The Golden Volcano

Did you feel that? The earth is rumbling. I can feel it beneath my feet. Over the past couple weeks, gold saw a significant breakout.

After consolidating a base for the past six years, gold’s breakout has a measured move target of $1,683. There is a large volume by price gap between here and there, so we could get there rapidly.

Looking at the long term twenty year chart, we can notice a couple takeaways. First, the bull market in gold at the beginning of the century lasted from 2001-2011. The bear market in gold lasted from 2011-2015. I would suggest with this month’s breakout, we have begun a new bull market in gold that will run from 2016-?

I will be breaking up this month’s analysis into three parts: July trading strategy, long term precious metal fundamentals, and investment recommendations. Let’s start off with a look at how to profit next month, as July begins on Monday.

Below is the chart for GDX going into July. As with all my monthly charts, you’ll notice updated monthly SD levels, value area, and updated POC for the previous month. POC for June was 22.55. The monthly value area is 25.36 to 22.08.

As I look at July’s setup, a couple things jump out to start with. First, we now have a cluster of five POCs between 22.16 and 22.55. This area is rock solid support. Second, June ended above the value area.

If you aren’t familiar with different methods for utilizing value area trading, this is a good time to discuss it briefly. The value area is where 70% of the trading volume took place (in this case the previous month). There are a few ways to use this information in trading, but one I’ll use here is the 80% rule. If price comes from outside the value area back into the value area, it then has an 80% chance of completing a move from the top of the area back to the bottom, or vice versa.

So with GDX, if price in July were to drop under 25.36, there is an 80% chance it will fall all the way to 22.08 before the month is out. With the breakout we saw in June, I don’t think this likely, but it is a possibility. So let’s examine how we can use that information into three trading possibilities for July.

Option 1 (Most likely)

As GDX remains overbought at the moment, price for July consolidates upward in a range from value high (25.36) to SD1 (27.48).

Option 2 (Less likely)

With breakout momentum gained in June, GDX continues its march higher right out of the gate, pushing up towards SD2 (29.40) before the month is out coming close to testing the previous highs from 2016.

Option 3 (Least likely)

From its overbought condition, GDX breaks down back into the value area under 25.36, and falls back down to value area low at 22.08. If value area high gives way, this would make for a nice short in July. Obviously with the breakout last month, I see this magnitude of a drop as my least likely option, but important to be aware of.

Next let’s take a brief look at a few key fundamentals that will be driving the precious metals market going forward.

Central Banks

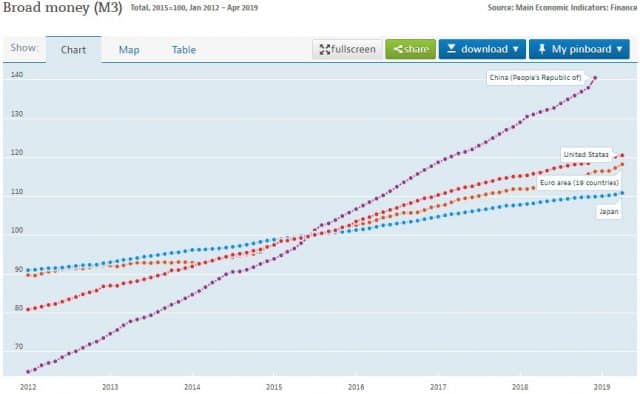

The financial world changed in 2008. If markets had been left to themselves, the world would have gone through its second Great Depression. That did not happen. The major global central banks of the world (US, Europe, Japan, China) began an aggressive expansion of the global money supply that has continued to this day. Over the past decade when one central has slowed the expansion of their money supply, another of the major central banks has taken the baton and more aggressively expanded their own balance sheet, thus over the past decade the aggregate global money supply has continued to increase. What has been the effect?

So can we expect this to continue? Let’s take a look at what the major central banks have been up to, and their expectations for the future.

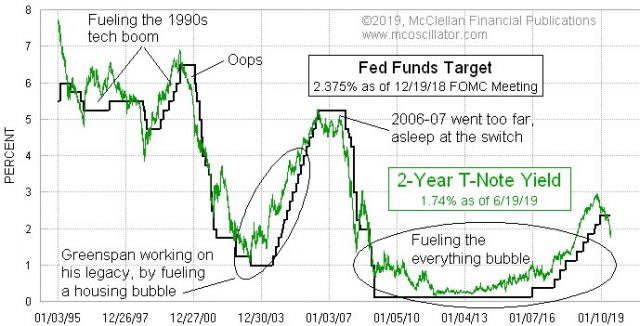

Federal Reserve

The Federal Reserve at their June meeting changed their tone, opening the door to rate cuts of at least 50bps this year. If we look to the US 2yr yield for direction as to where the Fed fund rate is heading, the Fed is currently 75 bps too tight, with a 2 yr yield of 1.75% and Fed feds rate of 2.5%. I expect the Fed will be cutting rates beginning in July, and cut a total of 75bps by year end.

ECB

There are problems in Europe. At their June meeting, the ECB effectively threw in the towel on rate normalization. The ECB President “finally threw in the towel and said that if the outlook doesn’t improve and inflation doesn’t strengthen, “additional stimulus will be required” adding that the ECB can amend its forward guidance, that rate cuts remain “part of our tools” and asset purchases are also an option.”

Source: “Draghi Unleashes Global Chaos“

China & Japan

Below you can see the BOJ and PBOC have continued monetary expansion as well, with China getting even more aggressive this year with a budding banking crisis and trade war with the U.S. As we move throughout 2019, and into 2020, I expect the global money supply to continue to grow rapidly.

Silver Supply/Demand

Silver production peaked in 2015, and has been in decline since. With industrial demand continuing to take 56-60% of supply, any significant increase in investment demand will have a profound effect on price.

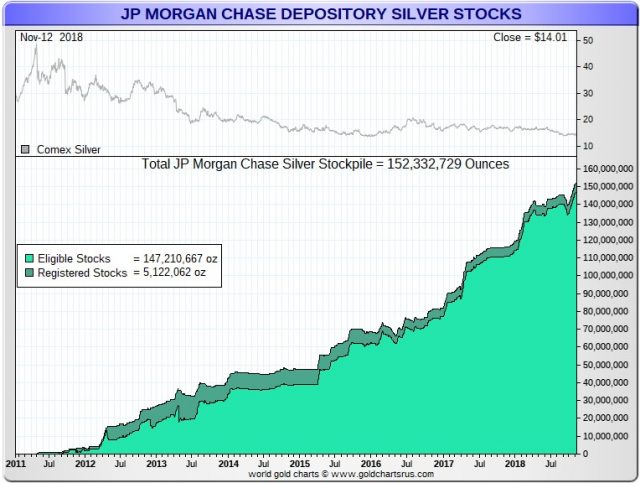

JP Morgan & Silver

In 2011, JPM began a process of completely eliminating their short position in silver, and accumulation of the largest silver stockpile in the history of the world. According to the CME’s latest report this week, JP Morgan owned over 153 million ounces of silver. If one of the most well connected, elitist financial institutions on the planet is hoarding silver, why aren’t you?

The Rise of Cryptocurrencies

Since Bitcoin’s (BITCOMP) inception, the cryptocurrency space has largely been a speculator’s market, subject to wildly volatile price swings. The vast majority of the world’s population does not use cryptocurrencies, whether for savings, investments, or daily transactions. That may be about to change.

This month Facebook (FB) announced their plans to launch their Libra (LIBRA) cryptocurrency which will be used on their platform, with their over 2 billion active users having access to use of the new currency. What are the implications for this? For the US Dollar? For the global fiat system that has been in place since 1971? For gold?

Libra has the ability to do something in the years ahead no other cryptocurrency, including Bitcoin, has been able to do… Become widely used by the global population as a daily means of exchange. Read about the possible implications of that scenario in “Is Facebook Trying To Become A Virtual Country“

Recommendations

Large Caps

Recommendations: NEM, NCMGY, WPM, AEM

Mid Caps

Recommendations: SSRM, AG, AUY, PAAS, MAG

Small Caps

Recommendations: GPL, EXK, AXU, THM, ISVLF

Options

Jan 2021 AUY $5 calls

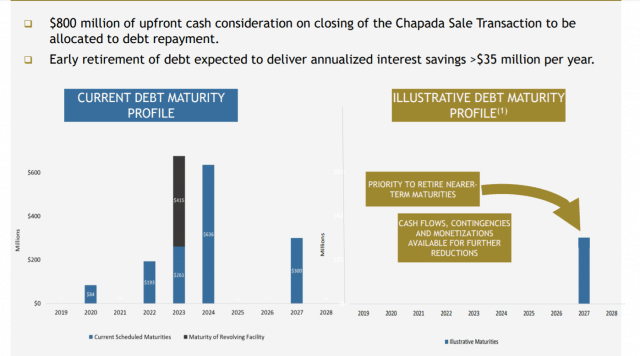

Yamana (AUY) is an interesting stock at the moment. Last month the company announced the sale of the Chapada copper-gold mine for a total consideration of over $1 billion. This is going to have four noticeable effects on the company. First, eliminating the copper production will concentrate the miner as an even purer gold mining play. Production is set to be 85% gold, 15% silver. Second, the company intends to use the proceeds of the sale to pay down long term debt, eliminating all debt set to mature over the next five years.

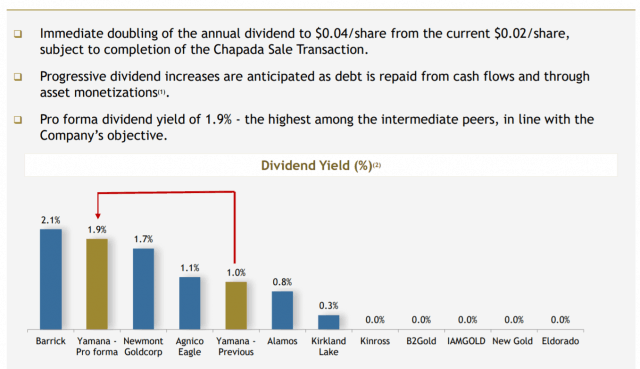

Next, Yamana will be doubling the size of their dividend, and anticipate further dividend increases going forward as further debt is repaid.

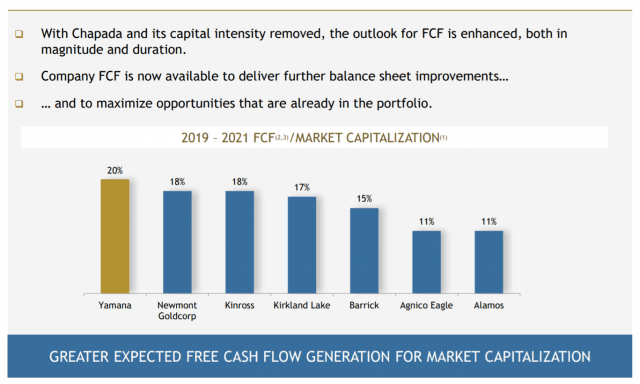

Finally, AUY’s free cash flow is greatly enhanced. The company is forecasting to have the highest FCF/Market Cap of it’s peers over the next two years.

(drops the mic)

Disclosure: None.