These Three “Stay At Home” Companies Gain Market Share As Coronavirus Numbers By State Increase

As the country continues to battle coronavirus, cities, including San Francisco, and likely by the time you read this, New York, will have issued shelter in place orders. This means people living in these places, which totals well into the millions, should simply stay home.

I’ve talked a lot in the past few weeks about the “at home” stocks, whether it’s working from home, or simply doing activities at home that you might normally do elsewhere.

The shelter in place orders have taken this to a new level. And, while temporary, these actions by federal, state, and local governments should, believe it or not, have a lasting positive impact on some businesses.

I don’t know about you, but people I know who are not subject to these orders, have begun cocooning and don’t want to go to the store on a regular basis anymore. But, they also don’t want to give up being able to have variety in what they eat. None of my friends are eating cereal for every meal yet.

As we navigate these unprecedented times and actions here in the U.S. and globally as coronavirus numbers increase, there will be winners and losers. I’ll keep trying to find stocks like these for you that may prosper in the current adversity we are experiencing.

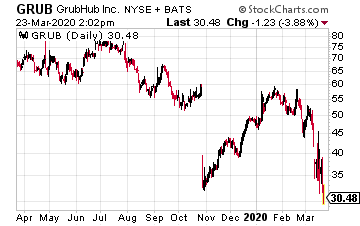

Grubhub (GRUB) delivers food from a huge variety of restaurants directly to your door. The company has signed contracts with the likes of Burger King, Taco Bell, and Pizza Hut.

And, not only does Grubhub deliver for major chains, but brings delivery options to local mom and pop restaurants that have either not been able to offer delivery options, or have a very limited area of delivery availability.

Even in restaurants that have delivery offerings, which have both a robust software to manage delivery offerings, as well as an in-place driver stable (not sure what that is?; audience may not either), the delivery may be cheaper and more efficient with Grubhub.

In its most recent quarter, the company reported $322.1 million in revenue, a 30% year-over-year increase from $247.2 million in the third quarter of 2018. Gross Food Sales grew 15% year-over-year to $1.4 billion, up from $1.2 billion in the same period last year.

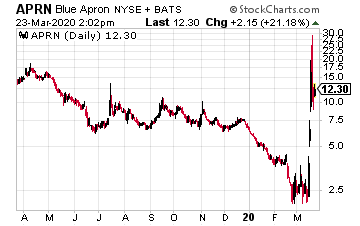

Another company delivering food to homes under a different model is Blue Apron (APRN). Blue Apron lets you pick your food choices from a large menu, and then provides all of the ingredients to make tasty meals for your family.

While the company has been struggling to get its cost structure in line with its product offering, the business model is a perfect fit for this shelter in place environment. Not only does Blue Apron deliver food, but it gives families stuck at home an activity they can do together.

I believe as customers turn to companies like Blue Apron, it will give the company a short term bump. But, it also gives the company a real chance of gaining a number of longer-term recurring customers.

In its latest earnings report, the company reported net revenue for the full year 2019 decreased 32% to $454.9 million from $667.6 million for the full-year 2018. The company went after a lower-end customer in offering huge discounts upfront in its marketing early on. They are in the process of pivoting from this customer profile, but the current crisis may redirect that thinking.

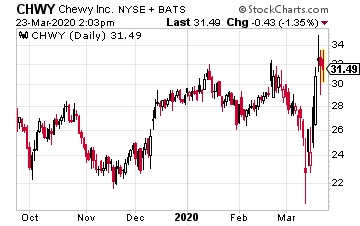

Finally, not only is the encouragement to stay home and shelter in place order impacting where we humans get our food, but where we get food for our pets. I believe Chewy (CHWY) is definitely worth a look here.

The order by mail pet supply company should also see an uptick in business in this environment. The company offers discounts for subscribing to a recurring delivery schedule for its pet food offerings. And, I believe they will pick up both short term and long term customers here.

In its latest quarter, the company had net sales of $1.23 billion, up 40% year-over-year. While the company lost $30.2 million, this was a 56% improvement year-over-year. Like many of the other delivery services, Chewy is still working through its business model to profitability, but the boost it should see from coronavirus fallout should give it a major shot in the arm moving forward.

Disclosure: None.