The Global Auto Market Collapse In 4 Charts

It is no secret that the auto market worldwide has been mired in recession that looks to not have any plans of decelerating anytime soon. We have covered, at length, the collapse of auto sales not only in the U.S. but in leading global markets like China and Europe over the last 18 months.

We have also covered how the "silver lining" of EV sales and investment in electric vehicles, may not be enough to stoke a recovery in the industry, especially with major cities like Beijing starting to shy away from purchase subsidies.

The contagion has spread, and a new article by Bloomberg includes four charts that show just how damaging the effects have been globally.

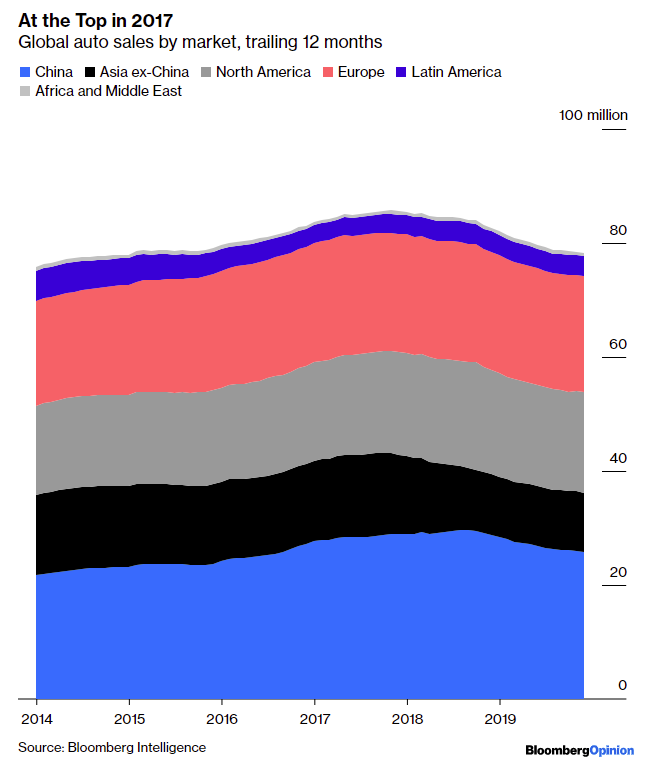

The first shows that global auto sales peaked two years ago at slightly under 86 million on an LTM basis. In October, that number stood at 78 million, a decline of about 9%.

The second chart shows trends from across the globe, noting that since China's market is so big, that it is been obscuring falling trends elsewhere in the world.

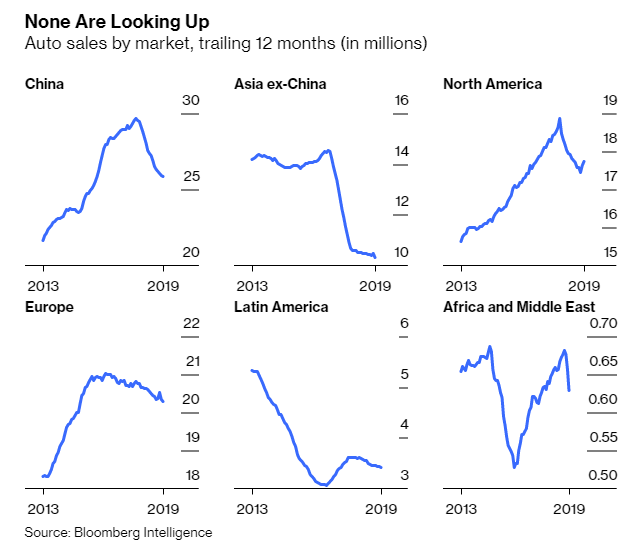

The chart shows China, Asia ex-China, North America, Europe, Latin America and Africa/Middle East all in steep downtrends.

North America and Europe could be argued to the be healthiest regions out of all of these, but the trends are still moving in the wrong direction. Bloomberg calls them "mature markets" that are "not poised for growth".

Looking deeper into Asia ex-China, which still includes major countries like Japan and India, we see that all other markets across the continent are lower. Japan is the healthiest, relative to others, and South Korea, Malaysia, and Singapore are all within 10% of their peak.

The third chart sums up the grim picture across Asia, despite these small points of optimism.

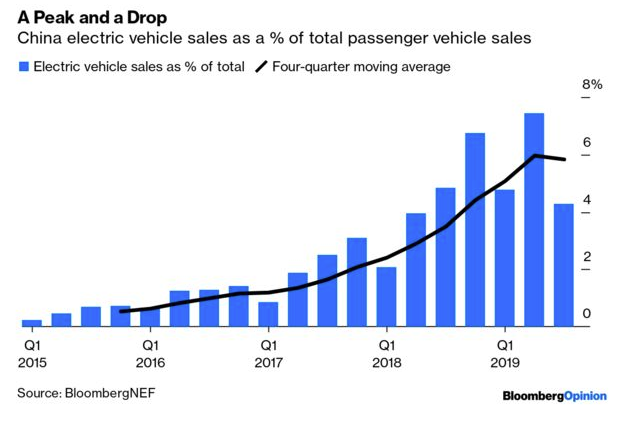

Finally, one has to look into the "silver lining" of the EV market to understand exactly how bad the recession in China is getting. The fourth chart shows a stark drop in the amount of sales in China that are comprised of electric vehicles.

Estimates for the year in China are for 2.2 million EVs sold, which is up 12% from last year. However, a four-quarter moving average of EV sales have shown the country's EV market recording its first downturn, as you can see in the fourth chart.

Recall, as we reported days ago, it's looking like Beijing isn't so excited to help sustain the EV niche of the market anymore.

We also noted that Beijing's ambivalence was starting to show up in the numbers. EV sales fell off a cliff after June of this year when the government slashed purchase subsidies. From July to October, sales of new energy cars were down 28% from the year prior.

Subsidies are unlikely to come back, we noted. The government is now aiming for "quality instead of just quantity", noting that subsidies would be more costly than they were a few years ago, when the market was smaller. Instead, Beijing said it will spend the money on building out its infrastructure, like its charging stations.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more