The Best Post-Pandemic High-Yield Dividend Turnaround Stock

The “coronacrash” of February–March 2020 devastated some previously outstanding income stocks. It has been interesting to watch how different companies handled the crisis and how they have performed coming out of the ruins. One of my favorite finance real estate investment trusts (REITs) has made all the right moves to keep the recovery of the last 12 months extending into the future.

The pandemic and resulting economic stresses triggered a massive sell-off of all types of high yield securities. A year ago, companies had no clear picture of how their business would be affected, so they reacted out of fear. The sell-off also forced many finance REITs to unload their leveraged investments. Meanwhile, New Residential Investment Corp. (NRZ) used the pandemic crash to add a business line that will produce great future returns.

I added New Residential to my Dividend Hunter recommendations list in July 2014. From that date until the peak before the pandemic crash, its stock plus dividends generated a total return of 123%, or 15.6% annualized. Reinvesting the high-yield dividends would have pushed the return up to 173%. I do love high-yield reinvestment!

However, the pandemic quickly changed New Residential’s outlook: the company sold off much of its portfolio to preserve capital. The dividend was slashed by 90%, from $0.50 per share to a nickel. Over about six weeks, the stock dropped from above $17 to $4. As I hinted above, outside forces caused high-yield investments to fall further than they should have, but in March–April 2020, New Residential was a company that looked ready to go under for good.

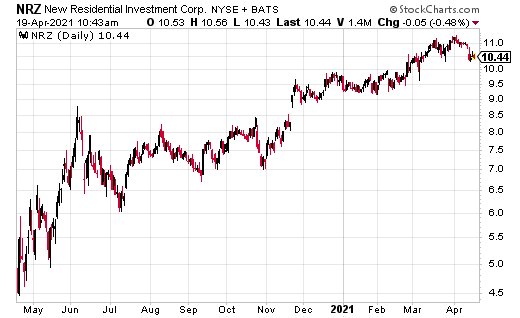

Yet, even in those dark days, I was confident the company could recover. The New Residential management team is one of the best around: they always take what is given and mold the business for profits. Last summer, I recommended that my subscribers add to their New Residential holdings and they have been well rewarded. Since May 2020, New Residential has boosted its dividend three times, and the stock has returned 88%… and still, I am convinced there is more to come.

Over the last several years, New Residential augmented its primary business of investing in mortgage servicing rights (MSRs), with a growing presence in mortgage origination.

In July 2018, New Residential entered the mortgage origination business with the acquisition of Shellpoint Partners. Then in October 2019, the company acquired additional mortgage origination assets out of the DiTech Holdings bankruptcy.

Through 2020 and the first quarter of 2021, New Residential was a significant player for both new home sales mortgages and mortgage refinancing. And last week, New Residential announced an agreement to purchase Caliber Home Loans, Inc. Along with its mortgage business, Caliber owns a $141 billion unpaid MSR balance.

The growth in traditional mortgage origination now allows New Residential Investment to grow and prosper in any mortgage environment. The current housing market remains hot, so providing mortgages for new home buyers will keep the loan officers busy. The recent rise in mortgage rates has slowed the refinancing side of mortgage origination.

However, the rising rates and slow refinancings will make NRZ’s very large MSR book more valuable and profitable. New Residential is now a company that can make money in every possible mortgage market scenario. I will be surprised if NRZ does not add another 50% in return by the end of 2021.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more