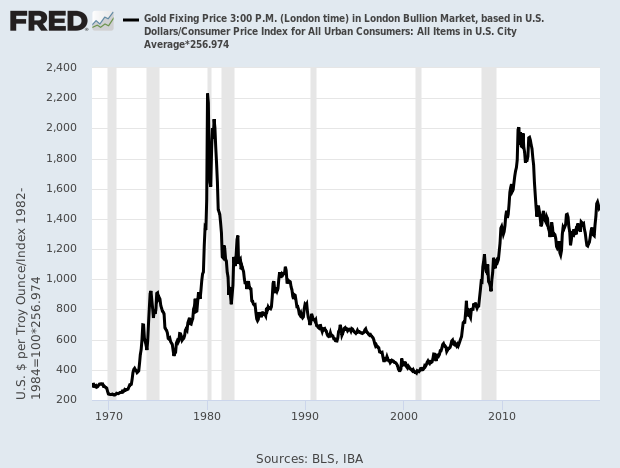

Speaking of everything going to hell, I neglected to mention an important anniversary. January 21 marked the 40th anniversary of gold’s peak.

Since then, gold is down one-third in real terms (gold has nearly doubled while inflation has tripled).

Here’s a chart of gold in today’s dollars.

The world looked pretty scary in 1980. The Iranian hostage crisis had recently started. Inflation was soaring, and the Soviet Union had just invaded Afghanistan.

When things get scary, people turn to gold as a hedge. At its peak, gold was going for $800 per ounce.

The rally was so impressive that it made Goldfinger look like a chump. In the movie, Goldfinger’s plan was to irradiate all the gold in Fort Knox, thereby boosting his holdings. But if he had skipped all the theatrics and simply waited, by 1980, he would have made 25 times his money.

At the time, the real bubble at the time was gold’s close cousin, silver. The Hunt Brothers of Texas tried to corner the world silver market, and they came very close. Fun side note: The Hunts were partly the inspiration Randolph and Mortimer Duke in the movie Trading Places.

Give the Duck Stock a Look

Fortunately, we don’t have to look to disaster stocks to do well. One of my favorite companies is AFLAC (AFL), the duck stock. The company is due to report Q4 earnings on Tuesday, February 4.

Three months ago, AFLAC report earnings of $1.16 per share. That beat the Street by nine cents per share.

The company also raised its full-year guidance to a range of $4.35 to $4.45 per share. That’s a big increase over the old guidance of $4.10 to $4.30 per share. The range is based on the 2018 exchange rate of ¥110.39 yen to the dollar.

AFLAC also said it’s aiming to buy back $1.3 to $1.7 billion worth of stock this year. This is one of the most reliable stocks you’ll see.

Disclosure: None.