Under The Spotlight: United Technologies

Under our spotlight this month: United Technologies (UTX) provides high-technology systems and services to the building and aerospace industries through four principal business segments: Otis, Carrier, Pratt & Whitney and Collins Aerospace Systems. Through large investments in technology, its 240,000 employees develop new and improved ways to keep people safe, comfortable, productive and on the move.

INDUSTRY LEADER

United Technologies’ predecessor, The United Aircraft and Transportation Corporation, was founded in 1929 when Frederick Rentschler of Pratt & Whitney and William Boeing joined forces to form a vertically-integrated aviation business to provide aircraft manufacturing and aviation services to the military and civilians.

Reflecting diversification into numerous high-tech industries beyond aviation, the company changed its name to United Technologies in 1975. Today, the company provides systems and services to the building and aerospace industries through four business segments: Otis, Carrier, Pratt & Whitney and Collins Aerospace.

Otis, with nearly $13 billion in 2018 sales, is the world's leading manufacturer and service provider of elevators, escalators and moving walkways.

automation, fire safety and security products for residential and commercial buildings. Pratt & Whitney, with $19.4 billion in 2018 sales, is a world leader in the design, manufacture and service of aircraft engines and auxiliary power units for military and commercial aircraft. Collins Aerospace Systems, with $16.6 billion in 2018 sales, is among the world’s leading suppliers of advanced aerospace products and aftermarket services for diversified industries worldwide.

SPINNING OFF BUSINESSES

Late last year, management announced its intent to create three industry leading companies by spinning off its Otis and Carrier businesses to shareholders in tax-free transactions. The remaining United Technologies’ business will focus on aviation and is expected to generate $50 billion of sales in 2020.

Operating separately will afford each company the flexibility to build on its distinct business characteristics, capital structures and investment profiles thereby driving greater long-term shareholder value. The companies will be appropriately capitalized with the financial flexibility to take advantage of future growth opportunities. Each business will be better positioned to pursue a capital allocation strategy more suitable to its respective industry and risk and return profile.

The businesses will have strong balance sheets with investment grade credit ratings and free cash flow conversion rates exceeding 100%. One-time spinoff costs are expected in the $2.5 billion to $3 billion range. The per share at the outset will be no less than United Technologies’ current dividend of $2.94 per share. During the transition, the company will suspend its share buyback program as it pays down the debt incurred for its $30 billion Rockwell Collins acquisition made in 2018. Spinoff completion is expected in early 2020.

FIRST QUARTER RESULTS

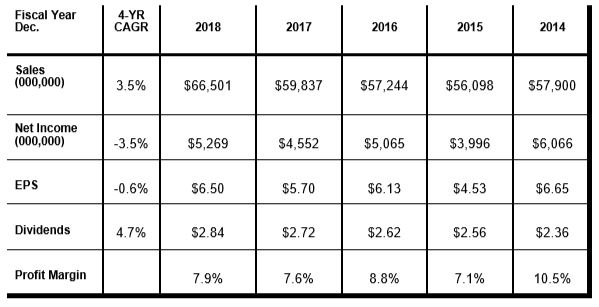

United Technologies reported first quarter revenues increased 20% to $18.4 billion, including strong 8% organic growth. Net income increased 4% to $1.34 billion with EPS dipping 4% to $1.56 on a higher share count. During the quarter, the company generated $1.1 billion in free cash flow, up from $116 million last year, with the company paying $609 million in dividends. United Technologies has paid cash dividends on its common stock every year since 1936.

2019 OUTLOOK

Management reaffirmed its 2019 sales and free cash flow outlook with sales expected in the range of $75.5 billion to $77 billion, including organic sales growth of 3% to 5%, and free cash flow of $4.5 billion to $5 billion.

Management increased the lower end of its adjusted EPS guidance to the range of $7.80 to $8.00, up from $7.70 to $8.00. Investors should consider taking a ride on this high-quality industry leader as it prepares to create even greater long-term shareholder value by spinning off business segments with strong cash flows and substantial revenues. Buy.

Disclaimer: Coppying, reproduction or quotation is strictly prohibited without written permission. Information presented here was obtained from sources believed to be reliable but accuracy and ...

more