The Fallacy Behind Conventional Trading Psychology

We hear it all the time: trading is mostly a mental game, all you need to do is tame your emotions once you have a winning trading method, etc. etc.

Total and complete bullsh*t.

Yes, of course, if markets were stable and deterministic, then we could just figure out what works and all that would be left is sticking with that.

But markets are not stable. They change in their patterns, their volatilities, and volume, their trends, their correlations within a day and across days. What works in one environment does not in others.

And markets are not deterministic. What drives markets today could be different tomorrow if we get a significant geopolitical event or central bank action.

The entire reason markets are so difficult to trade--and it's so challenging to make money from them--is that the game is always changing. We adapt to one regime and make money only to face a different regime and lose that profitability. That can be frustrating. That can be bewildering. That can be discouraging. But it's the changing markets--and the changes they create for our trading--that stimulate the emotional reactions. It's not emotions preventing us from making money from fixed, ever-successful trading methods.

Consider an analogy. Let's say our blood sugar levels rose and fell greatly throughout the day, making us sleepy and lethargic when we were hyperglycemic and shaky and unable to concentrate when we were hypoglycemic. The swings in our energy and focus throughout the day interfere with our work productivity and we fall behind in our goals. That becomes frustrating and we start to fear that we'll lose our job. Then along comes a business guru who tells us if we just master our frustration and fear, we'll be more productive and reach our goals. He even teaches us some positive thinking and relaxation exercises.

You would consider such a guru to be a complete moron. You could work on your frustration and fear all day every day and, as long as your blood sugar levels are changing wildly, your work efforts and productivity will be variable. The emotional fallout is the result of the changing situation, not the cause. So it is with markets. If you could stabilize your body's state, perhaps with medication that controls your blood sugar levels, the emotional problems recede--because you've addressed their cause. Similarly, if you have methods to adapt to market changes, a great deal of emotionality in trading is circumvented.

But of course, it's more comfortable for traders to say they need to work on their discipline than to acknowledge that what had worked a month ago now yields entirely random outcomes. And would-be gurus and coaches? It's difficult for them to know about changing environments if they lack the tools for measuring blood sugar or market regimes.

Sigh.

Think of it this way:

If markets were stable and discipline could sustain profitability, then backtested trading systems would forever remain profitable. There would be no need for discretionary traders whatsoever.

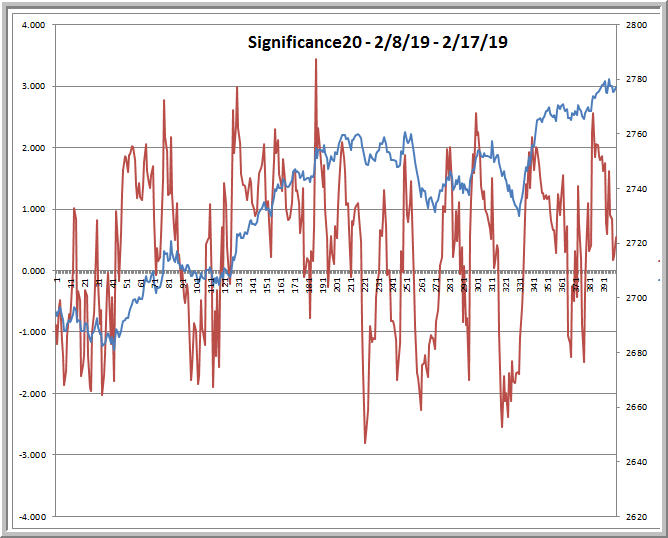

Above is a quick screenshot from my laptop of the recent ES market. Every data point represents the ES price after the index has made 500 price changes. The blue line and right Y-axis represents the ES price. The red line and left Y-axis represent price change over the last 20 periods, where price change is measured in standard deviation units.

When the market slows down, we have fewer data points. When the market is less volatile, the standard deviation units represent less movement. The chart is one way to standardize price action--make it more stable--given shifting activity and volatility. Thus standardized, we can ask intelligent questions about trend, the presence/non-presence of stable cycles, etc. Those questions can help us frame trading strategies in the midst of market changes.

When we do so--perhaps by relying on a repeating cycle to enter/exit trades in the direction of the overall trend--we have a clearer idea of what we're doing and why we're doing it. That anchors our understanding and our trading decisions and, thus anchored, lo and behold: trading becomes less emotionally fraught.