The China View From 30,000 Feet

I have long sat beside the table of Mckinsey & Co., the best management consulting company in Asia, hoping to catch some crumbs of wisdom (click the following link for their home page: at http://www.mckinsey.com).

So, I jumped at the chance to have breakfast with Shanghai based Worldwide Managing Director, Dominic Barton, when he passed through San Francisco visiting clients.

These are usually sedentary affairs, but Dominic spit out fascinating statistics so fast I had to write furiously to keep up. Sadly, my bacon and eggs grew cold and congealed.

Asia has accounted for 50% of world GDP for most of human history. It dipped down to only 10% over the last two centuries, but is now on the way back up. That implies that China’s GDP will triple relative to our own from current levels.

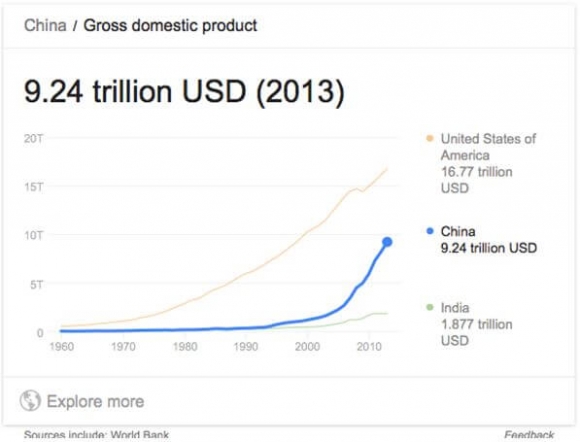

A $500 billion infrastructure oriented stimulus package enabled the Middle Kingdom to recover faster from the Great Recession than the West, and if this didn’t work, they had another $500 billion package sitting on the shelf. But with GDP of only $9.24 trillion today, don’t count on China bailing out our $16.5 trillion economy.

China is trying to free itself from an overdependence on exports by creating a domestic demand driven economy. The result will be 900 million Asians joining the global middle class who are all going to want cell phones, PC’s and to live in big cities.They'll want bandwidth too.

Asia has a huge edge over the West with a very pro-growth demographic pyramid. China needs to spend a further $2 trillion in infrastructure spending.

Some 1,000 years ago, the Silk Road was the world’s major trade route, and today intra-Asian trade exceeds trade with the West.

The commodity boom will accelerate as China withdraws supplies from the market for its own consumption, as it has already done with the rare earths.

Climate change is going to become a contentious political issue, with per capita carbon emission at 19 tons in the US, compared to only 4.6 tons in China, but with all of the new growth coming from the latter. Protectionism, pandemics, huge food and water shortages, and rising income inequality are other threats to growth.

To me, this all adds up to buying on the next substantial dip big core longs in China (FXI), commodities (DBC) and the 2X (DYY), food (DBA), and water (PHO).

A quick Egg McMuffin next door filled my other needs.

Disclosures: The Diary of a Mad Hedge Fund Trader, ...

more