The World Is Facing A $400 Trillion Retirement Shortfall By 2050

Though many Americans are probably more worried about an immediate financial emergency than their long-term prospects for retirement, the World Economic Forum, an organization comprising jet-setting billionaires and corporate captains of finance and industry, has published a study to remind ordinary Americans they better get used to the idea that they will be working until they die.

Unless Elizabeth Warren improbably succeeds in her campaign to be the next president and simply bails out everybody who is drowning in student loan debt, millennials will likely continue to see the 'retirement gap' - the 'shortfall' between how much money one has saved, and how much one will need to make it to the end of their lives - expand. Put another way, millennials are going to have a hard time making sure their money lasts longer than they do.

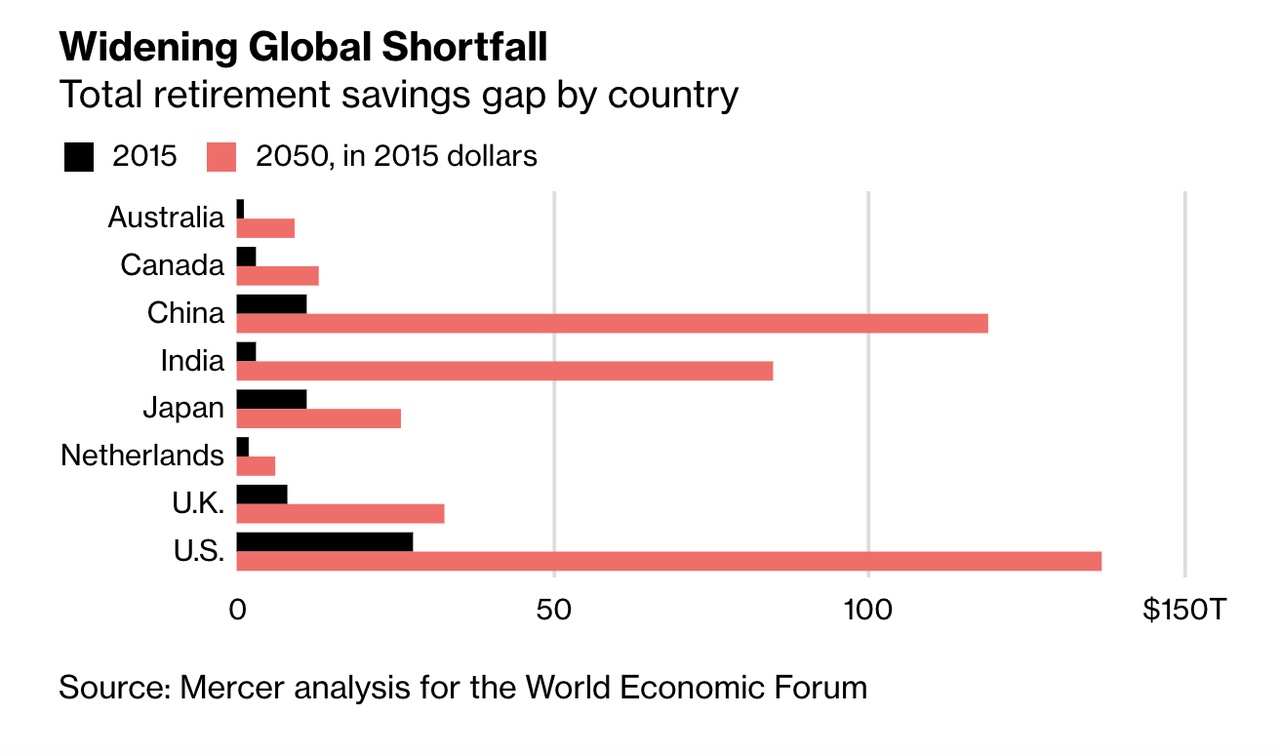

According to BBG, the size of the world's collective savings gap could be larger than $400 trillion by 2050. That's up from $70 trillion in 2015. In further bad, though not surprising, news, the US is forecast to have the biggest retirement savings gap at $137 trillion, followed by China ($119 trillion) and India ($85 trillion).

Some are saying this issue now requires "action" from "policymakers, employers and individuals" before droves of the elderly find themselves in the worst financial predicament of all: broke, and too old to do much about it.

Unless something is done, older people will either need to delay retirement, or learn to get by on less.

According to the data, in the US, 65-year-olds have enough savings to cover just 9.7 years of retirement income. That leaves the average American man with a gap of 8.3 years, while women, who live longer, face a 10.9-year gap.

Under their methodology, which seems fairly conservative, the forum assumed retirees would need enough income to cover 70% of their pre-retirement pay. But on the other hand, they didn't factor in Social Security or other government welfare payments, which method might overestimate the true number.

Still, millennials have gotten so used to the idea that they will never retire, that they make resigned jokes about it. Unfortunately, with birth rates dropping, we could end up with a situation where there's masses of old and broke elderly without children wealthy enough to intervene, meaning that the state may inevitably step in.

But there's one developed economy that's doing worse than the US, and that's Japan. Japanese women (who have the world's highest life expectancy, 87.1 years) face a retirement gap of 20 years, while man face a gap of 15.

Elderly people who are forced to re-enter the workforce often take low wage jobs, like working as a cashier at McDonald's, meaning that many former professionals must adjust to a lower standard of living.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more