Term Spread And Inflation Breakeven Declining, Real Rates Still Low

All suggesting slowing growth…maybe

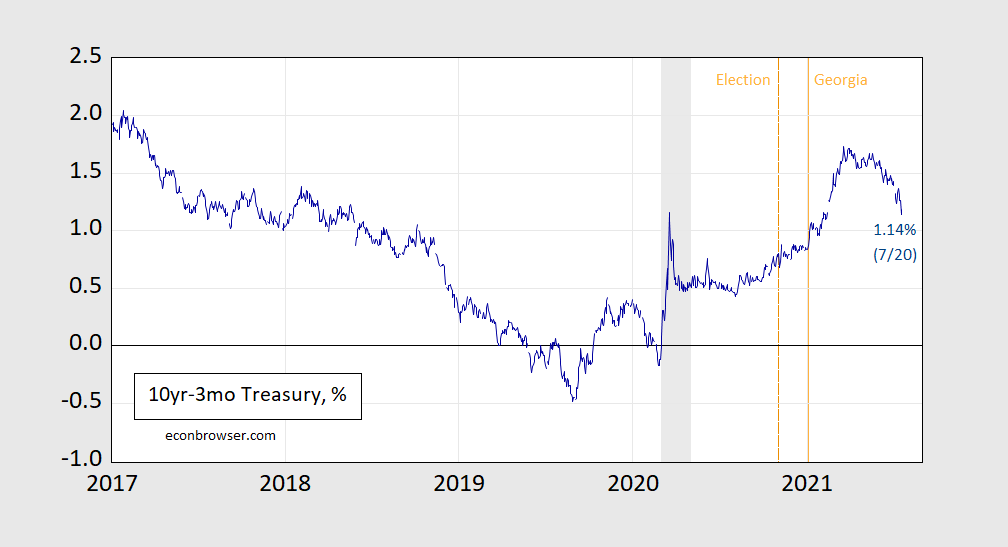

Figure 1: Treasury 10 year constant maturity yield minus 3-month yield, %. Source: Treasury via FRED, and author’s calculations.

Maybe we won’t get that red hot economy, bumping up and over full-employment GDP.

From Reuters:

“Equity markets were pricing an explosion of growth and margins over the next two to three years and it’s clear now we won’t have that,” said Ludovic Colin, senior portfolio manager

at Vontobel Asset Management.Colin said however bond markets appeared too pessimistic in starting to price recession.

“We don’t think we will have recession, just long-term growth that won’t be as beautiful as what was expected by investors in January-March period.”

Given the spread is still positive, predicting another recession seems unlikely, especially given special factors affecting the term premium (e.g., flight to safety, Fed quantitative easing, etc.).

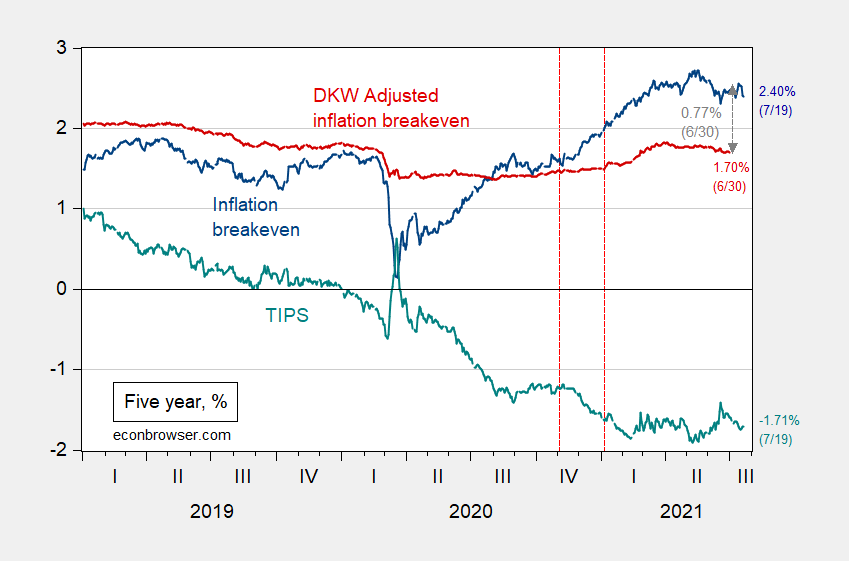

Declining inflation expectations (or at least breakeven calculations) and real rates similarly suggest cooling (relative to prior expectations).

Figure 2: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red),and TIPS five year yield (teal), all in %. Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW), and author’s calculations.

Disclosure: None.