The 10 Most Heavily-Shorted Stocks Of January 2021

(Click on image to enlarge)

The Briefing

- Retail brands, among others, have been the target of short-sellers amidst the COVID-19 pandemic

- Individual investors have rallied behind a number of these stocks in an attempt to force a “short-squeeze”

Short Sellers Look to Profit from Struggling Companies

The prospects of retailers such as GameStop have deteriorated over the course of the COVID-19 pandemic, leading many hedge funds to bet against them by taking short positions.

Shorting a company involves borrowing its shares, selling them at current prices, and then buying them back in the future at what is hopefully a lower price. Essentially, short-sellers are betting that the company will underperform in the future.

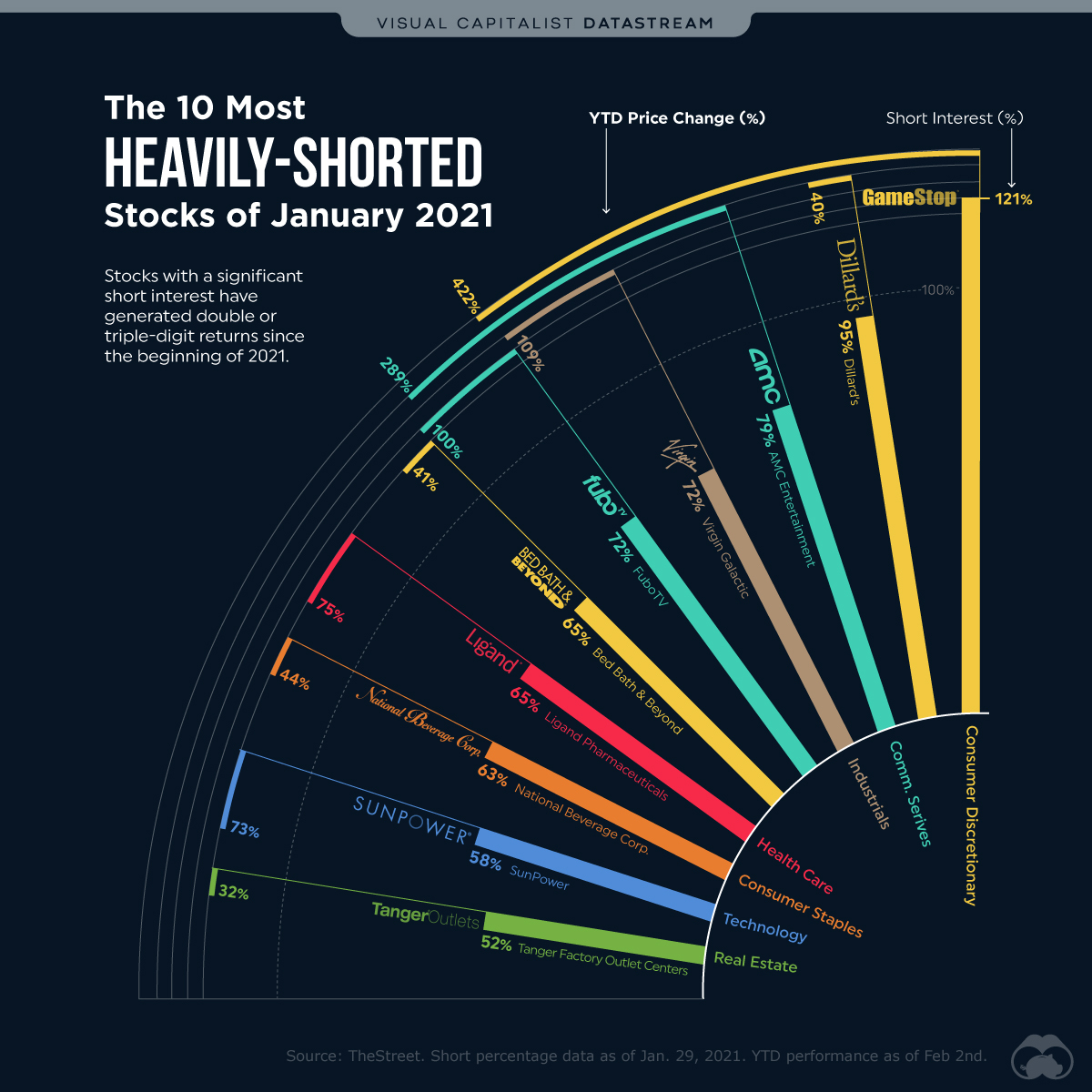

The 10 Most Heavily-Shorted Stocks of January 2021

The following companies had the highest short interest as of January 29, 2021. Short interest is the % of a company’s shares that have been borrowed and sold, but not yet returned.

| Company | Short Interest (%) | YTD Return (%) | Sector |

|---|---|---|---|

| GameStop | 121% | 422% | Consumer Discretionary |

| Dillards | 95% | 40% | Consumer Discretionary |

| AMC Entertainment | 79% | 289% | Communication Services |

| Virgin Galactic | 72% | 109% | Industrials |

| fuboTV | 72% | 100% | Communication Services |

| Bed Bath & Beyond | 65% | 41% | Consumer Discretionary |

| Ligand Pharmaceuticals | 65% | 75% | Health Care |

| National Beverage Corp. | 63% | 44% | Consumer Staples |

| SunPower | 58% | 73% | Technology |

| Tanger Factory Outlet Centers | 52% | 32% | Real Estate |

Source: YTD returns as of Feb. 2, 2021

Many of the companies on this list are brick-and-mortar based retailers that have struggled to attract business during COVID-19 lockdowns. This includes GameStop, Dillards, Bed Bath & Beyond, and AMC Entertainment, America’s largest operator of movie theatres.

Short sellers have also targeted Tanger Factory Outlet Centers for similar reasons. The mall operator’s revenues fell to $64 million in Q3 2020, a 45% drop from the same quarter in 2019. The expectation that a quarter of U.S. malls will close by 2025 could also be a factor for the company’s high short interest.

Retail Investors Clash with Short Sellers

If these companies are expected to fail, why are their share prices making double, and sometimes triple-digit gains? The answer is a phenomenon known as the “short squeeze”.

In an unprecedented move, retail investors have banded together to buy millions of dollars worth of shares to push these companies’ stock prices up, rather than down.

This has forced short sellers to repurchase the shares that they previously borrowed (and sold) at a much higher price. This places even greater upward pressure on the stock and can result in the triple-digit gains seen in the case of GameStop.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more