Market Briefing For Monday, Jan. 21

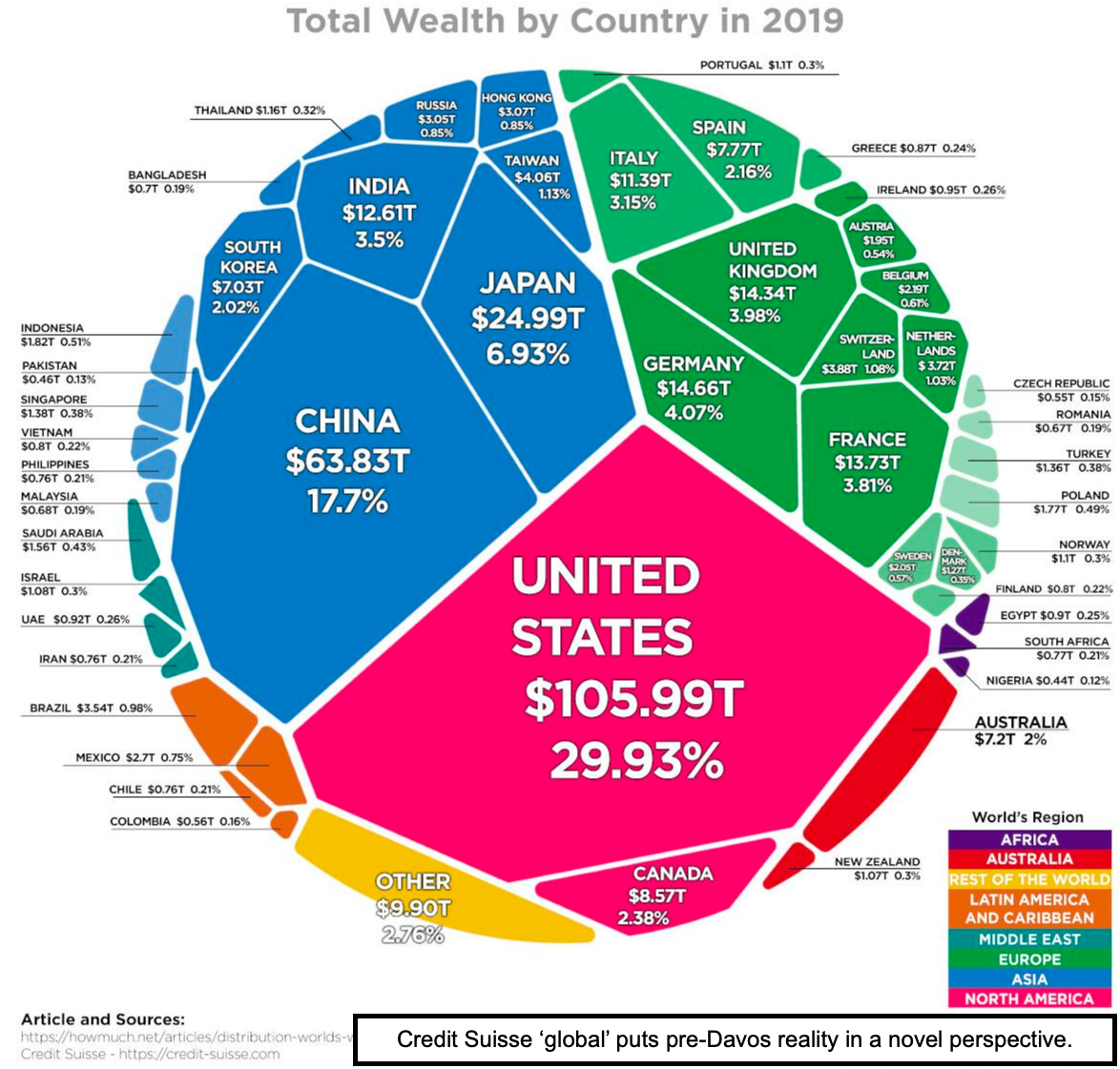

Davos will dominate financial media in the week ahead, with perhaps a few interesting observations about the risks of monetary expansion and the struggles of the banking system (especially in Europe), besides what will be requisite discussions about the economic disparities in society.

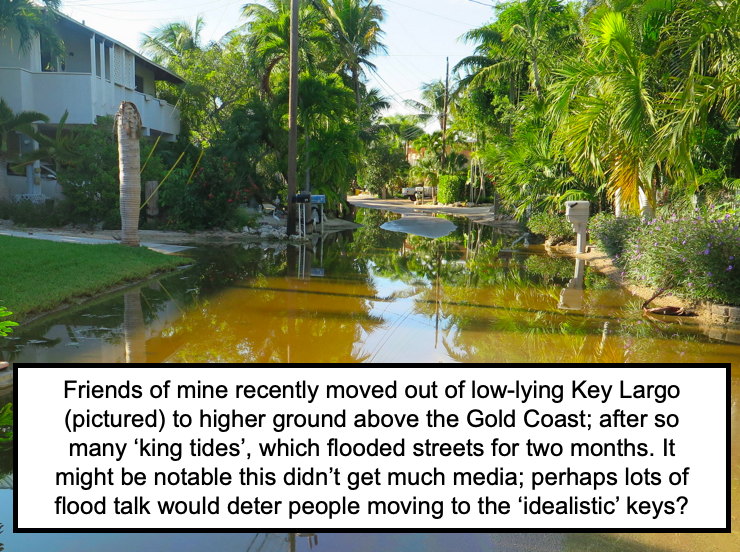

It's probably to much to wish (because it's reality); but Davos should be focused on 'global risk profiles', related to everything from of course easy money, to rising sea levels, and how that alone is going to 'water down' long-term planning at least for retirement on the coasts; but perhaps fuel a boom of inland growth. And it should notbe focused on our American political chaos; but perhaps consider the real importance China/USMCA deals have for growth; especially if China retreats a bit from BRI projects (China's own debt picture might inhibit more nations entering debt traps, if they're not really able to aggressively finance Belt & Road Initiatives).

On climate change and sea levels, it amazes me how many continue to invest in pricey coastal Florida homes 'as if' they think something will be effectively done to hold back rising tides. Yesterday a Tampa newspaper referred to the McKinsey consulting group talking about coastal property prices declining 10-15% in this decade due to rising tides; and 30-40% the next decade. Well fine; except I doubt it will be linear like that; merely according to tidal shifts; especially because of insurance 2.0 changes (a plan is developing now that will really make coastal insurance impossible to obtain absent an affordable fallback on National Flood insurance that a majority of Americans don't wish to subsidize for those buying or building in areas that everything suggests significant flooding or undermining). It may be though that this creates a huge boom for 'inland' home builders.

When a single big flood or surge exceeds anything seen since (Sandy); a super-storm (and that's especially if rising tides occur without a hurricane) insurance will soar. (Already it is impossibly priced for many, so they self-insure which you can only do if there's no mortgage.) I suspect that there will be a point where investors won't touch anything basically East of US1 on the East Coast of Florida.

(For-instance, in Fort Lauderdale there's a proposed complex of 30-story condo and hotel towers and it joins a couple already built about 2 miles inland; in this case the hold Searstown property. People will take note of these changes and abandon plans as they see downward price trends especially with waterfront housing. That's my view. While everyone says 'not in our lifetime', the quality of life isn't just expensive in South Florida, but will change as this evolves. At the moment it seems attractive for the migrants coming to escape tax-traps like New York City and New Jersey; because the foreign buyers have mostly evacuated already (or simply are not coming due to poor currency exchange issues). (For those unaware; New York City can defend itself with seawalls; Miami and so on cannot; because instead of granite just porous limestone is underneath. Thus it's wishful thinking that a series of walls will protect it; as South Beach is throwing money into the ocean; while downtown Miami shrugs.)

Back to current assets . . . disparities in the stock market, dominated for months by a noted handful of mostly-FANG-type stocks, was expected to be augmented this month, at least initially, with post-tax-selling rebounds in the broader list. Of course the idea was that they would contribute a bit to the heavy lifting borne by that known (and expensive) list of leaders.

That both segments participated is exactly how and why the S&P made it to these levels. This weekend we'll relax (I'm recovering from a cold but it is already better); and look for more upside in the new trading week, and that of course presumes that none of the angst regarding Richmond or a couple other rumors out there amount to a Hill of Beans. But if they do; of course then it becomes an exogenous event; only if there's a big financial impact, which seems unlikely from anything just yet, including politics.

In-sum: housing matters and will see a dramatic shift in years ahead; for sure in the coastal areas as noted. In this year, certain political outcomes could result in a higher likelihood of stocks going underwater (that pun s intended); but it depends how near-term caucuses and so on turn-out.

So yes a market top and break can occur from political events that so-far we'd viewed as merely backdrop noise (important as they may otherwise be to many); or from a parabolic thrust that is entirely unsustainable. The bullish pattern continuing our cycle from December of 2018 (over a year now) needs to have pullbacks contained within the pattern structure).

By the way here's a couple slides from Amarin's presentation this past week at the JP Morgan Healthcare Conference. New members may find these simplify understanding the characteristics of Vascepa in reducing cardiovascular disease, especially when combined with statins. (And my suspicion is that since statins cause more muscle weakness concerns, it may eventually be documented that one can reduce statin dosage but of course this hasn't been established aside the 'Trial' saying Vascepa can be used where there is 'stain intolerance'; and that often is muscle pain).

Bottom-line: stocks increasingly will risk moving erratically forward, after current thrusts; and ideally will avoid going into a parabolic mania. That of course would be dangerous and potentially cap the move. It's why slow growth and a friendly Fed have been the preferred approaches; with what we suspect will be a correction 'within uptrend context' ensuing.