The Roku Story: How Far Can It Go?

- Roku is a “platform for television distribution”, focused on hardware creation, content distribution, and advertising services.

- The company trades at a high valuation, especially compared to their tech peers.

- They are issuing an additional 1M shares of stock that they plan to use toward working capital and general corporate purposes.

- Roku is focused on making TV better, specifically by building a TV-specific operating system.

- The space they are in is fiercely competitive.

Roku: Not A Hardware Company

Roku (ROKU) is a technology company that specializes in streaming devices, advertising, content distribution and creation. The company had 29.1M active accounts as of Q1 2019, with users streaming over 9.8B hours in the first quarter alone on the platform. The average Roku user is up to 3.5 hours a day in terms of platform engagement.

Roku sells the technology that hosts streaming services like Netflix, Amazon Prime Video, and Hulu. The company has recently expanded into advertising, which allows them to collect information from the platform, including user registration data, audience engagement metrics, and ad interaction. They sell this data back to advertisers using the Measurement Partner Program, and they work with over 70% of the largest advertisers in the US.

For their advertising partners, they recently released Activation Insights and Reach Insights, which allows brands to measure the amount of user engagement they receive through the Roku interface. For consumers, they released Roku OS 9.1 on April 9th of 2019, which allows for services such as voice command, guest mode, and different exclusive offers for users.

The company is doing a lot in a heavily saturated space, and has built out key partnerships with some of the top players in the streaming industry. But there is a balance between growth opportunities and company valuations, and Roku is currently very expensive. According to my DCF calculations, they have an expected share price of $80.57, which is a 14.9% downside from their current price of $92.65. They are currently too expensive to be considered a good investment, despite their growth opportunities.

Segmentation: Platform and Players

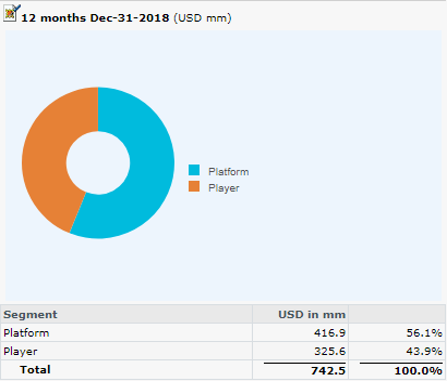

Roku operates in two primary segments, platform and players. The Platform includes the Roku OS, advertising, etc. The Players include their hardware streaming product line, which includes Roku TV, wireless speakers, Roku Express, Roku Streaming Stick, and others.

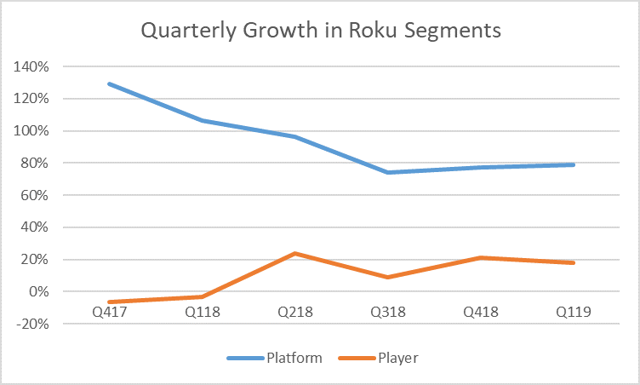

They’ve expanded their Platform revenue mix from 15.6% in 2015 to over half of their revenue by 2018, increasing at a CAGR of 102.9% over that time frame. The company earns a lot more from their platform segment, with their player gross margin stagnant in the low single-digits. They use hardware to get into people’s homes, but the real growth opportunity is within the Platform, whether it be from subscription services or advertising dollars.

Source: Capital IQ

OTT: Over The Top Viewing is a Growth Pathway

OTT, over-the-top viewing, which connects user to content through the Internet, previously consisted of set-top boxes like the traditional Roku player, but those devices are increasingly being integrated into TVs. Currently, Roku’s fastest growing segment are their Roku TVs, and they partner with Chinese manufacturers, like TCL, to create and distribute the product. TCL and Roku announced their partnership to build an 8K TV, which is expected to be released at the end of 2019. It is important to note that the trade war tensions with China could negatively impact them in the future.

However, Roku has several different exposures through the television interface. Roku has built an operating system for TVs, completely separate of Android and iOS software. It’s TV-specific software, which could provide them a leg up on the competition moving forward. Apple TV has its own OS, but Anthony Wood, Roku’s CEO remains confident in Roku’s product stating “We’re much more focused. All we do is we come to work every day and we think about how to make TV better.”

Advertising: Follow the Audience

Not only does Roku have opportunity through TV distributors, but they are also increasingly expanding their advertising services. Advertisers can buy a range of ads, but “every ad served on Roku is targeted, 100 percent targeted, one-to-one, personalized” according to Roku’s CEO, Anthony Wood. Roku sells their ads by audience, not by product or brand. They work with the advertisers to determine the potential target market, and they release those ads to the viewers on the platform that exist within that segment.

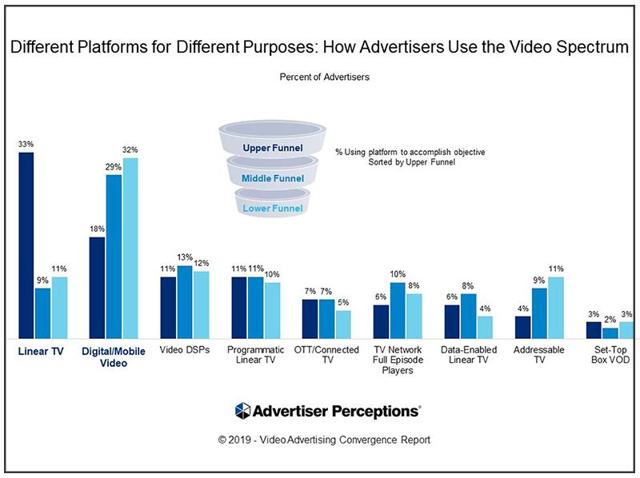

On their most recent earnings call, the company said that advertising was the biggest component of their platform segment. This makes sense, because in order to reach users that stream, advertisers will have to switch to advertising over streaming platforms, which is where Roku comes in. Advertisers are becoming more optimistic about the opportunities of streaming services, according to a report from Advertiser Perceptions.

Source: Advertiser Perceptions

There is a 10% year over year increase in video advertising, with advertisers increasingly focused on using TV for generating brand awareness, represented by upper funnel marketing. Middle funnel marketing represents conversion, so getting users to switch from one product or service to another. For OTT/Connected TV, advertisers are equally as likely to use that specific platform for generating awareness as well as conversion, which is promising for future growth across advertising opportunities.

The Potential of Disney Outweighed by Other Threats

Disney recently announced that Disney Plus would be streamed on the PS4 and Roku, which could give Roku a boost when that product is released in November. Roku will get a share of revenue when people sign up for the service, which could be worth $200M a year, and could boost the market value of the company by 15%.

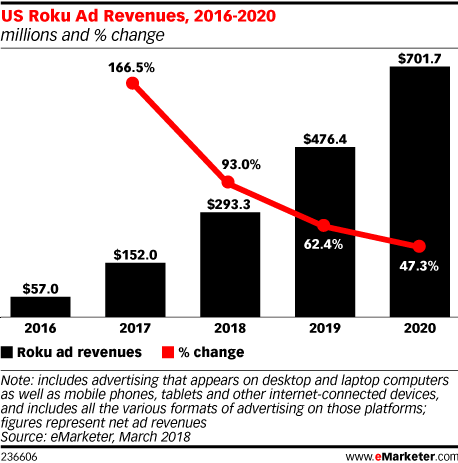

However, the company has other barriers that it will have to work through, including a drop in ad revenue growth as well as fierce competition in the streaming space. Apple TV created tvOs, which allows users to personalize their Apple TV interface. Google, Amazon, and others are all gaining on Roku as well, and it could be hard for the company to keep up in the future.

Source: E Marketer

The Growth of Competitors

The company has a large focus on hardware, but their business model surrounds services and advertising, as well as content distribution.

They make money when their users subscribe to services like HBO or Showtime, not when they sell their Smart TVs. That incentivizes the company to keep strong ties with the streaming platforms. The hardware that they sell is just a gateway into consumer households. The company is really focused on generating advertising dollars as well as subscriptions services.

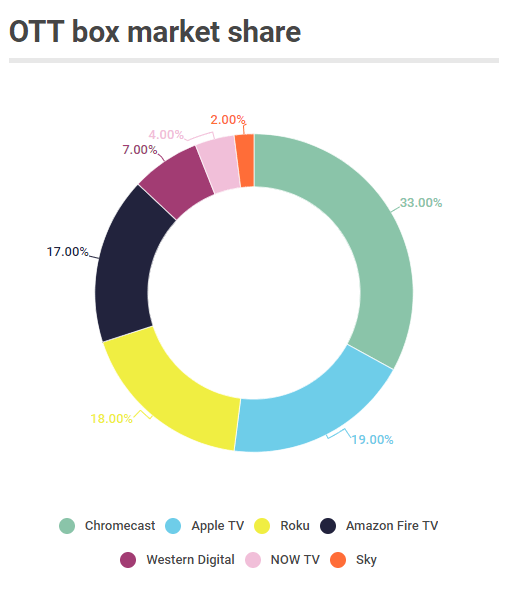

However, the company must maintain focus on the hardware, especially as streaming players get built into Smart TVs. That’s why they focus on the Roku TV, as well as their various streaming options. They are currently the #1 selling smart TV in the US, with estimates that 1 out of every 3 smart TVs sold were Roku.

Source: Broadband TV News

Internationally, Google Chromecast is preferred by 1 in 3 consumers, and the Amazon Fire TV stick is number one in both the UK and Germany. Amazon Fire TV has over 34M active users, as compared to Roku’s 29.1M user base. Roku still dominates the US market, but the other players are quickly catching up.

Looking into the Future: Strong Growth Prospects Based on Consumer Tastes

The company’s revenue is expected to grow well into the future, surpassing $1.04B in 2019. They currently operate at a net loss, and they are expected to continue to do so until 2021, according to estimates from Capital IQ.

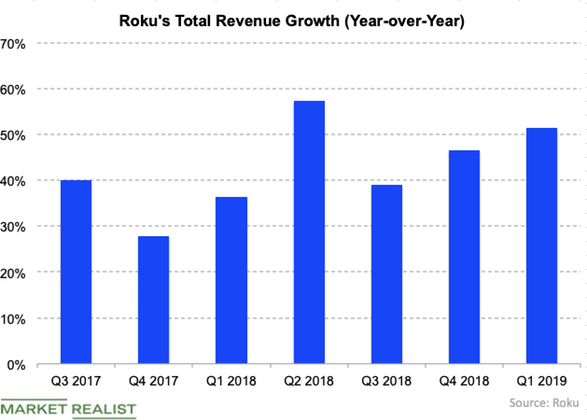

Source: Market Realist

Their growth is driven primarily from inflows from their ads and licensing segment. Their hardware revenue rose only 17.9% year over year, as compared to their 78.7% year over year growth in Platform revenue, which has stagnated in recent quarters.

Source: Capital IQ

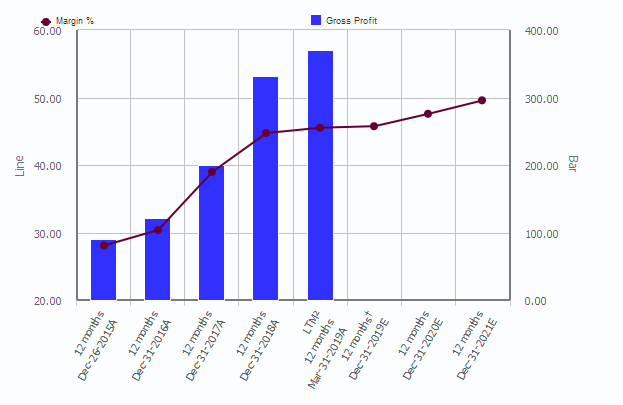

Because they don’t make any money, their profitability metrics are all negative. They do have a strong gross margin of 45.5%, which is generated primarily from platform revenue. The company believes that gross margin is the best indicator of their performance, especially because their platform and their player service are so different in terms of industry profile.

They’ve increased their gross margin by 16.6% since 2015, which is strong, especially if they can continue to expand that growth into the future. Gross profit has increased to $369.9M for Q1 2019, a 60% increase year over year.

Source: Capital IQ

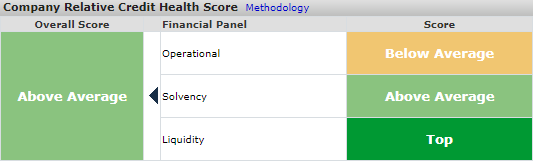

The company currently has no outstanding debt, leaving them entirely financed by equity. They filed to issue 1M more shares, with the “proceeds going towards working capital and general corporate purposes”. They had $15M of debt in 2016, which they’ve paid off over the past two years. They have a strong debt management metrics, with a current ratio at 2.2x and a quick ratio of 2.0x. Overall, they have a strong credit health panel, weighed down only by operational metrics due to their negative profitability metrics.

Source: Capital IQ

Conclusion: Growing, But Not Worth the Price

Roku has a strong network of dealers and suppliers, as well as first mover advantage in an increasingly saturated market. There is a certain degree of brand recognition, especially as the company continues to capitalize upon the different brand opportunities, such as the Disney deal. Streaming will only increase in popularity within the next few years, and the company is primed to benefit from that growth.

However, their business model is relatively easy to imitate, and easily replaceable if the top players decide to do it on their own. Their biggest competitors are much larger than they are, and Roku’s existing contracts are short term, and can be easily disrupted. Roku does carry a network of almost 30M accounts, which could keep them in the game for a while longer.

Disclaimer: These views are not investment advice, and should not be interpreted as such. These views are my own, and do not represent my employer. Trading has risk. Big risk. Make sure that you can ...

more