The Wise Man Does At Once What The Fool Does Finally

This post is about what I believe to be coming for various asset classes and gold in particular.

The subject line is a statement attributed to Niccolò Machiavelli, who is referred to as the father of modern political philosophy. It was his advice to the Princes of Italy in the city-state era.

A wise man, on identifying a problem or on having a problem pointed out to him, will do what he needs to do to rectify the problem. After a due consideration and planning, he will enact the plan to accomplish the desired solution to the problem.

The fool, after the problem has been brought to his attention, will fluff about, dilly dally, ponder, form committees and otherwise waste his and everyone else’s time and money. This allows the problem to grow like a weed because of course nothing has actually been done to correct it. Finally, when nothing but panicked immediate action is required to avoid an outright disaster, the fool will act. What could have been solved easily and quickly is now a life-and-death struggle for the fool. The lesson – Don’t be a fool.

Onwards…

No doubt by now you’ve seen the pictures and videos of folks in Asia queuing for masks. It’s as if Elvis had come back from the dead and was selling tickets to a one-night-only special.

Some were clearly too late or perhaps have been elbowed out of the way, and so they’ve been resorting to jamming bottles on their heads and other…ahem ‘alternate’ methods that wouldn’t be out of place at a BDSM party.

Desperate times call for desperate measures. I can sympathize. New Zealand grows many delicious wonderful things, but worryingly, good red wine is not one of them. Normally this isn’t a problem, what with the “lucky country” as a neighbor supply is usually plentiful. That was until God decided to try to burn the place to the ground, damaging vineyards, which prompted me to go straight out and buy an embarrassingly large amount of Ozzie reds. Trust me in 6 months' time the quality will be garbage (smoke does that to grapes) and the price probably 20-30% higher (supply curtailment does that).

Knock on effects present investors with opportunities to both prosper and protect our capital…or secure good wines. This is why we’ll wait for the earnings season on Aussie wine retailers to disappoint and perhaps (time will tell) look to the long side. The bushfires in Ozzie may disrupt their red wine exports, but when it comes to the coronavirus, it is the proverbial black swan and the knock-on effects promise to be vastly more dramatic.

Fear of death

Is close to fear of running out of red wine and as such induces panic behavior.

Take the odd mask-wearing folk above who are not doing it for any other reason than demand has overwhelmed supply. Which is one good reason why mask maker APT is up on a stick.

As is LAKE

Those are just two short term trades mentioned in the past month or so in this telegram channel, where I discuss markets with a select group of buddies, but I think this is nothing compared to what’s coming. And that’s where currently all the asymmetry lies.

Let’s review what’s happened since the coronavirus broke free from its cage in a Wuhan lab and began burrowing its way into folks' immune systems.

Think about our proverbial face mask buyers. It’s been 17 years since the SARS outbreak, which was when they last needed to run out and stock up. That’s a sufficiently long enough time to forget about pretty much anything. And so they did. And unlike my red wine haul – which I don’t really need, with face masks when you need them like you do now – you really need them. It’s not a want. It is a NEED. And that makes buyers behavior completely different to most any other time in any given market – ergo the queues.

Which brings me to…

Being prepared

There has been a spike in folks suggesting we need to go all Bear Grylls, learn how to survive by drinking our own urine and building shelters from jungle vines and rat poop. This is daft. If you live in the countryside you already live in the countryside and your home is surely more comfortable than a shelter made from the feces of a rodent, and if you live in a city a trip to the local park is about as “close to nature” you’re likely going to get so none of that is going to do you any good. No the odds you die from this are negligible. About twice the odds of dying from the flu though it appears vastly more contagious than the flu. I can’t help you with any of that but what I can speak to is the need to protect ourselves from what’s coming. And what’s coming is a preposterously large overreaction by central banks. Watch!

This isn’t a big call by any measure. Consider that we’ve had a near-linear perpetual trend of central bankers injecting stimulus into the global economy without any real resistance. It’s human nature to be emboldened when finding “success” in doing anything. Central bankers and indeed market participants are arguably the most emboldened with this “successful” strategy than at any other time in human history. Take a look.

Except for this time around they have a real crisis. A health crisis and rest assured they will do “whatever it takes”. So prepare yourself for shock and awe from central bankers. I think they’ll massively overdo it.

The always excellent Kevin Muir @kevinmuir (give the fella a follow) puts it well.

One of my main beefs with Fed forecasters is that too often they make their analysis too complicated. Sure, the Central Bank has all these fancy econometric models that influence their decisions, but the FOMC board members are people, and their motivation is too plainly simple. They don’t want to make a mistake. They don’t want to be embarrassed. They weigh the consequences of being right and wrong and then vote accordingly.

Usually, this results in them being behind the curve. Why risk your career with a bold call? The risk-reward does not favor doing anything except reluctantly going along with what the market prices in.

However, I contend this flu situation is different. Let’s face it – the Federal Reserve is the only Central Bank that matters. With world trade grinding to a halt, what the world needs is US dollars. Sure, the ECB can do an emergency cut to an even-more-negative rate, but is that going to help their economy? Not a bloody chance. I would argue it would actually hurt more than help. Could Australia or another smaller Central Bank cut? No doubt. But what is that really going to do?

I’ve been saying this for some time. The next crisis (and this is it) would see the Fed overshoot.

The first step will be monetary because that’s what:

a) is expected and

b) is easy to implement rapidly

That’s not going to work. For the stock market sure maybe, but for the economy? Nope.

To understand why consider that monetary stimulus now presents a twofold problem.

Firstly monetary stimulus, via QE has been the standard playbook, and while this will help Joe Sixpack’s stock portfolio, what it doesn’t do is replace his lost income when the company he works for only had 3 weeks inventory (Just-in-time supply chains remember) and therefore can’t source parts from China, which means they can’t manufacture their widgets which has now sent their cash flow into a tailspin forcing an axing of 50% of the workforce. Think I’m kidding? I just spoke to a gent who has just had exactly that take place. Except this isn’t localized. This is now global. Because supply chains are global.

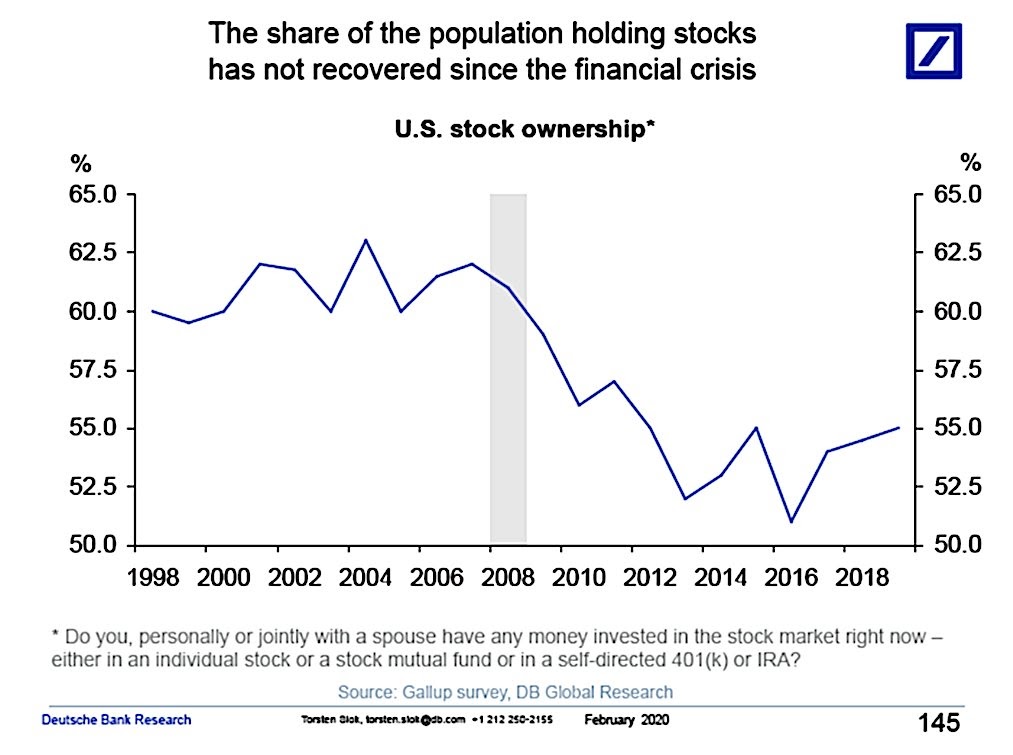

So monetary stimulus won’t help, except to increase stock portfolios. And the problem with this was highlighted by Deutsche bank this month and is shown below.

Further monetary stimulus will only increase the gap between the have-nots and have-yachts further…and that will mean social instability will only increase. Not good.

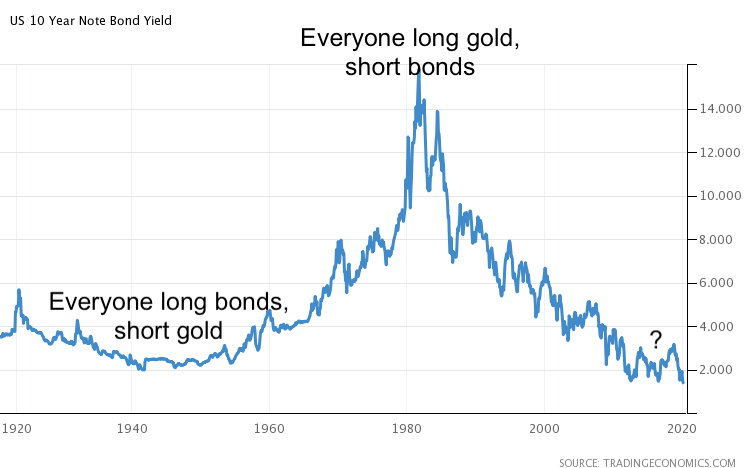

Secondly, there is that annoying little problem that governments are already broker than Borris Becker. Borrowing more can only happen in the face of rising demand for their debt. The deflationists say that’s where we’re headed and to buy government bonds with both fists because demographics stirred into a recession pot will mean demand collapses. Maybe.

The problem I have with this…other than the fact that lending money to a bankrupt entity strikes me as mad is that this is already priced. Take another look at that bond chart…or any government bond market chart. You can pick any of the US maturities, Bunds, Gilts…doesn’t matter. They’re all the same. Asymmetry sure as hell doesn’t live in the deflation camp, and so even if this is indeed where you think things are going, given the absolutely extraordinary scenario that involves Government borrowing exploding higher (I know hard to imagine but these are desperate times) while simultaneously tax receipts are collapsing (recessions do that) I’m going to humbly suggest that buying some insurance would make some sense no?

More on that in a minute

What else?

Supply chains.

What the coronavirus is to the Chinese manufacturing logistical supply chains (hammer blow) so is the coming economic downturn to the world’s monetary and financial system. The complacency towards the bond and equity markets as we face what has to be a massive hit to global GDP is rather stunning to us. The current narrative is this. Anything bad is good because the central banks will just slash rates, juicing equity markets and bond markets simultaneously.

This will likely go on…until the weakness is exposed and then it’s a come to Jesus moment.

And when that happens in the financial world the rush to buy protection will make the queues for facemasks in Asia look positively orderly in comparison.

So what is the financial equivalent of face masks?

Gold.

- Limited in supply…just like face masks only more so.

- You go for very long periods of time when you don’t really need it. And then periods of time when you need it like oxygen.

- It’s price can and does skyrocket when panic sets in.

Right now gold is sniffing a problem

The sheer odds of something going horribly wrong with a completely broken system just got greater.

Now what.

Well stop reading now and go buy some insurance if you’ve not got any already. And if you want to get some real kick in your portfolio there has never in all my professional life, been a better time to go to where the next bubble will be. The mining markets. Yeah I know it’s full of scheisters and scumbags. Let’s face it, this industry is littered with more crooks than parliament, but you know what? That’s not going to stop folks from rushing into it.

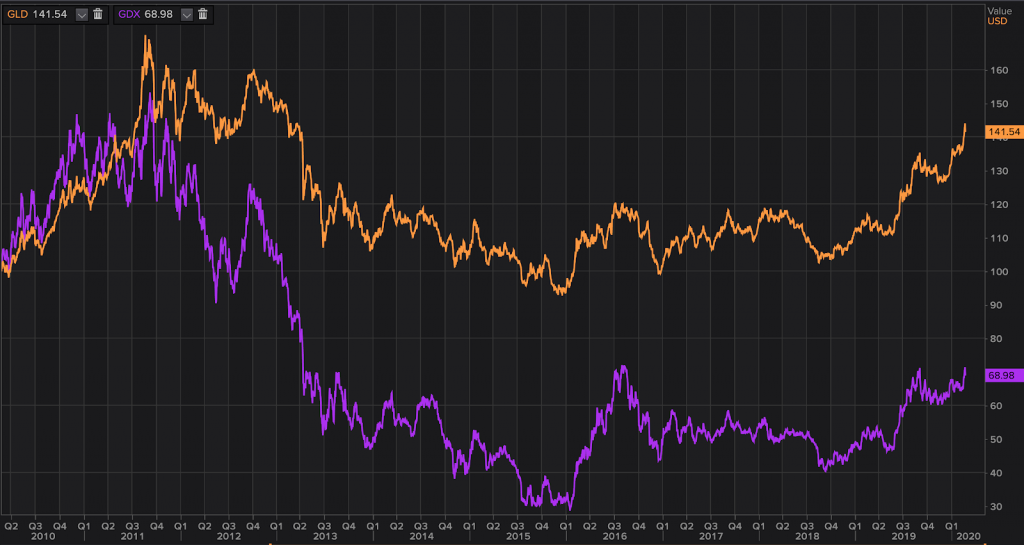

Take a look at this.

There’s a saying in the financial community. Alligator jaws always close. Here’s Gold (orange) vs Gold Miner ETF GDX (purple) indexed to 100.

Selfishly right now we’re taking advantage of this disconnect in the most asymmetric way I can think possible. Namely sourcing and securing private deals. Our last deal just went public earlier this week on a double. Yay for us. We’re closing on another this week. I think you should take a look.

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even ...

more

So Chris, other than speculating in hygienic face mask stocks, what are your suggestions for Joe and Jane investor, they obviously cannot go about securing private deals?