The Dangers Of Managed Fund Distributions And How To Spot Funds In Trouble

Many closed-end funds have managed distribution policies. The idea is for a fund to pay steady dividends that investors can count on, as opposed to the variable dividends often paid by mutual funds and exchange-traded funds (ETFs). Who wouldn’t want to own a fund that pays monthly dividends with a great yield?

Nuveen describes these dividend plans this way: Managed distribution programs are typically used for closed-end funds that expect capital appreciation to comprise a meaningful portion of the fund’s return, such as those with equity or alternative investment strategies. These programs seek to convert a fund’s expected long-term total return into attractive regular distributions.

That’s right; the distributions on many high yield closed-end funds are a combination of portfolio income and expected capital gains.

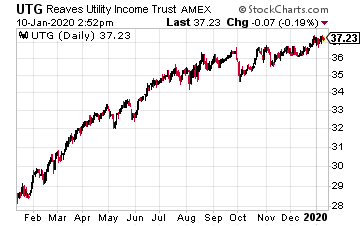

A managed distribution policy can work well. For example, the Reaves Utility Income Fund (UTG), recommended to my Dividend Hunter subscribers, has paid a fully earned, attractive yield and a growing dividend for over 15 years.

However, if a fund’s dividend exceeds its portfolio income and earnings, the dividends will include what is called return of capital (ROC). The ROC portion of a fund’s dividend is essentially a return of the investors’ own money and not income or profits earned by the fund’s portfolio.

There are closed-end funds that set unrealistically high managed distribution rates and end up mostly paying investors back with their own money. Here are a few warning signs that a closed-end fund is paying cash as dividends that the fund is not earning.

- An unreasonably high yield. There are about a dozen closed-end funds with yields over 15%. These naturally attract investors looking for income. It’s more likely that these will be money-losing investments.

- A history of dividend reductions. If a fund is paying out principal in its managed dividends, the fund portfolio will shrink, and the share value will erode. The dividend will be cut to keep the payout closer to “reasonable” based on the share price.

- Lookup a fund’s dividend tax characteristics. You can find this on a fund’s website or the CEFConnect.com website.

Here are three high yield closed-end funds to avoid:

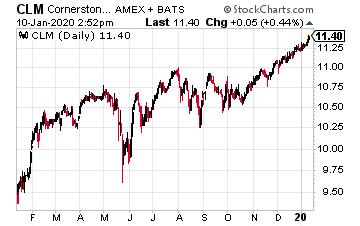

The Cornerstone Strategic Value Fund (CLM) has a current distribution yield of 21.8%.

Unfortunately, over the past 12 monthly dividends, ROC has accounted for 72% of the dividends paid.

This means that the CLM portfolio is earning about 6%, and the remainder is a payback of an investor’s own money.

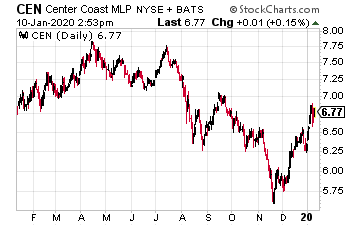

Center Coast MLP & Infrastructure Fund (CEN) is an interesting case. The distributions paid by master limited partnerships (MLPs) are classified as ROC, even though they may be actual earnings.

For MLP investors, all of the tax consequences flow from the Schedule K-1 sent out at tax time. The danger gives away for CEN is the 18% dividend yield.

The average yield in the MLP sector is about 8%, so it is very unlikely that this closed-end fund is earning the declared, managed dividend.

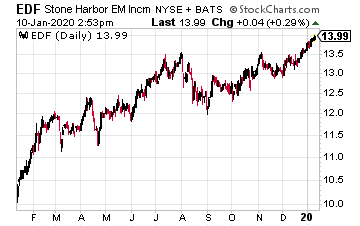

Stone Harbor Emerging Markets Income Fund (EDF) pays monthly dividends and currently yields 15.5%.

A look at the dividend tax characteristics shows that more than half of the $0.18 per share monthly dividend is classified as return of capital.

To me, it makes little sense for the fund managers to prop up the dividend.

I think an emerging markets income fund with a 6% to 7% yield would appeal to investors looking to diversify their portfolios.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more