The Best Time To Start Saving For Retirement (With & Without Debt)

The end goal for just about every investor is to save enough money to one day leave the workforce.

Or, if an investor has already reached retirement (which happens at 61 on average in the US), to continue to earn enough through their investments to live comfortably without having to work.

But how does one get there?

The answer to that question is saving throughout one’s working life with discipline and a long-term view.

Indeed, the question of when one should begin saving is an easy one to answer.

The power of compounding returns means you should begin saving for retirement as soon as possible.

This gives you the best chance of having enough money set aside for retirement when the time comes and thereby increases the chance of producing enough income to live comfortably in retirement years.

Note on investing and debt: The question of if you should save while still carrying debt (or a mortgage) is related. Having personal debt and/or a mortgage while also investing is virtually the same as using leverage to invest in stocks from a personal balance sheet perspective.

The short answer is that you should pay off all high-interest rate debt (especially credit cards) before investing. Long-term debt at a low-interest rate (like a mortgage) doesn’t need to be paid off before you invest, as it has the requirements needed to be ‘good debt’ in that it is (1) non-callable and (2) almost certainly carried at a low-interest rate.

With that said, it’s hard to overstate the power of compounding and therefore the importance of investing as soon as possible.

The Magic of Compounding

Compounding is the process whereby prior investment gains see additional gains in the future. For example, suppose an investor invests $10,000 in a stock and that stock returns 10% in the first year. The investor now has $11,000 thanks to the $1,000 in returns. In the second year, the stock returns another 10%, but instead of the investor earning the same $1,000 as year 1, the investor earns 10% on the earnings from the prior year as well, bringing total returns to $1,100 for year 2. When we extrapolate this process out over many years, the evidence is clear that the correct time to begin saving is as quickly as practicable.

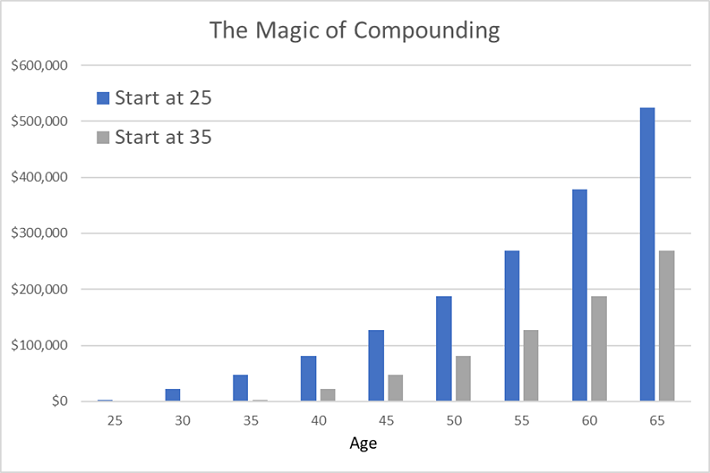

Below is an example of exactly the same saving and investing scenario except for one significant variable; one investor begins at age 25 while the other waits until age 35. Other than that, both scenarios assume a person that makes $60,000 per year, is saving 5% of their pre-tax income ($3,000) and achieves annual returns of 6%.

We can see that by the time the first investor is age 35, they’ve already accrued nearly $48,000 in their account while the second investor hasn’t begun saving yet. That head start turns into enormous gains at the terminus, which in our example is age 65. Indeed, the first investor achieves $525,000 in savings by age 65 while the second investor has an ending balance of just $270,000. While that is a significant sum of money to be sure, it is just over half of what the first investor achieved simply by starting 10 years earlier. Everything else being equal, the power of compounding is absolutely enormous.

In this example, the first investor saves a total of $123,000 from their earnings; the balance of $402,000 comes entirely from investment returns. Our second investor saves a total of $93,000 and the balance of $177,000 comes from investment returns. The gap is explained by $30,000 of savings but $225,000 in additional investment returns for the first investor through the power of compounding.

To further the evidence, in order for the second investor to have the same $570,000 balance at age 65 as the first investor, they’d have to save nearly double the amount of the first investor annually. In our example, both investors are saving $3,000 annually. However, in order for the second investor to catch up by age 65, they’d have to save $5,840 annually, which is very close to twice as much as the first investor. That could be a significant financial strain or even impracticable depending upon the individual’s situation. This is why it is so important to begin saving as quickly as possible in order to give oneself the best possible chance at achieving financial freedom.

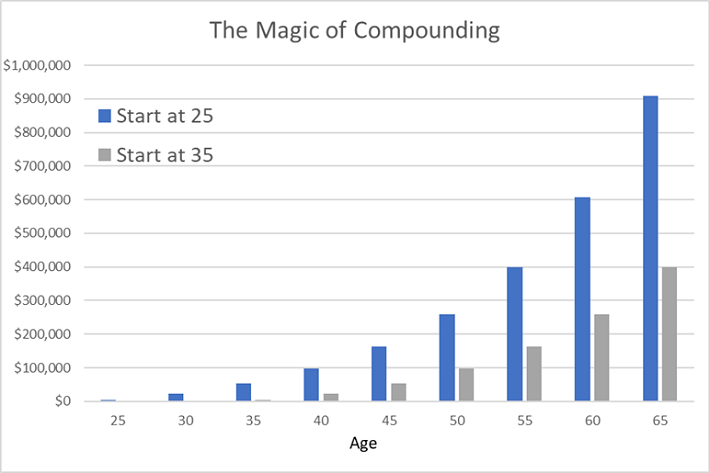

If we assume 8% annual returns instead of 6%, the case for starting early is even more compelling. We’ll use the same assumptions as before regarding savings but this time, annual returns are 8%.

The first investor accrues $910,000 by age 65 under this scenario while the second investor accrues $400,000, well under half of what the first investor achieved. In other words, the higher the expected returns, the better the case for starting early in order to take advantage of compounding. In order to achieve the same $910,000 as the early investor, the later investor would need to save a whopping $6,830 annually compared to the $3,000 annually of the first investor. Again, this may be so high as to be an impossible target; beginning early is the preferred route.

Final Thoughts

The weight of the evidence is overwhelming in suggesting investors should begin investing as quickly as they possibly can. It doesn’t take thousands and thousands of dollars of savings each year in order to accrue significant wealth at retirement. However, it does take discipline and investing with a long-term approach. One way to do that is to find high-yielding dividend stocks or blue-chip stocks with long track records of rewarding investors. Whatever route one chooses to take in order to achieve financial freedom, the important thing is to begin as quickly as possible because time is on one’s side.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more