The Crypto Weekly – Thawing?

The compare and contrast of Bitcoin (BTC, BITCOMP) to the NASDAQ and USD has brought an early Winter thaw to the bear market of crypto currencies. Whether this lasts will rest on many factors. The backdrop of the worst week since 2011 for US shares and another US government partial shutdown all set the stage for alternative investments. Whether BTC and other coins can prove to be such requires better news for the digital assets space. There are two stories – 1) Facebook developing its own crypto currency for WhatsApp transfers and 2) Swiss Federal Council opts for minimal regulation. Both of these stories suggest ongoing growth for the crypto currency world into 2019. The rally from near $3000 lows ($3158) in BTC back over $4000 builds hope for a 2018 top and bottom that leads to a less volatile and more constructive price action for the new year.

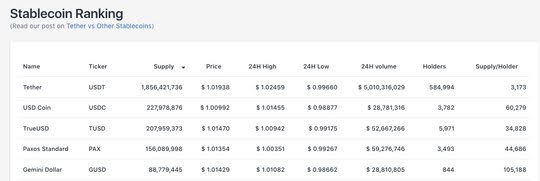

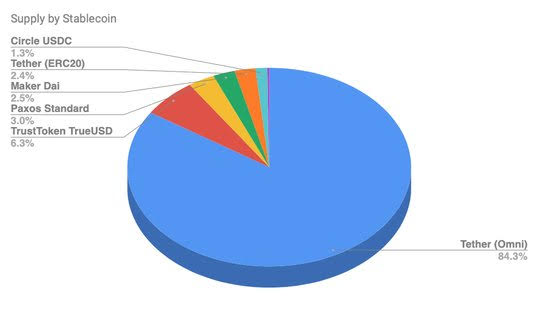

To understand the latest thaw in crypto currencies you need to note three drivers – 1) the correlation to technology shares broke down – as the NASDAQ is now in a bear market while BTC and others rallied 20% from their lows; 2) the fears of more bad news driving down prices didn’t materialize – as the recent headlines weren’t great but the prices stabilized – (see the list of what happened further in this report); 3) as the doubts about Tether were reversed with a Bloomberg article and as Bitfinex indtroduces margin trading for USDT/USD. While the first 2 factors maybe sufficient to support the market – the need for clarity on the third point remains essential for a crypto Spring. Tether (USDT) is the 6th largest crypto currency with $1.9bn market cap and it accounts for 30% of all BTC transactions on platforms – according to Blockspur data.

In order to understand what this Bloomberg report does for the crypto markets you need to have a grasp of the history behind the fears about un-Tethering. Below is a short history of Bitfinex, Noble Bank and Tether– (sourced from Bloomberg, Reuters, BBC, NY Times). The trading platform of Bitfinex formed in December 2012 as a peer-to-peer exchange for Bitcoin with margin lending for BTC. The sourcecode came out of Bitconica, a previously hacked platform. Tether is a stablecoin pegged to the USD which shares management with Bitfinex as both have the same CEO JL van der Velde and CFO Giancarlo Devasini. Tether was launched in November 2014 originally as Realcoin, with Brock Pierce, Craig Sellars and Reeve Collins using the OmniLayer platform built on Bitcoin protocol. The Bitfinex platform integrated Tether into its operations in January 2015. Bitfinex is registered in the British Virgin Islands under the name iFinex Inc, with subsidiaries Bitfinex in Hong Kong and BFXNA in the US.

In May 2015, the platform was hacked and 1500 bitcoins stolen. In August 2016 Bitfinex was hacked again losing 119,756 bitcoins. The problems with the platforms software earned it the nickname “bugfinex” given numerous shutdowns and a flash crash. The hacks of Bitfinex place it on the list of the top 5 hacks in the short history of Bitcoin. Bitfinex’s bank troubles began in March 2017 when Wells Fargo told the four Taiwan-based banks Bitfinex and Tether were using that it would no longer process their wire transfers coming into the US. That cut off the companies’ access to USD. Bitfinex CEO van der Velde said Wells Fargo’s decision threatened the entire business.

In the Spring of 2017, Bitfinex sought the assistance of Crypto Capital Corp., a private Panamanian firm. Through its president, a Canadian who lives in Panama City named Ivan Manuel Molina Lee, Crypto Capital had links to Bank Spoldzielczy in Skierniewice, Poland, which Bitfinex apparently used for EUR deposits, and the Portugal-based Caixa Geral De Depositos SA. In March 2017, Bitfinex began to use Noble Bank International in Puerto Rico for USD. Using intrabank transfers, a Bitfinex user who had a Noble account could have USD or EUR moved internally to the Bitfinex account, or vice versa. Noble did not lend or re-hypothecate client assets; rather it segregated accounts in the name of the client using BNY Mellon as custodian.

The founder and CEO of Noble, John Betts, was behind the 2014 Sunlot Holdings move to take over and potentially rescue MtGox. Sunlot was backed by Brock Pierce, one of the founders of Tether. Noble partnered with Seabury Capital in May 2017 to launch Noble FX. Seabury Capital also participated in Noble’s Series A round. After pressure from the crypto community in late 2017, Tether acquired the services of Friedman LLP to conduct a short review of its account balances.

In December 2017, Noble accounted for 90% of the cyrpto inflows into Puerto Rico totaling over $3bn. In December 2017 the CFTC sent a subpoena to Tether and Bitfinex to investigate claims of price manipulation and to investigate the real-time ledger of tokens to the underlying monetary reserve. The Justice Department is also investigating the connection.

In February 2018, Tether stopped the auditing process, claiming that it wouldn’t be completed in a reasonable period of time, but another law firm Freeh, Sporkin and Sullivan reported findings that there were adequate reserves. Tether claimed that no official audit was possible and fought allegations of market manipulation in court. To date, there has been no official audit of the Tether fiat-currency reserves.

By the summer of 2018, competition in stablecoins started in earnest. In September, Paxos and Gemini launched two new stablecoins called the Gemini dollar (GUSD) and the Paxos Standard (PAX), which are both backed by the US dollar on a 1:1 ratio like Thether. Goldman joined the fray backing Circle (USDC). All these alternative stablecoins are based on the Ethereum blockchain using ERC-20 token standards, which also ensures full transparency of these coins, as Ethereum can verify the smart contract of both ERC-20 tokens. By late September, the rumors about Tether and fiat-reserves led to a run on Noble bank and talk of a sale for the bank “desperate” for USD funding. This led to alternatives to Noble for Tether clearing into fiat, with the return of Lee and GTS directing accounts to a private HSBC account and other entities like Deltec in the Bahamas. By October 16, Bitfinex had a new distributed banking solutions with KYC disclosures required.

Bottom Line: The relationship of Tether to BTC trading matters. The margin role of Bitfinex in driving prices higher in BTC early in the bubble also matters. The present public relations of Bitfinex and Tether matter in the context of the entire crypto ecosystem. Fear of a US government penalty remains high with the CFTC and Justice Department investigations ongoing. The verified but not audited connections between Tether and fiat-currency holdings offers up some modest comfort, but the role of stablecoins and trading crypto currencies continues to beg for more clarity on regulations – not just from the US but everywhere.

What Happened in the last 2 weeks? The headlines other than Facebook, Swiss Regulators and Bloomberg on Tether were less than encouraging. The fact that the price action ignored these stories matters.

- Bakkt delays? The January 24 launch of the ICE bitcoin futures is in doubt, risking a second delay, this time blamed on regulators. Unlike the bitcoin futures offered by CME Group and Cboe, Bakkt’s will be physically settled, meaning actual bitcoin will change hands rather than cash when the contracts expire. According to CoinDesk’s sources, “the CFTC must grant an exemption for Bakkt’s plan to custody bitcoin on behalf of its clients in its own ‘warehouse.’ Typically, the CFTC requires customer funds to be held by a trusted third-party intermediary like a bank, trust company, or futures commission merchant. While CFTC staff members have finished reviewing Bakkt’s exemption request, the commission has yet to cast votes on whether or not the proposal should be put out for public comment. If the commission does vote for public comments for the proposal, there would be a 30-day comment period, followed by a review of these comments. Because Monday and Tuesday are federal holidays, the earliest date the commission would be able to vote is on Wednesday, December 26.

- More Mergers?Picks & Shovels and CoinVantage, a former unit of accounting firm MG Stover, are set to form Interchange, a firm that will provide over 100 clients with tools to support hedge funds, exchanges, and family offices. Co-Founder of Picks & Shovels, Matt Galligan said in an interview with The Block that institutions laid the foundation for entering the crypto market in 2018 and 2019 will be when businesses such as Fidelity’s crypto brokerage unit and Bakkt’s trading platform launch. That will support more investors such as hedge funds to enter the market and will increase demand for Interchange’s offering.

- More Fraud?The push back against exchanges continues with the excecutives of the Korean Upbit exchange formerly indicted in Seoul.The executives are alleged to have made fraudulent transactions between September to December of last year, using a fake corporate account to make bogus orders worth 254 trillion won (or $226.2 billion) to inflate trading volume figures and attract more customers to the exchange. They are also accused of selling 11,550 bitcoins to customers to reap 150 billion won (or $133.8 million) through rigged transactions.

- More Layoffs? ConsenSys, the Ethereum production studio, could be laying off as many as 50-60% of its employees, according to The Verge. Documents reviewed by The Verge show that the production studio is spinning out a large number of its spokes. Spokes are essentially startups incubated by ConsenSys' venture studio, ConsenSys Labs. According to ConsenSys Lab's website, it has incubated over 50 spokes to date.

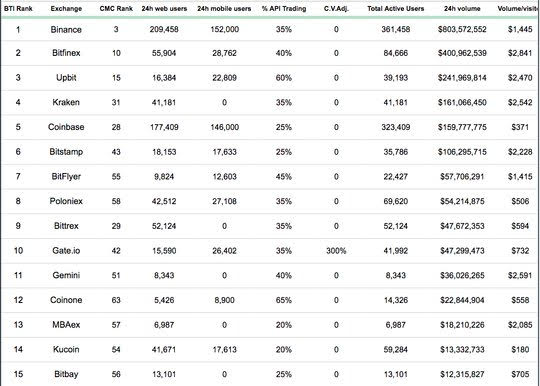

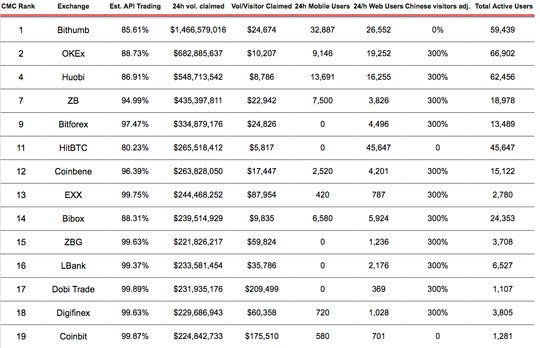

Question for the Week Ahead: Can this rally get legs? Given the pain and suffering in the crypto currency markets in 2018, the bounce back from the bottom is not likely to be trusted. The need for BTC to break over $4300 and run to $6000 would alleviate some of this doubt. Dead-cat fears pervade even in the midst of a rally. There are two key factors in the present crypto trading environment – volume and price - and the trust in both datasets remains critical. Reports that volume in December has been inflated by wash trading comes from the BTI. The two charts to read are – first, their list of December exchange volume leaders

and then second, compare it to the exchange advisory list.

What seems to be most important for 2019 beyond price and volume data and the trust of the market in such is a return to postivie stories. The list of such is just starting with the US regulation story the one to watch. The potential for Bakkt to lift markets further being a key component for hope into the new year.

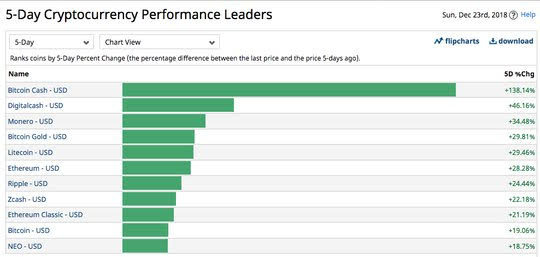

Market Recap: Just about every crypto currencies rallied last week. The correlation of BTC remains high but the BTC Cash move grabbed headlines. There is life after a fork. The overall capital losses are still 95% from the all time highs.

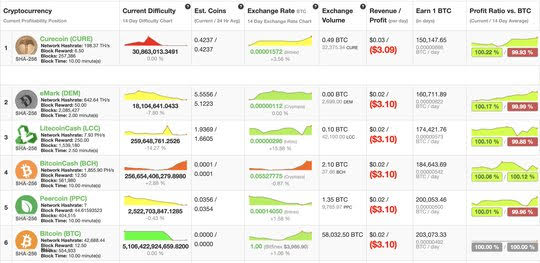

There are some key reasons for the recovery in BTC Cash. After the fork, the coin’s hash rate has dropped significantly, but it has made the mining operations more profitable. According to the CoinWarz SHA256 index, bitcoin cash is more profitable than bitcoin. The end of the hash war with bitcoin SV. The cost of that fight was $9bn in market capitalization.

The BTH chart has much of the same price dynamic as that of BTC with the rounding bottom near $55 opening up tests for $300. The need for a break to $325 to regain upside momentum seems obvious but less clear is the news to get the demand. Driving BTC or BCH in 2019 will require more than hype.

Good luck!

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.