The Most Important Chart Of The Past Decade?

The following excerpt from the February 5, 2019 issue of the Global Investment Letter discusses one of the most surprising and important charts I’ve seen in the past ten years and the potential consequences for the S&P 500 and other markets.

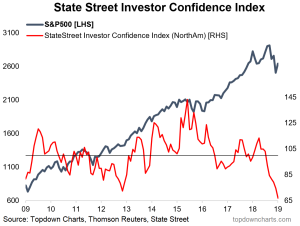

The S&P 500 posted a very strong January rally following a sharp bullish reversal late in 2018. The chart below helps to explain the strong, and widely unexpected, rebound in U.S. equities, the likelihood of the rally continuing, and implications for the next bear market.

This chart of the State Street Investor Confidence Index is one of the most dramatic we have seen for some time. According to the chart, investor confidence at year end 2018 was significantly below levels seen at the bottom of the last bear market in March 2009! Such extremes of sentiment almost always present relatively low-risk buying opportunities…….and this was no exception.

What is surprising is that sentiment grew so negative in a much better economic environment than that existing in early 2009. It may not be possible to pinpoint a precise reason given the proverbial “madness of crowds.” However, a possible contributor to the pessimism may lie with the current political environment in the United States. Political views are highly polarized and confidence in institutions has been eroded.

Moving forward, an important consideration will be how investors with this state of mind will react to more substantial negative news than that of late 2018. There is growing evidence of a global economic slowdown. Economic growth in the European Union and China is claearly slowing. The Fed has recently paused its interest rate increases in response to signs of economic softening. As we have discussed for some time in the Global Investment Letter, the next recession in the United States is likely to be very severe given the elevated levels of debt throughout the system and the limited means available to the Fed to combat it.

How will investors respond to bad economic news given the psychology on display in the chart above? The inference is “not well”, which would increase the severity of the next bear market. Adding to the potential volatility of the next bear market is the popularity of indexed or “passive” investing. The effect of so much capital moving into one strategy or type of investment vehicle is akin to many passengers moving to the same side of a ship. Thus, the fragile investor psychology depicted in the chart above increases the likelihood of widespread investor capitulation in a bear market, the effect of which could be exacerbated by or tied to “passive” investment instruments. Since index funds are, by definition, heavily correlated, meaningful sales of these instruments could create a cascade effect by magnifying downside volatility. The fragile state of investor psychology and the trend to “passive” investing are but two of a number of reasons we expect the next bear market to be very sharp.

In the shorter-term, the current rally will likely continue given the deep investor pessimism from which it commenced. A pullback as it approaches the 40-week moving average would not be surprising given the sharpness of the rally. The 40-week average remains an important barrier for the S&P to cross to restore the market to an unequivocally bullish mode.

Markets around the globe are in a tenuous state, which is likely to grow still more tenuous over time through a combination of high global debt levels, slowing economic growth and geopolitical turmoil. However, we hold steady to our long-held view that U.S. denominated assets will continue to outperform other asset classes. U.S. equities hold the potential for more upside in part because of the absence of compelling alternatives. The still formidable American economy and dollar will continue to attract capital. U.S. equities remain our first choice among developed markets. A bear market is inevitable, but there is insufficient evidence that it has arrived yet. Nevertheless, investors should remain attentive as the next five years are likely to be very volatile for capital markets.

The Global Investment Letter is a monthly journal of ideas and opinions about capital markets. Global macro considerations are the primary drivers of markets today and the Global Investment Letter is based on the principles that all markets are interconnected and that the economic and geopolitical issues we are experiencing have deep historical roots. The coming years will be even more challenging for investors and thus it will be even more important to stay attentive to geopolitical developments and have a good understanding of their potential consequences as they will no doubt influence investment returns.

Disclaimer:

This material is sourced from the Globalinvestmentletter.com website and is subject to the terms ...

more