The Housing Bust Will Take Longer This Time

Let’s start by sketching out a rough spectrum of the pandemic’s impact on major industries. At the hellish end of this spectrum is hospitality, where cruise ships, vacation resorts, and other crowd magnets have been rendered toxic and therefore useless overnight. Most of these companies will fail and their flagship assets will be repurposed or trashed.

At the other, much happier end of the spectrum are “stay at home” businesses like Amazon, Netflix, and food delivery service Instantcart, which can’t publically admit to loving the pandemic but would probably not mind if it became the new normal.

In the middle of the spectrum – and therefore tougher to predict – is housing. Specifically, are prices going to plunge or soar in this new world, and how should buyers and sellers behave going forward?

In the last recession, the answer was clear-cut: Houses were the epicenter – in fact, the cause – of the crisis, and were going to behave the way bubble assets always do.

Home prices ended up falling by 40% in many formerly hot markets, foreclosures soared and banks ended up with mountains of unwanted property that they were legally obligated to unload at fire-sale prices. With hindsight, the obvious strategy was to sell at the bubble peak in 2007 and buy back in at a deep discount a few years later.

This time around housing is collateral damage. It’s expensive in a lot of places – frequently higher than at the previous cycle’s peak. But supply hasn’t run out of control, and pre-pandemic there were widespread house shortages. So a repeat of the previous bloodbath would only make sense in the context of a 1930s-style deflationary Depression – certainly possible but unlikely in a world of negative interest rates and central banks with fiat currency printing presses.

All that being said, it’s still going to be ugly in a lot of housing markets. A global pandemic is not conducive to shaking hands with realtors and touching other people’s doorknobs. An equities bear market, meanwhile, generates the kind of negative wealth effect that makes writing a check for a 20% down payment on a half-million-dollar house even more painful than usual.

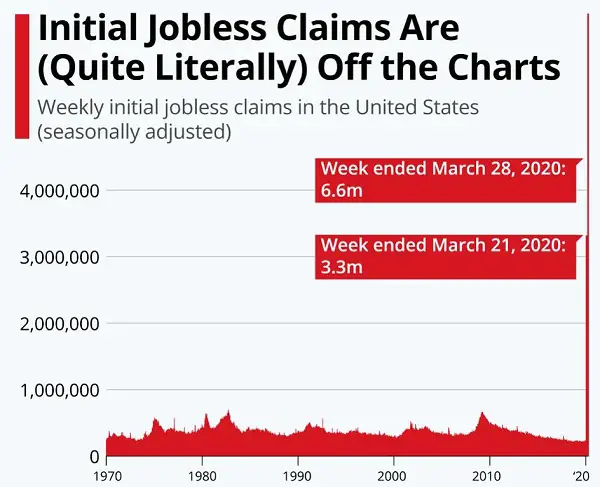

And jobs are evaporating. The past two weeks’ initial jobless claims reports show a staggering 9 million newly unemployed. It’s a safe bet that anyone in that group who was house hunting now has other priorities.

(Click on image to enlarge)

Then there are the people who have a house but virtually no other savings (something like 20% of the population). Once they become unemployed, the occasional government relief check won’t prevent them from having to sell their home to put food on the table. The result: A lot of new housing inventory coming to market.

Last but not least are the people who still have the wherewithal to buy a house but understand what’s coming and are gleefully waiting to toss low-ball-offer hand grenades into the crowds of desperate sellers.

The result: A period of rising inventory and falling prices that produces some serious bargains. Maybe not quite as juicy as the half-off sales in Florida condos and suburban McMansions circa 2010, but still very nice deals compared to the overheated bygone days of last summer.

When will housing statistics start reflecting the coming buyer’s market? Almost immediately:

Housing market shows first signs of trouble from pandemic

(MSN) – March started out as a strong month for the U.S. housing market — but by the second half of the month, the first indications that the coronavirus pandemic would weigh on homeselling activity began to emerge, according to a new report from Realtor.com.

Real-estate firms have taken steps to brace for the impact of the coronavirus pandemic. So-called iBuyers including Zillow (ZG) and Redfin (RDFN) that purchase homes from sellers and then sell them for a profit had wound down their home-buying operations in anticipation of an economic downturn.

Google search activity for “homes for sale” is currently down about 25% from year-ago levels.

Another sign that home sales will slump this spring: Mortgage applications. The volume of mortgage applications for loans used to purchase homes was down 24% compared with a year ago for the week ending March 27, according to data from the Mortgage Bankers Association.

So the top is definitely in. But the bottom is probably a ways off. If COVID-19 disappeared today, the global economy would still take years to return to a semblance of 2018-style normal – assuming that that’s even possible after the coming wave of corporate and personal debt defaults wreak havoc on hedge funds, pensions, and government budgets.

In housing, government mortgage forbearance will allow people to keep their homes longer than was the case during the Great Recession. This will spread the pain over multiple months (maybe years if forbearance is extended) instead of concentrating it in one big foreclosure spasm.

So while housing will likely go through the typical “denial … anger and resistance … panic … capitulation” process, with prices bottoming at maybe two-thirds of their 2019 peaks, the descent might be slower than last time around.

The takeaway: If you’re a seller, smack whatever bids are out there now. If you’re a buyer, be patient. Bargains are headed your way, but slowly.

Housing will face other issues going forward as the baby boomers end up leaving the market and demand for property by foreign investors drops dead after Corona. Sadly there are a lot of houses sitting vacant as investments which is just tragic.