Palo Alto Networks: A Growth Leader In Cybersecurity

Cybersecurity demand has skyrocketed in recent years, and everything indicates that demand for all kinds of cybersecurity services will continue increasing in the years ahead. Palo Alto Networks (PANW) is a growth leader in cybersecurity with an impeccable track record of rapid growth and outperforming expectations.

Firing On All Cylinders

Palo Alto Networks initially positioned itself as a leading player in cybersecurity thanks to its next-generation firewall appliances. Over the years the company leveraged on such as strength by expanding its subscriptions and support services in relation to firewalls, as well as new services based on protection for cloud-based traffic and software-as-a-service. Cloud security and Artificial Intelligence are two key growth areas for the company in the years ahead.

Palo Alto has made several acquisitions of smaller players in the past few years. These moves provide Palo Alto Networks with more capabilities and more customers, which creates plenty of cross-selling opportunities. When Palo Alto purchases a new company, it can sell its existing solutions to the new customers and also offer the newly acquired capabilities to previously existing customers.

Customer acquisition costs are one of the most important expenses in the industry, so cross-selling opportunities created by acquisitions are particularly valuable. Besides, offering a holistic set of security solutions with only one provider makes things much easier for customers.

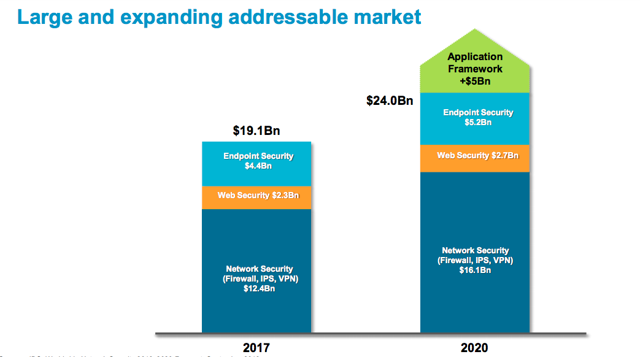

Cybersecurity is currently a top concern for many companies all over the world, the global cost of online crime is expected to reach $6 trillion by 2021, and Palo Alto calculates that the total addressable market is currently worth around $24 billion.

Source: Palo Alto Networks

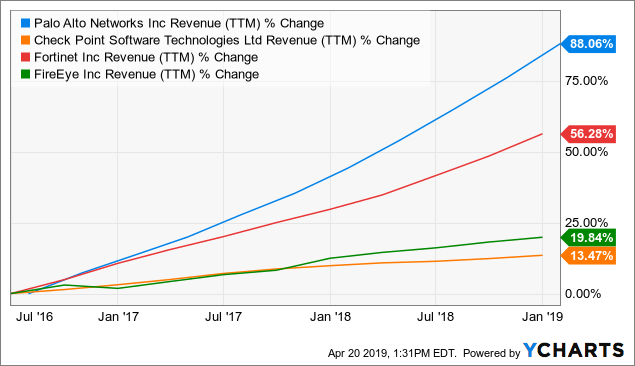

Demand for cybersecurity is booming in recent years, so multiple players en the sector are benefiting from such growth. That said, Palo Alto is also outperforming competitors such as Check Point (CHKP), Fortinet (FTNT), and FireEye (FEYE). Most cybersecurity providers are growing well, but Palo Alto is outperforming the competition.

Data by YCharts

Financial performance numbers for the quarter ended in January of 2019 confirm that the business keeps firing on all cylinders. Revenue grew 30% percent year over year to $711.2 million, compared with total revenue of $545.6 million in the same quarter during the previous year.

Adjusted earnings per share came in at $1.51 per share versus or $1.05 per share in the year-ago quarter. Operating margin amounted to 24.6% of revenue, and free cash flow margin represented 38.2% of sales during the period.

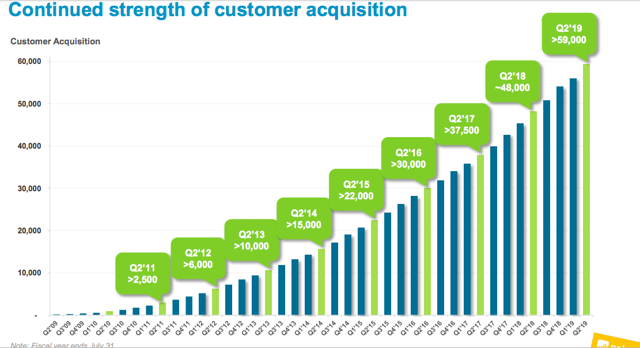

Customer acquisition trends are impressive over the long term, and the most recent quarter is no exception at all in terms of customer growth.

Source: Palo Alto Networks

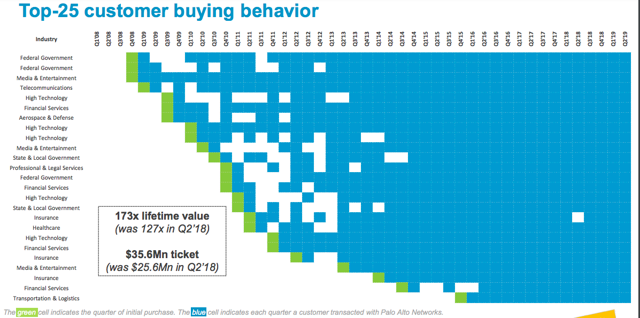

The company is also doing a great job at increasing the lifetime value of its main customers. This metric represents the total revenue a particular client is expected to generate net from expenses related to client acquisition and servicing.

On the back of a growing customer base and increasing revenue per customer, Palo Alto Networks is positioned as a growth leader in a remarkably dynamic industry with plenty of potential for expansion in the years ahead.

Driven By Strong Fundamental Momentum

Fundamental momentum can be a powerful return driver for stocks. Current stock prices are reflecting a particular set of expectations about the future of a business. When analyzing the earnings numbers from a company, the market reaction to those numbers does not depend on the financial metrics in isolation, but on the numbers in comparison to previous expectations.

In simple terms, if a company can consistently deliver better than expected earnings, this generally means that the stock price will need to rise in order to reflect increasing earnings expectations for the business behind the stock.

The table shows the expected earnings figures and the actual reported numbers for Palo Alto in the past four quarters. Not only has the company outperformed expectations in each and every quarter, but it's also beating expectations by an increasingly large margin.

| Earnings History | 4/29/2018 | 7/30/2018 | 10/30/2018 | 1/30/2019 |

| EPS Est. | 0.96 | 1.17 | 1.05 | 1.22 |

| EPS Actual | 0.99 | 1.28 | 1.17 | 1.51 |

| Difference | 0.03 | 0.11 | 0.12 | 0.29 |

| Surprise % | 3.10% | 9.40% | 11.40% | 23.80% |

Data Source: Factset

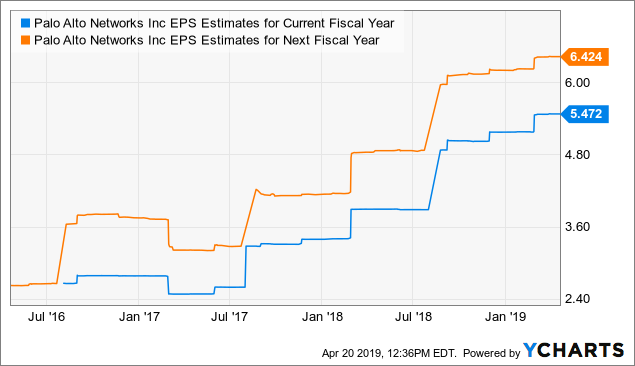

The chart shows how earnings estimated for Palo Alto in both the current year and next year have substantially increased over time. Wall Street analysts are typically running from behind, as the company delivers earnings numbers above expectations, then forward-looking expectations are subsequently increased.

Data by YCharts

Fundamental momentum is not easy to maintain, but companies that can consistently outperform expectations tend to deliver outstanding returns for investors. When it comes to fundamental momentum, Palo Alto has an extraordinary track record.

Priced For Growth, But Not Overvalued

The market is expecting vigorous growth from Palo Alto Networks, so the stock is priced at demanding levels in comparison to current earnings and cash flows. However, valuation is not excessive at all when considering growth in the equation.

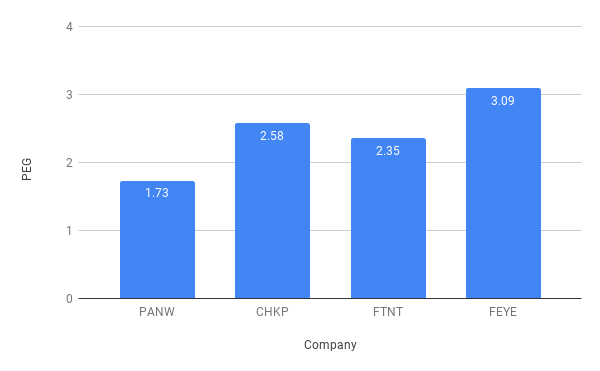

All else the same, the faster the growth rates in earnings, the more valuable each dollar in current earnings for investors. The price to earnings growth (PEG) ratio is obtained by dividing the classic price to earnings ratio (P/E) by the expected growth rate in earnings, and it can be a remarkably effective tool to compare valuation ratios for companies with different growth rates.

The chart shows the PEG ratios based on long term growth expectations for Palo Alto Networks, Check Point Software, Fortinet, and FireEye. Palo Alto has the lowest PEG ratio among the four companies considered.

Data from S&P Global via Portfolio123

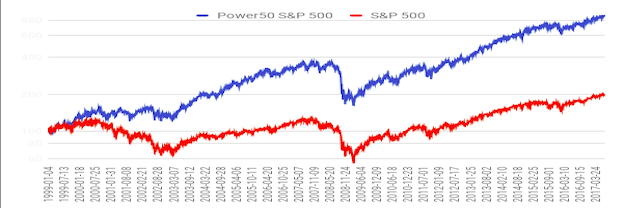

The PowerFactors system is a quantitative investing system available to members in "The Data Driven Investor." This system basically ranks companies in a particular universe according to quantitative return drivers such as financial quality, valuation, fundamental momentum, and relative strength.

Data from S&P Global via Portfolio123

Palo Alto is one of the top companies in the market right now, with a PowerFactors ranking above 99.2. According to the backtesting data, this should mean that Palo Alto is well positioned for attractive returns when considering metrics such as financial quality, valuation, fundamental momentum, and relative strength in combination.

The quantitative algorithm does not guarantee future performance, of course. The numbers show that a group of companies with strong numerical attributes tend to outperform the market over the long term. But this does not guarantee that a specific company such as Palo Alto will necessarily outperform in a particular year.

In order to justify current valuation levels for the stock, the company will need to continue delivering rapid revenue growth and improving profitability over the coming years. Nevertheless, the main point is that Palo Alto stock is not overvalued at all when the valuation ratios are analyzed in combination with other quantitative metrics.

The Bottom Line

No investment is risk-free, and Palo Alto is, in fact, an investment proposition with above-average risk levels. Some key risk factors to keep in mind:

- Competition in cybersecurity is remarkably aggressive, and technological disruption is always a possibility.

- A rising bar is hard to beat, and Palo Alto is facing high expectations in the coming quarters.

- Momentum is a double-edged sword. High Growth stocks such as Palo Alto tend to be particularly volatile in times of risk aversion in the market.

Those risks being acknowledged, when considering the company's track record, growth opportunities, fundamental momentum, and valuation levels Palo Alto Networks stock is well positioned for attractive returns in the years ahead.

Statistical research has proven that stocks and ETFs showing certain quantitative attributes tend to outperform the market over the long term. A subscription to The Data Driven Investor provides you access to profitable screeners and live portfolios based on these effective and time-proven return drivers. Forget about opinions and speculation, investing decisions based on cold hard quantitative data can provide you superior returns with lower risk.

Disclosure: I have no positions in any stock mentioned and

no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more