These Three CEFs Are Worth Another Look

Every month, I ask readers to my Dividend Hunter Insiders service to send in any stock they want for a deep dive analysis. Out of the submissions, I pick one stock to analyze and share my thoughts with all Insider subscribers. Each month, when the email to send in stock picks goes out, I am always surprised at the number of closed-end funds (CEF) symbols that show up in my email.

Currently, there is only one CEF on the recommendations list. The good news is that the fund has been a big winner for subscribers! My issue with the CEF universe is the host of negative factors that may detract from the investment potential of a particular fund. It takes a lot of work and deep investment product knowledge to be able to separate the good CEFs from the mediocre and bad.

Factors affecting closed-end fund results include some that are pertinent to the CEF structure itself. One factor is the fact that a fund’s stock market share price may be at a significant premium or discount to net asset value (NAV). The NAV would be the value per share if the fund were liquidated. In the CEF world, sponsors do not sell or redeem fund shares. A new CEF launches with an IPO like event, and after that, the shares trade on the stock exchange, with no sponsor intervention.

Share prices respond to buying or selling pressure, and that pressure can make a fund trade for more or less than the NAV. If you invest in a CEF trading at a premium, you are paying more than a dollar for a dollar’s worth of assets.

Currently, the highest premium to NAV CEF trades at a 59% premium to NAV. That’s crazy! There are eight funds trading at 30% or more above NAV.

On the flip side are CEFs trading at a discount to NAV. Currently, more than 50 closed-end funds trade at a discount of 10% or greater. Often a fund trades at a discount because it is a poor performer. However, don’t use discounts to NAV and current yield as your only criteria when picking CEFs in which to invest.

Here are three CEFs priced at a discount, where a quick scan of recent results shows positive investment potential. Do your own deep dive before investing.

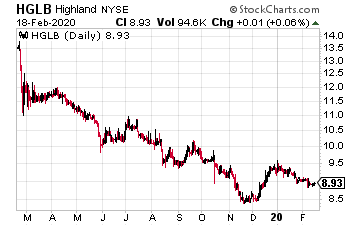

The Highland Global Allocation Fund (HGLB) currently trades at a 21.1% discount to NAV.

The fund manager, James Dondero, invests primarily in the U.S. and foreign equity and debt securities that the portfolio manager considers to be undervalued by the market but have solid growth prospects.

Fund literature claims a low correlation to domestic equity markets. This means the fund severely underperformed over the last few years. This is a contrarian investment idea.

The current distribution yield is 11%.

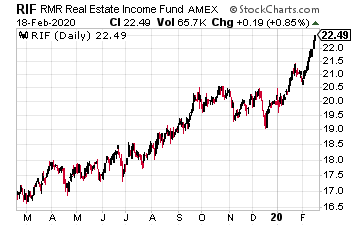

The RMR Real Estate Income Fund (RIF) trades at a 16.3% discount to NAV.

The fund invests in income-producing securities issued by real estate companies. This fund uses leverage to boost the returns from its portfolio of real estate investment trusts (REITs).

RIF has filed with the SEC to covert from a registered investment company into a commercial mortgage REIT. That conversion, when it happens, should drive the discount closer to zero. Management expects to increase the dividend rate after the conversion.

The fund shares currently yield 5.9%.

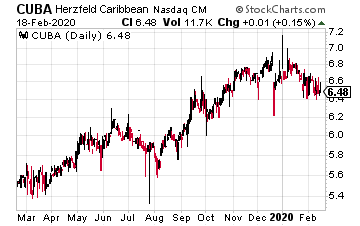

The Herzfeld Caribbean Basin (CUBA) trades at a 15.3% discount to NAV.

The fund invests in equity and equity-linked securities in the Caribbean Basin countries including:

- Cuba

- Jamaica

- Trinidad and Tobago

- the Bahamas

- the Dominican Republic

- Barbados

- Aruba

- Haiti

- Netherlands Antilles

- Puerto Rico

- Mexico

- Honduras

- Guatemala

- Belize

- Costa Rica

- Panama

- Colombia

- Venezuela

On a share price basis, CUBA returned 47% in 2019. Right place, right time. This CEF is not a high-yield fund.

Distributions consist of realized capital gains.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more