These 9 Big Name Pot Stocks Are Heavily Shorted

By Lorimer Wilson munKNEE.com

Despite the growing acceptance towards cannabis, many investors do not believe all the hype and predict that the industry is overvalued. Below are the most shorted cannabis stocks for the month of August and the truly remarkable profits the short sellers have realized to date.

Shorting, or short-selling, is when an investor borrows shares and immediately sells them, hoping he or she can scoop them up later at a lower price, return them to the lender and pocket the difference.

A short squeeze occurs when short sellers either panic or are compelled to buy stocks to cover those that were previously short sold. This leads to a lot of artificial buying, not based on fundamentals, that causes a stock or ETF to move higher in price and, when short squeezes end, artificial buying goes away and stocks drift down. Marijuana stocks are especially prone to short squeezes and a big part of the run-up in marijuana stocks earlier this year was due to short squeezes.

The short Interest ratio is a simple formula that divides the number of shares short in a stock by the stock's average daily trading volume. Simply put, it can help an investor very quickly find out if a stock is heavily shorted or not shorted versus its average daily trading volume.

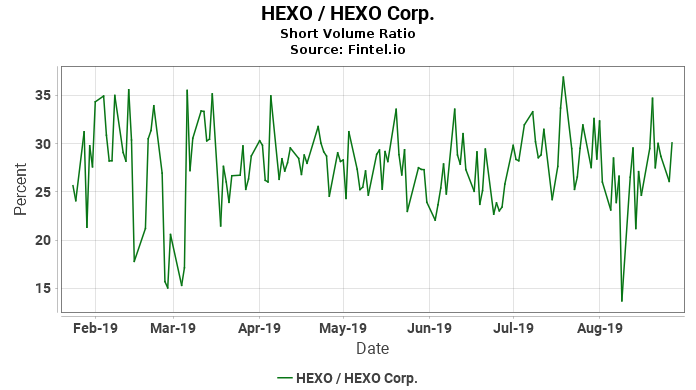

Short volume is a data set that can be used to understand investor sentiment:

- If the short sale volume increases as a percentage of the total volume, then that suggests a bearish (negative) sentiment by the market.

- If short sale volume decreases as a percentage of total volume, then that suggests a bullish (positive) sentiment.

The short volume ratio is the total number of short shares traded divided by the total shares traded each day

Based on the above definitions we can conclude that stocks that are being shorted are expected to go down in price and the greater the shorting ( the higher the short interest ratio/greater the short volume ratio) the greater the expectation that those stocks will drop in price. Below are the most shorted cannabis stocks as reported in the latest Consolidated Short Position Report from the Investment Industry Regulatory Organization of Canada:

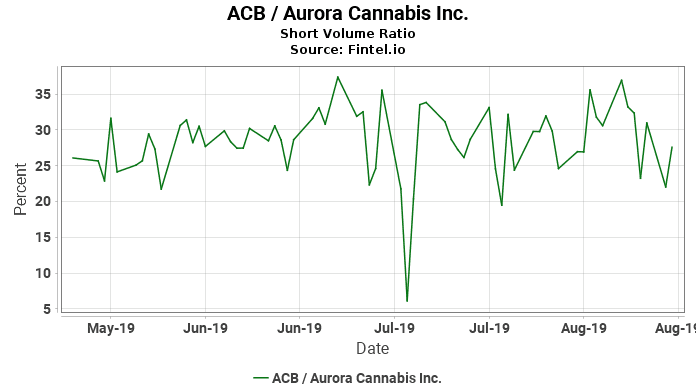

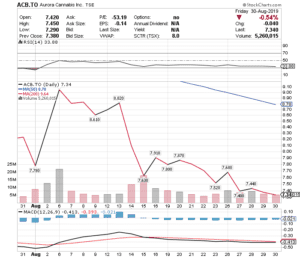

1. Aurora Cannabis Inc. (TSX:ACB; NYSE:ACB), a vertically-integrated and horizontally-diversified cannabis company based in Edmonton, Alberta, Canada. Its current short interest ratio is 7.9x with a short volume ratio of 26.

Interestingly, as can be seen above chart, the short selling began in earnest on August 13th and the stock has dropped 17% since then.

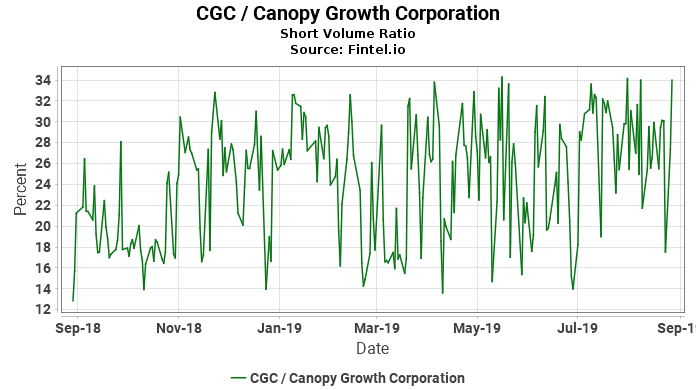

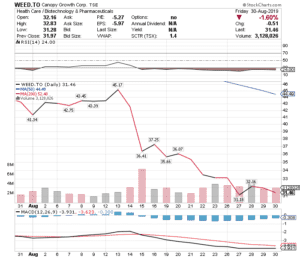

2. Canopy Growth Corporation (TSX:WEED; NYSE:CGC), the largest cannabis company listed by market cap on the TSX and NYSE. Its current short interest ratio is 5.4x with a short volume ratio of 28.

Like with Aurora, the short selling began on August 13th and its stock price has declined 30% since then.

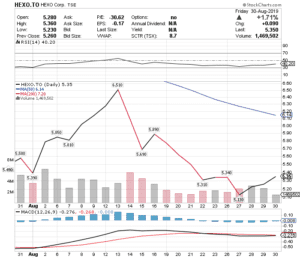

3. HEXO Corporation (TSX:HEXO; NYSE:HEXO), a consumer-packaged goods cannabis experience company has a short volume ratio of 27.

The short selling of HEXO stock also began on August 13th and has dropped 18% in value since then.

In addition to the above, 6 other major cannabis stocks were also heavily short sold in August, all commencing on August 13th. They were:

- Village Farms Int'l Inc. (Nasdaq:VFF; TSX:VFF);

- short volume ratio : 27

- stock price decline: 22.5%

- OrganiGram Holdings Inc. (Nasdaq:OGI; TSX:OGI);

- short volume ratio: 31

- stock price decline: 23%

- Neptune Wellness Solutions Inc. (Nasdaq:NEPT; TSX:NEPT);

- short volume ratio: 26

- stock price decline: 19%

- Charlotte's Web Holdings Inc.(CWBHF) (TSX:CWEB);

- short volume ratio: 22

- stock price decline: 24%

- Tilray Inc. (Nasdaq:TLRY);

- short volume ratio: 21

- stock price decline: 44%

- Cronos Group Inc. (Nasdaq:CRON; TSX:CRON)

- short volume ratio: 17

- stock price decline: 20.5%

In summary, the 9 stocks mentioned above had declined 29% as of last Friday and if the short sellers were to return the stocks today to those they borrowed them from back on August 13th, they would realize a 40% return and that is compared to the -13% decline the cannabis sector experienced during that same period. Now that's how you make money in the stock market!