The Biden Put

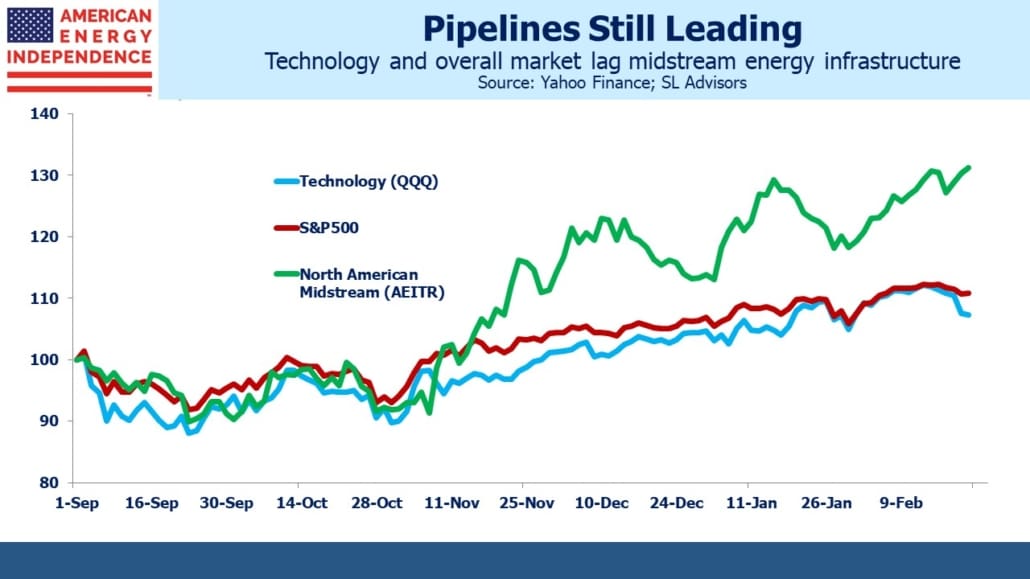

nflation fears are percolating. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) had its biggest ever stretch of outflows over the past six weeks. There are plenty of warnings signs. Commodity prices are booming. This is happily driving up midstream energy infrastructure, with the American Energy Independence Index up 15% YTD, well ahead of the S&P500 at up 4%. Cyclical and value sectors are drawing renewed interest. Energy has been outperforming technology since November’s vaccine announcement.

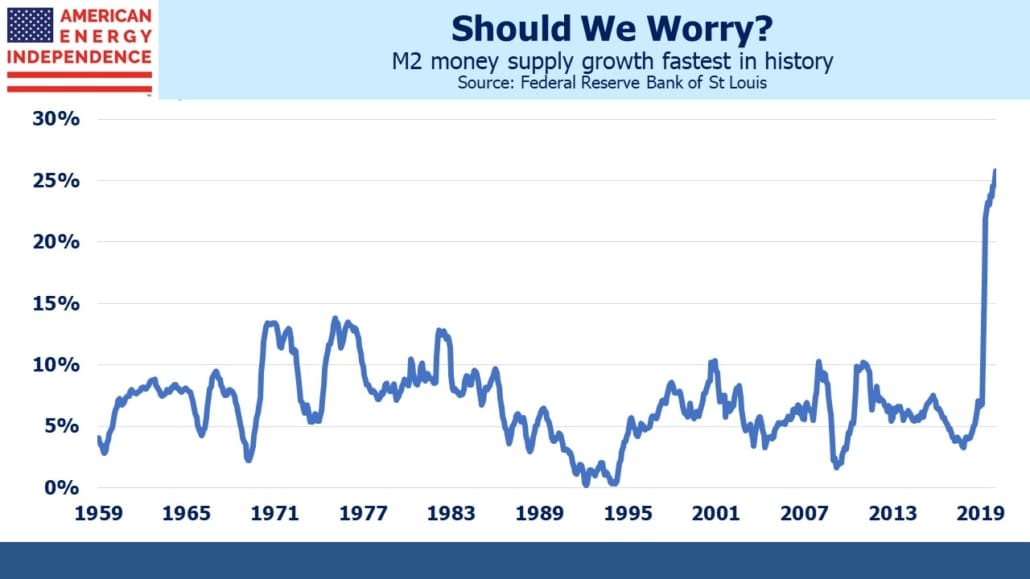

M2 money supply is growing at 26% year-on-year, the fastest since records began. The link between inflation and money supply broke years ago. Money velocity is down sharply, which is why inflation isn’t surging. The Fed isn’t worried. They would be happy with inflation running above their 2% target for a while. For those of us whose careers include the 1980s, when inflation and interest rates peaked, this is quite an an adjustment.

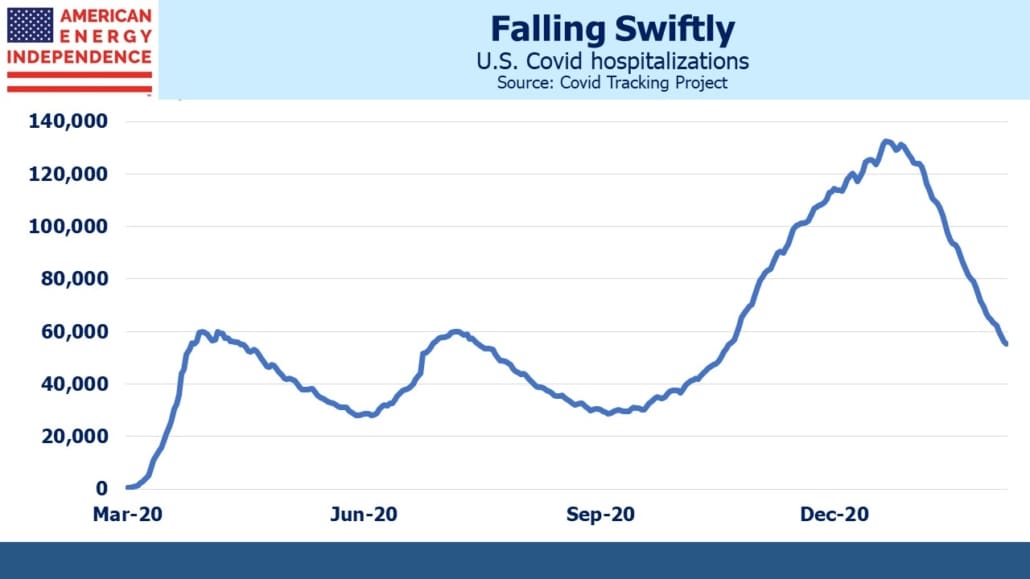

COVID figures are collapsing, which will likely unleash pent-up spending that interminable lockdowns have stifled for a year. The CDC counts 474K deaths involving COVID, less than the 500K figure seen elsewhere because the CDC waits for official death records to be uploaded by the states. This is without doubt a tragedy.

Over the same period, 3.3 million Americans died without COVID. They spent their last months or year alive constrained by all the restrictions we know so well. To pick one cohort, 99K people aged 65-74 died with COVID, but 631K of the same group died without it. 21K aged 45-54 died with COVID, reflecting their low risk profile, but 183K in this group died from other causes, while enduring pandemic restrictions like the rest of us. Even for those 85 and older, who are almost a third of all COVID fatalities, 87% of deaths in this group were non-COVID.

A friend of mine I’ve known since elementary school died on Saturday from a heart attack, which probably caused me to consider the figures in this way. The lost final year of life for the non-COVID fatalities denied the normalcy of dinners out, companionship with friends, travel and so on is another tragic element of the pandemic, but doesn’t get much attention. Do you know anyone who isn’t ready to get out there and live once more?

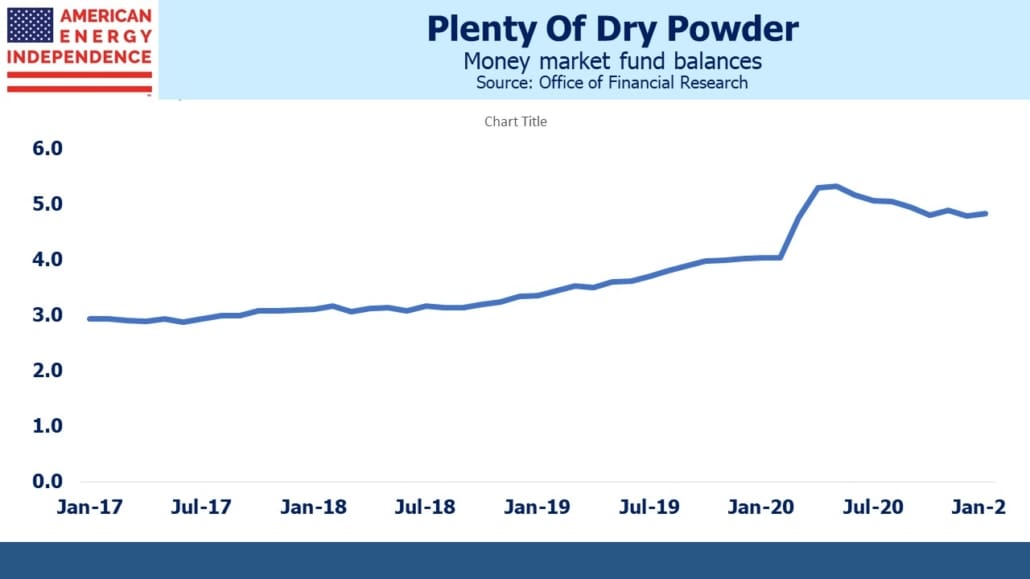

Money market funds hold around $5TN, a figure that’s slowly declining but still nonetheless $1TN higher than a year ago. This has low velocity while it’s sitting there but could easily be deployed in a recovery of consumer spending. Examples of rising prices include crude oil, copper and resins used to manufacture plastics. Pipelines, which move with commodity prices and reflect ownership in physical assets, offer more protection than most sectors in this environment.

Meanwhile, the Administration wants to spend $1.9TN on COVID relief – even if that figure is negotiated down, the vaccine rollout and falling hospitalizations suggest that the worst is behind us. A weekend article in the WSJ even suggested that the U.S. was nearing herd immunity. It’s predicated on an estimate that 0.23% of people who get infected die. Assuming that’s a reliable statistic and the 500K COVID fatalities is also accurate, it suggests 217 million Americans have been infected (500K divided by 0.23%). That’s approximately two thirds of the country. Add the growing vaccinations and you can see the country could be at 70-80%.

It’s a controversial assessment, and friends/readers who know more than us on the topic will be moved to respond. Fauci isn’t so optimistic. Virus mutations may cause a setback. But it’s not possible to definitively reject the optimistic conclusion, only to say it’s unclear.

Once the COVID relief plan is approved and money being sent out, Biden will turn to infrastructure – another $1TN. Climate change will justify at least that in addition. There are no longer any fiscal hawks (see Modern Monetary Theory Goes Mainstream).

Although there are plenty of warning signs that inflation will rise, we’ve had almost three decades where it hasn’t. Many worried about the inflationary effects of Quantitative Easing when it was first deployed following the 2008 financial crisis. To Ben Bernanke’s credit, he knew it wouldn’t and he was right. The economists at the Fed are similarly confident today. They’re expected to keep short term rates low for at least the next couple of years.

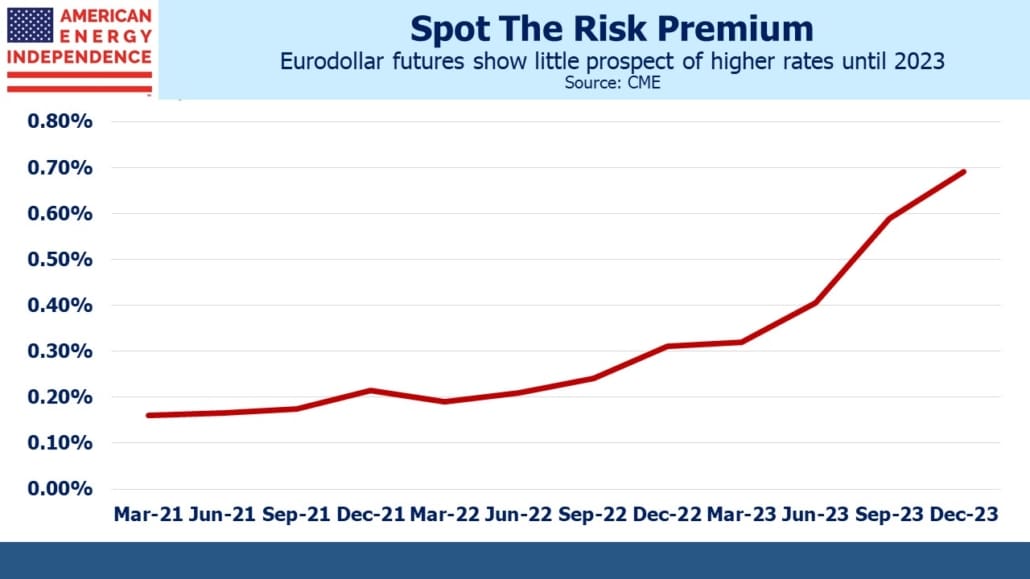

Betting against the Fed is usually wrong. But today, betting with them doesn’t offer much upside. The eurodollar futures curve remains extremely flat, so an investor in two year securities will do scarcely better than holding overnight deposits for the same period of time. Fed chair Powell reiterated his cautiously optimistic outlook yesterday with no need to raise rates anytime soon.

The Federal government is pouring fiscal and monetary stimulus into the economy simultaneously. And if a virulent COVID mutation sets back the current path to re-opening, more $TNs will be forthcoming.

People used to refer to the Bernanke “put”, recognizing that the Fed would respond to sharp economic weakness by easing, giving equity investors effectively a put option on their holdings. Nowadays we have both the Powell Put and the Biden Put. Bond yields are too low to properly reflect the new reality.

Disclosure: We are invested in all the components of the American Energy Independence Index via the ETF that ...

more