Medigus, A High-Risk, High-Reward Micro-Camera Play

Medigus (MDGS) is an Israeli technology company offering the following products:

The company is concentrating on the ScoutCam (which also happens to be an important component of the MUSE, as it happens), and that seems a very good decision as the technology has much wider application than just the medical field and order backlog is rising rapidly.

At first sight, this more singular focus on ScoutCam (and the intention to sell the MUSE business) is complicated a little by two announced participations (which are supposed to close next week), but management argues that they can make these a source of cash, financing the growth of their ScoutCam business.

The market doesn't seem to bite yet, but we think recent developments of the ScoutCam warrant a little more optimism not yet reflected in the share price.

MUSE

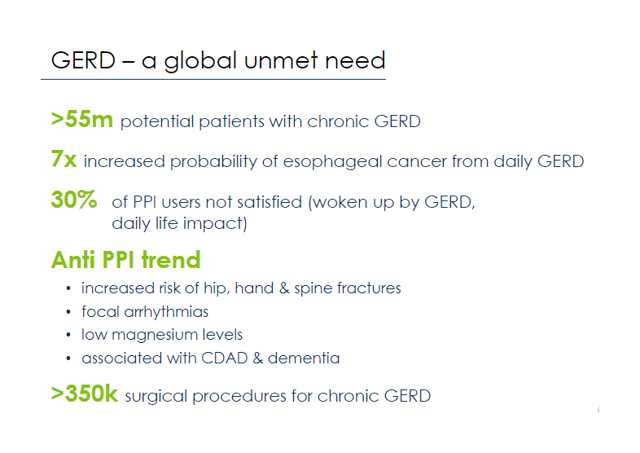

The company's flagship device is the MUSE system, which addresses the unmet need in between drug therapy and invasive surgery for the long-term treatment of GERD (gastroesophageal reflux disease), commonly referred to as acid reflux. From the most recent company presentation:

And to have an idea of the market:

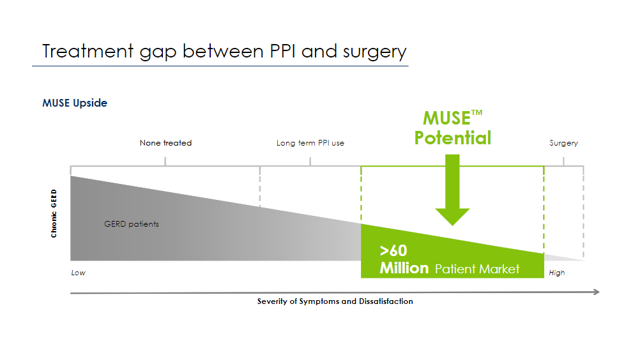

Not necessarily all that market is addressable, the MUSE competes against medicine and surgery but there is a valuable niche in-between:

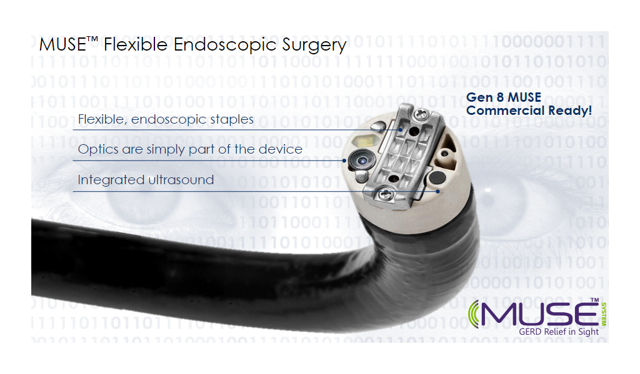

You see the head of the device here with the microcamera:

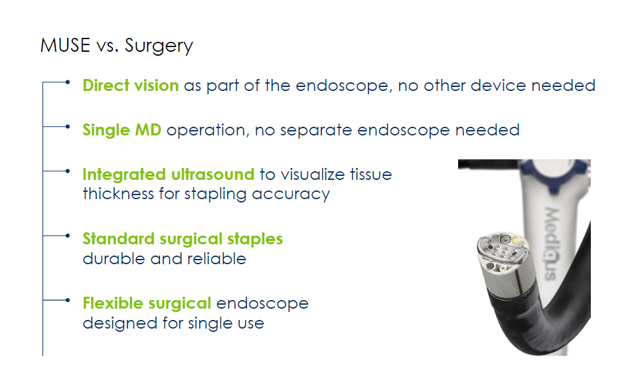

But it has important advantages versus traditional surgery:

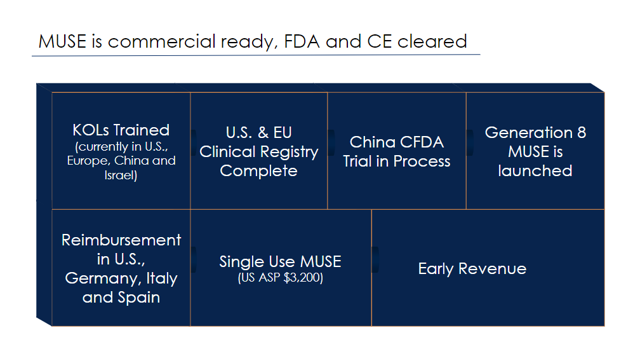

And it has already received a lot of regulatory clearances and reimbursement for treatment from payors:

- One can find clinical studies here (and here).

- The company had 70 world wide patents and 17 US patents, and this was last year, a couple of patents have been added more recently (for the ScoutCam).

The technology has been FDA approved (20-F):

The clearance by the FDA, or ‘Indications for Use’, of the MUSE ™ system is “for endoscopic placement of surgical staples in the soft tissue of the esophagus and stomach in order to create anterior partial fundoplication for treatment of symptomatic chronic Gastro-Esophageal Reflux Disease in patients who require and respond to pharmacological therapy”. As such, the FDA clearance covers the use by an operator of the MUSE ™ endostapler as described in the above paragraph. In addition, in the pivotal study that was presented to the FDA in order to gain clearance, only patients who were currently taking GERD medications(i.e. pharmacological therapy) were allowed in the study. In addition, all patients had to have a significant decrease in their symptoms when they were taking medication compared to when they were off the medication. As such, the FDA clearance included the indication that MUSE ™ system is intended for patients who require and respond to pharmacological therapy. The MUSE ™ system indication does not restrict its use with respect to GERD severity from a regulatory point of view. However, clinicians typically only consider interventional treatment options for moderate to severe GERD. Therefore, it is reasonable to expect the MUSE ™system would be primarily used to treat moderate and severe GERD in practice.

The company now intents to sell the MUSE business (see below).

ScoutCam

This is their micro (1.2mm – 6.5mm diameter) cameras that were designed for medical purposes, from the company website:

It features a micro medical camera equipped with micro CCD / CMOS sensors and ultimate image technology which cover a broad scale of innovative medical applications... It is already in use as medical inspection camera, for fiber optic endoscopes, as endoscopy camera, gastroscopy camera, laparoscopycamera, urology camera, arthroscopy camera, gynecology camera, surgical camera, ent camera etc.

The same web page shows a host of products based on this technology. But this technology has wider application opportunities besides the medical field, it's also applicable in a range of industrial practices, from the company website:

It is already in use for remote non-destructive testing (NDT), remote visual inspection, micro drilling inspections, cavities inspection, as tube inspection camera, pipe inspection camera and robotics.

And again the web page comes with a host of products. From the IR presentation:

After receiving a US patent the technology is getting some further traction recently:

- $1.1M Order backlog (June)

- $650K Order (July)

- Two more orders (July)

- More orders (July)

It's early days and not too many firm conclusions can be drawn from this, but it certainly looks like this is off to a promising start in just a couple of months. Indeed, that order backlog of $1.1M as of May 31, 2019 for its micro-camera business, a 245% increase over 2018 revenues of the entire company, and things haven't stopped here.

The technology is applicable in many use cases, both medical and industrial, and they keep expanding these, for instance at the start of the year (PR):

it has filed an application under the framework of a consortium for a European grant for the development of a fluorescent colonoscope from Horizon 2020 fund. The expected duration of the project is four years, and its budget is 3,000,000 Euros and its intention is to improve the ability of early detection of colorectal cancer.

In addition to Medigus (MDGS), three universities from Germany and the Netherlands (Helmholtz Zentrum München, Technical University of Munich, University Medical Center Groningen) and a German company (Amcure), are parties to the consortium. While the universities and the other company will focus on the development of molecular-chemical aspects of the fluorescence molecular endoscopy of malignant and pre-malignant colorectal tumors, Medigus will be responsible for the development of a revolutionary colonoscope, which will contain two cameras, one for HD white light imaging and one for infrared vision (NIR).

However, a lack of finance also constrain the growth of the business, in 20-F, management argues that:

We have a limited sales and marketing infrastructure and have limited experience in the sale, marketing or distribution of products. To achieve commercial success for any product for which we have obtained marketing approval, we will need to establish a sales and marketing infrastructure or to out-license our products. In the future, we may consider building a focused sales and marketing infrastructure to market ScoutCam™ and potentially other product in the United States or elsewhere in the world.

This is basically the same problem they have with the MUSE and the reason to sell that business, but on the other hand, any proceeds of selling the MUSE business can be used to build the sales apparatus for the ScoutCam technology and that has even raked up sales already without this.

Even so, the products sort off sells itself as the company is already able to serve multiple industries like aerospace, medical, defense, industry and more.

Among the company's high- profile projects, are two successful projects for NASA. The company developed custom-made camera and illumination which were integrated in remote refueling robot and tested outside the International Space Station, providing live video from space. For additional info, click here.

Over the past six month, ScoutCam expanded and deepened its presence in various fields by selling its products and strengthen collaborations with leading international companies and organizations, such as large defense organizations, global nuclear reactor group, medical companies and more.

And there is more to come (20-F):

Our most advanced camera is a prototype CMOS-based camera measuring only 0.99 mm in diameter transmitting 45,000 pixels in HDMI format, which we believe to be the smallest video camera ever produced. This camera is based on “through-silicon-via” technology whereby the electronics pass vertically through the sensor, permitting smaller diameter devices. This prototype camera will not be commercially available in the foreseeable future.

The 20-F also contains a useful summary of the competition:

The main devices that compete with our miniature cameras are manufactured by Awaiba, Fujikura, MicroCam (Sanovas), Precision Optics, Opcom,Misumi and FISBA. The miniature cameras of each of these vendors differ in various factors include image quality and resolution, camera shape and dimensions,sensor technology, optic characteristics, and user flexibility and customization. In recent years, OmniVision, a global leader in CMOS sensors, expanded itsinterest in micro sensors, and in supporting them with optics and video processing solutions. We use OmniVision sensors in the MUSE ™ system as well as inmany of our ScoutCam ™ projects and strive to strengthen our partnership with OmniVision.

Strategy change

The company appointed a new CEO in April and changed its strategy (from the 20-F):

In the recent months, we have materially changed our business model, adjusted our exclusive focus on the medical device industry to include other industries, abandoned our strategy to commercialize the MUSE ™ system, transferred our ScoutCam ™activity into our subsidiary, and we are assessing several new ventures. We cannot guarantee that these strategic decisions will derive the anticipated value to us and to our shareholders, or any value at all.

So:

- Trying to sell its MUSE business.

- Broadening the appeal of the ScoutCam to other industries (and with some immediate success, as we showed above).

- Entering other sectors (see below).

First off, until the company actually manages to sell the MUSE business, they keep on developing it and actually with some success of late:

- A new clinical study in China (April 8)

- A $3M licensing and sale agreement in China (June 3)

In addition to that China deal, they are also looking for similar deals elsewhere. The decision to sell the business probably makes sense:

- The company lacks the resources to build a global sales, marketing and distribution network.

- Even if sold off, it can still capture significant value as their ScoutCam are a crucial part in the MUSE system.

Here is some further clarification on the strategy for the MUSE going forward (20-F):

As part of our board of directors decision to examine potential opportunities to sell our MUSE ™ technology, or alternatively grant a license or licenses for the use of the MUSE ™ technology, our board of directors has reexamined the efforts and resources currently invested by us in our MUSE ™ technology distribution agreements as well as the revenues obtained through such agreements in order to assess their financial viability. As a result of this analysis, our board of directors resolved to terminate our distribution agreements, except for our distribution in China, in order to redirect our resources to securing licensing agreements, which may in turn generate significant income in the short term, reduce operating expenses and lower the Company’s burn rate

Other sectors

The company seems to pursue other activities:

- Taking a stake in an online marketing company.

- Announcing interest in the CBD and medical cannabis industry.

On March 19 this year the company entered into an agreement with an Israeli online marketing company Algomizer in the form of a $5M investment, from the PR:

Medigus to invest NIS 5.4 million directly in Algomizer Ltd., which is engaged in field of internet advertising and whose shares are traded on the Tel Aviv Stock Exchange Ltd. The investment will be made at a price per Algomizer share of NIS 4.15. Medigus will invest an additional NIS 9 million through a direct acquisition of the shares of Linkury Ltd. from Algomizer, at a company valuation of Linkury of approximately NIS 96 million. Medigus will further invest an additional $1 million in Algomizer through equity exchange by issuing Algomizer American Depositary Shares (ADRS) at a price of $3 per ADR in consideration for Algomizer shares based on a price per Algomizer share of NIS 4.15.

In addition, Medigus will issue Algomizer warrants to purchase ADRs in an amount equal to the ADRs issued to Algomizer, at an exercise price of $4 per ADR. Furthermore, Algomizer will make its best effort to list its shares on a national stock exchange in the U.S.

That's a substantial participation, Medigus will hold 17.9% at Algomizer Group and the deal is supposed to close next week. One reason for the participation might be (20-F):

We have a limited sales and marketing infrastructure and have limited experience in the sale, marketing or distribution of products. To achieve commercial success for any product for which we have obtained marketing approval, we will need to establish a sales and marketing infrastructure or to out-license our products

It makes more sense in relation to their efforts of selling their MUSE business though. Management also argued in the 20-F that it expects to derive significant value from the participation, but in the same breath argued that there are no guarantees, not even for a successful completion of the transaction.

But there is more, the company also (from company PR):

announced today that it has entered into a binding memorandum of understanding with Linkury Ltd., a leading company in the field of online advertising, which is wholly owned by Algomizer Ltd. (TASE: ALMO). As part of the memorandum of understanding Linkury will establish a commercial technological platform for the manufacturing, marketing and distribution of cannabidiol based (CBD) products. In addition, the two companies will examine entering into a definitive agreement and the formation of an international advertisement company, which will carry out the joint venture... the manufacturing, operation, and regulation related to the CBD products will be carried out by Meidgus. The companies will jointly invest up to $500,000 in the venture for infrastructure and marketing and will own it in equal parts. This is Medigus’ first investment in the field of CBD, after announcing on February 14 that it intends to enter the CBD and medical cannabis markets.

Without much further information it is difficult to assess the potential here. In any case, the upshot of the strategy change is summed up (20-F):

We plan to derive most of our future revenue from product sales and development services of our imaging equipment and our flagship ScoutCam™ and its future applications. Our future growth and success is dependent on the successful commercialization of the ScoutCam™ system.

So going forward it seems that the company is betting on the ScoutCam and the participations in the online marketing companies. We contacted management for the rationale of the Algomizer/Linkury deals and it seems to be twofold:

- To use the cash of the company in order to generate a return as to reduce cash burn.

- To use the experience of the management team in order to make Linkury a publicly traded company.

Well, we have to wait and see how this goes.

Figures

Here is an overview of the last five years:

Data by YCharts

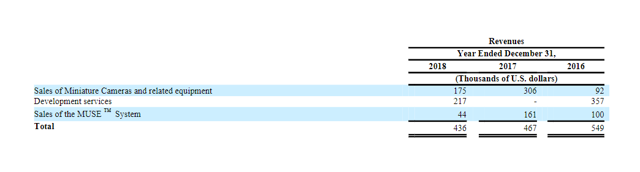

Not a whole lot in terms of revenue, and some operational deterioration. Here is how the sales split out (20-F):

What are these development services? Well, from the 20-F:

The increase in revenues from development services was primarily due to:

- (I) during the year ended December 31, 2018 we recorded revenues for development services provided to a customer in the amount of approximately $130,000 (see ‘Customer A’ in note 17d to our financial statements for the year ended December 31, 2018). We did not receive any revenue from this customer during the year ended December 31, 2017; and

- (II) during the year ended December 31, 2018 we recorded revenues for development services provided to a customer in the amount of approximately $87,000. We did not receive any revenue from this customer during the year ended December 31, 2017.

Net cash used in operating activities for the year ended December 31, 2018 was $4.2 million, an decrease of $0.5 million, compared to net cash used in operating activities of $4.7 million for the year ended December 31, 2017

Financing

Given the substantial losses and cash bleed, the company regularly resorts to financing:

Data by YCharts

And there is more on the way in the form of the warrants (20-F):

As of March 25, 2019, the following warrants are outstanding:

- Unregistered warrants to purchase an aggregate of 990 ADSs at an exercise price per ADS of $57.50. These warrants expire on September 8, 2021.

- Unregistered warrants to purchase an aggregate of 10,469 ADSs at an exercise price per ADS of $36. These warrants expire on June 6, 2022.

- Unregistered warrants to purchase an aggregate of 998 ADSs at an exercise price per ADS of $29.48. These warrants expire on December 6, 2021.

- Warrants to purchase an aggregate of 535,730 ADSs at an exercise price per ADS of $14. These warrants expire on March 29, 2022.

- Warrants to purchase an aggregate of 37,501 ADSs at an exercise price per ADS of $17.5. These warrants expire on March 29, 2022.

- Unregistered warrants to purchase an aggregate of 101,251 ADSs at an exercise price per ADS of $9. These warrants expire on May 27, 2023.

- Unregistered warrants to purchase an aggregate of 14,177 ADSs at an exercise price per ADS of $10. These warrants expire on November 24, 2022.

- Warrants to purchase an aggregate of 3,263,325 ADSs at an exercise price per ADS of $3.50. These warrants expire on July 18, 2023.

- Unregistered warrants to purchase an aggregate of 198,637 ADSs at an exercise price per ADS of $4.375. These warrants expire on July 18, 023.

The biggest of these are the Series C (penultimate in the list above) which are trading on Nasdaq under the symbol “MDGSW” since July 2018. So there is at least 4M+ potential additional shares coming via warrant conversion, although the conversion would also bring in quite a bit of cash.

Conclusion

While it remains to be seen how the Algomizer/Linkury participations will play out, the decision to focus on the ScoutCam seems right on the mark and that's off to a flying start this year.

The ScoutCam can be used into many more markets and applications and this is rapidly proving itself out, with orders piling in. While the company has just a $7M market value, they seem to have a very interesting piece of technology and the $3M Chinese license deal for MUSE will keep the company going for a while.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time, and ...

more

Interesting company, but still waiting for it to recoup where it was just last month. It's been a bit up and down since then.

Yep, they have some interesting technology which is applicable in numerous situations.

Sounds like good things are on the horizon for this company.

Frist I'm hearing of this company, but it sounds like they are on the cutting edge of some impressive stuff! Taking a closer look at $MDGS.