Fiverr Could Head Lower With Lockup Expiration

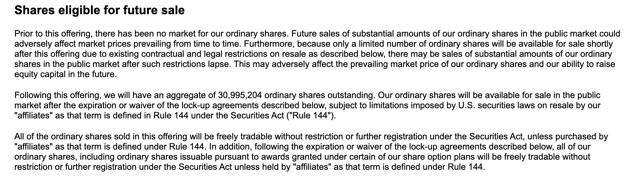

When the lockup period ends for Fiverr International (NYSE:FVRR) early next week on December 10th, pre-IPO shareholders and company insiders will have the opportunity to sell 25 million currently-restricted shares that are currently subject to lockup agreements.

(Source: S-1/A)

The number of shares subject to the lockup dwarfs the 5.26 million shares offered in the IPO.

(Source: S-1/A)

Significant sales of FVRR stock by currently-restricted shareholders could flood the secondary market and cause a sharp, short-term dip in share price when the lockup expires. The FVRR lockup expiration provides a short opportunity for aggressive, risk tolerant investors.

Business Overview: Digital Platform Connecting Businesses with Freelancers

Fiverr is a digital platform that connects businesses with freelancers across a wide array of services. Their e-commerce platform is designed as a marketplace that uses a comprehensive services catalog and a robust search process. At the time of its IPO, the company reported that it had facilitated over 50 million transactions and had approximately 830,000 freelancers across 160 countries selling services like video creation, logo design, editing, blog and article writing, and website development.

Fiverr believes that its business model easily facilitates the order and payment process for both buyers and sellers. Its catalog of services offers over 200 categories, which the Fiverr calls Gigs®. Individual Gigs have well defined parameters, including duration, scope, and price. Buyers can leave reviews. The prices range from $5 to thousands of dollars depending on the service and seller. Fiverr calls this their Service-as-a-Product (SaaP).

In July 2019, Fiverr launched a new service called Fiverr Studios. It enables freelancers to offer bundled services in order to take on larger projects. Some studios offer services such as packages to help create and maintain Shopify stores or kickstarter packages, including business card design, letterhead, logo design and a social media kit. The company notes that the average Gig on Fiverr Studios is approximately seven times larger than a typical Gig on Fiverr. The company expects to focus on Fiverr Studios as an area of future growth.

The company generates revenue through service and transaction fees. It has approximately 370 employees and maintains its headquarters in Tel Aviv, Israel.

Company information was sourced from Morningstar, the firm's S-1/A and company website.

Financial Highlights

Fiverr International reported third-quarter financial highlights for the period ending September 30, 2019:

-

Revenue was $27.9 million for an increase of 42%

-

Active buyers reached 2.3 million for an increase of 16%

-

Spend per buyer was $163 for an increase of 15%

-

GAAP gross margin was 79%

-

Non-GAAP gross margin was 80.8%

-

Net loss was ($8.4) million

-

Adjusted EBITDA was ($4.4) million

Financial highlights were sourced from Morningstar.

Management

Co-founder and CEO Micha Kaufman has founded several technology ventures, which include Spotback, Invisia, and Keynesis. He serves as a board member of Fiverr. He previously served as an Advisory Board member of Cerca Partners, and he currently serves as a board member of Drove Network. He earned an LL.B degree at Haifa University in Israel.

CFO Ofer Katz has served in his position since July 2017, although he has served as CFO since February 2011 under a consulting contract. He founded Nextage in 2001, and he continues to serve as Co-Chief Executive Officer for Nextage. His previous experience also includes acting as CFO for Adallom Technologies, Wix.com, Onavo, and Wilocity. He earned a B.A. from Tel Aviv University in Israel.

Company bios were sourced from the company's website.

Competition: Upwork, Guru.com, and Freelancer.com

There are many freelancer platforms in the digital marketplace. Fiverr faces competition from Upwork (NASDAQ:UPWK), Freelancer.com, Envato Studio, PeoplePerHour, Toptal, Guru.com, DesignCrowd, Nexxt, DesignContest, TaskRabbit, and crowdSPRING, among many others. They also face competition from platforms that offer boutique services such as blog writing.

Early Market Performance

The underwriters priced the IPO at $21 per share. Shares of FVRR had a first day return of 90%. However, shares began a long decline and reached a low of $17.68 on September 24. FVRR currently has a return from IPO of 1.6%.

Conclusion: Short Opportunity

When the IPO lockup for FVRR expires on December 10th, pre-IPO shareholders and company insiders will be able to sell more than 25 million shares of currently-restricted stock. With just 5.26 million shares of FVRR trading pursuant to the IPO, there is a potential for significant sales to flood the secondary marketplace and cause a sharp, short-term downturn in share price.

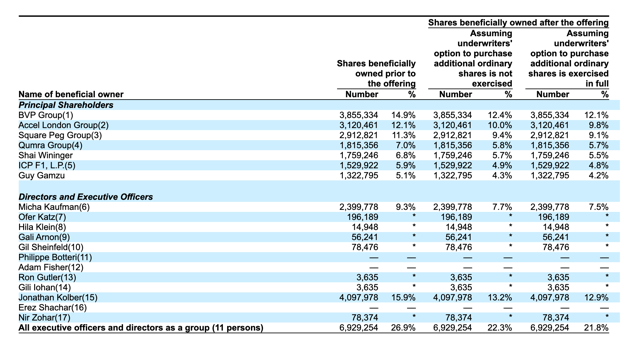

This group of pre-IPO shareholders and company insiders includes numerous executives and VC firms.

(Source: S-1/A)

Aggressive, risk-tolerant shareholders should consider shorting shares of FVRR ahead of the lockup expiration on Tuesday, December 10th. Interested investors should cover short positions during the trading sessions on December 11th and December 12th.

Interested in learning more about IPO Lockup investment opportunities? Check out our subscription service, IPO Insights. We update subscribers with actionable investment opportunities that follow the debut of select companies on U.S. exchanges.

Disclosure: I have no positions in any stocks mentioned, but may initiate a short position in FVRR over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more