The September Retail Sales Shocker

Remember how people used to say, “This isn’t your grandpa’s recession”? Well, this isn’t even your slightly older brother’s recession.

The government just announced that retail sales surged 1.9% in September, way above expectations. In a normal year, that would be 6-months worth of growth.

Some will argue that when rebounding from a deep slump it’s levels that matter, not growth rates. And to some extent that’s true. But retail sales had already fully recovered by August, so this figure pushes us well above trend.

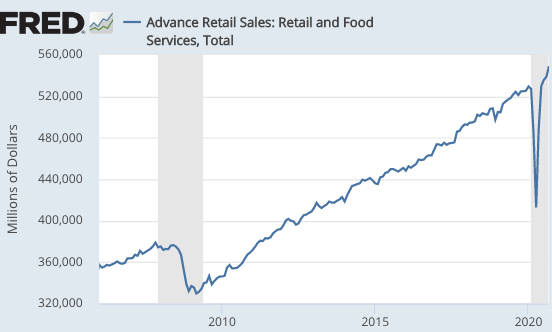

It’s almost impossible to overstate the weirdness of this recession. In a normal recession, retail sales plunge sharply and take years to fully recover. Look at the Great Recession, for instance. This time around sales fully recovered in just 4 months, and just 5 months from the April trough sales are already above trend:

And yet despite the surge in retail sales, the overall economy remains deeply depressed. RGDP is down sharply, and total employment is down by roughly 10 million. What gives?

Obviously, this is not a normal demand-side recession. That’s why the fiscal cliff at the end of July did not affect retail sales. The economy is being held back by COVID-19, not a lack of disposable income. COVID is obviously a problem in the service sector, but more surprisingly is also a problem in manufacturing. But how could manufacturing remain deeply depressed while retail sales booms? Who builds the stuff being sold in stores?

American manufacturing is increasingly focused on investment, not consumer goods sold in stores (many of which are imported.). The slump in travel affects everything from fracking to aircraft manufacturing to hotel/restaurant construction. With less investment, there is less manufacturing of inputs used in investment, like oil pipelines for frackers. We’ve seen other manufacturing mini-slumps when oil prices tanked, even when the broader economy was OK.

We don’t need fiscal stimulus. We do need a fiscal relief package to help the many people who are being hurt by COVID-19. The difference between fiscal “stimulus” and a fiscal relief package is that the latter would not include $1200 checks to middle class Americans with jobs.

PS. This post is not a forecast. Hospitalizations are now entering a third wave, and this may slow the economy. I cannot predict COVID and thus I cannot predict the economy. I’m also not denying that demand still has some effect, even in a supply-side recession. Nor am I denying that it would be better to have a more expansionary monetary policy, expansionary enough to raise inflation expectations up to 2%. That’s all true. Nonetheless, this recession could end quickly if we get a widely available vaccine or a cure. It’s mostly supply-side, which means it’s nothing like 2009.