Buying Opportunity In Splunk Stock

Splunk (SPLK) stock is under selling pressure lately, mostly due to a negative reaction from investors to the company's most recent earnings report. The company is growing at full speed but cash flows are disappointing because Splunk is transitioning towards a business model more focused on recurring revenue, which has negative implications on cash flow generation in the short term.

Over the long term, however, management is leading the company in the right direction, and temporary weakness seems to be presenting a buying opportunity for investors in Splunk.

A Fundamentally Sound Business

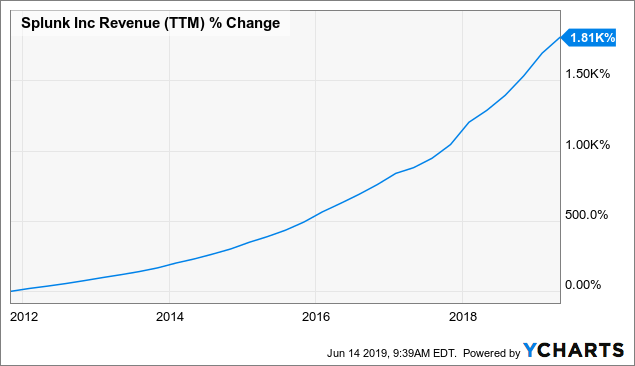

Splunk is a leading growth player in data analysis and security, an industry offering exceptional opportunities for growth over the long term. Management is doing a great job in terms of capitalizing on such growth opportunities and generating exponential revenue growth for investors.

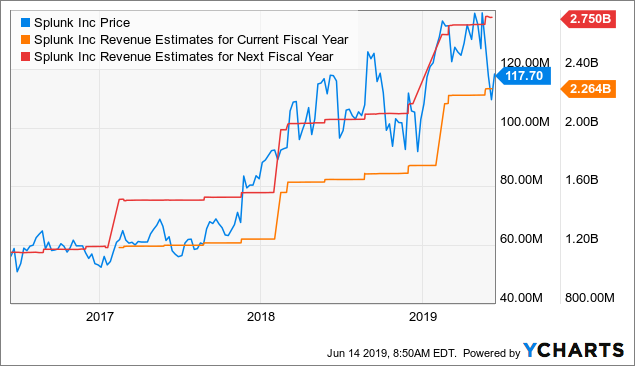

Data by YCharts

Splunk reported better than expected numbers last quarter, and the company also raised guidance for the rest of the year. The main business metrics are clearly pointing in the right direction:

- Total revenue reached $425 million, up 36% year-over-year.

- Software revenue amounted to $265 million, growing 54%.

- The gross profit margin was 82% of revenue, up by 2%

- Operating loss was $7.8 million, representing a margin of -1.8% and above the company's expectations.

- The company signed more than 400 new enterprise customers during the period.

However, Splunk is changing its business model, moving away from perpetual licenses and focusing on recurrent cloud-based revenue. Management reached a renewable mix of 77% last year, which was 12% higher than planned, and renewables are expected to be over 85% this year.

This business model has many advantages both for the company and its clients, but the transition is also having a negative impact on cash flow generation.

From the conference call:

With respect to cash flow; as mentioned before that the shift to renewable bookings impacts the timing of our invoicing and therefore the timing of our cash collections... Seasonality of cash flow will be impacted as well and we are modeling negative operating cash flow of about $125 million in Q2 flipping to about $125 million positive in Q3. Importantly, we expect that the timing of cash collections will normalize once the renewable mix reaches a steady state.

Splunk is firing on all cylinders. The company is still losing money because of big investments in R&D and in sales and marketing, which are basically investments for growth. However, gross profitability is improving, and management is doing the right thing by prioritizing the strategic direction of the business above short-term cash flows.

Reasonable Valuation

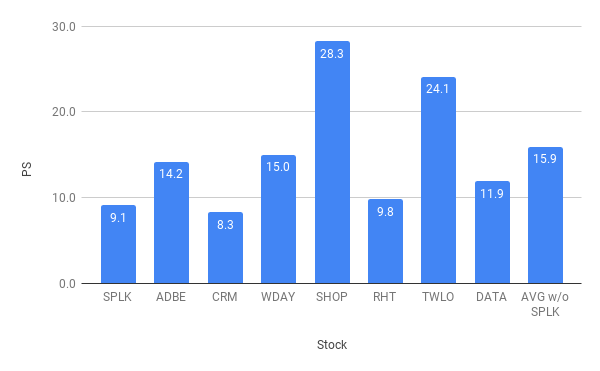

Companies operating in the software and big data segments trade at a considerable premium versus the broad market due to the industry's much promising potential for growth. In Splunk's particular case, the business is not yet profitable at this stage, so we need to rely on revenue for valuation.

To begin with, it's worth noting that the price to sales ratio has significantly declined in recent years, and the stock is trading at a valuation level near the low end of the valuation spectrum.

Data by YCharts

In terms of relative valuation, Splunk is not too expensive by industry standards. The chart below shows the price to sales ratios for Splunk versus Adobe (ADBE), Salesforce (CRM), Workday (WDAY), Shopify (SHOP), Red Hat (RHT), Twilio (TWLO), and Tableau Software (DATA).

These companies are very dissimilar in terms of profitability and size, so the comparison is not very straightforward. However, it's worth noting that Splunk is trading at a discount versus other players in the industry. As a reference, the average price to sales ratio for the companies in the group excluding Splunk is almost 16.

On a forward-looking basis, Wall Street analysts are expecting Splunk to make $2.26 billion in revenue during 2020 and $2.75 billion in 2021. Under these assumptions, the stock is trading at forward price to sales ratios of 7.8 and 6.5 respectively. This is making Splunk look attractively cheap in comparison to other companies in the sector.

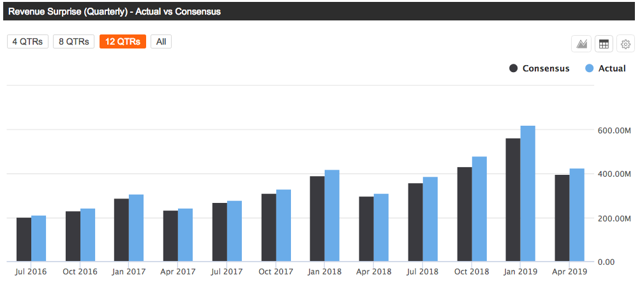

Importantly, Splunk has an impressive track record in terms of outperforming expectations. The company has delivered revenue figures above analysts' forecasts in the past 12 consecutive quarters. The chart below shows consensus revenue estimates and the actual reported revenue numbers for Splunk over time.

Source: Seeking Alpha Essential

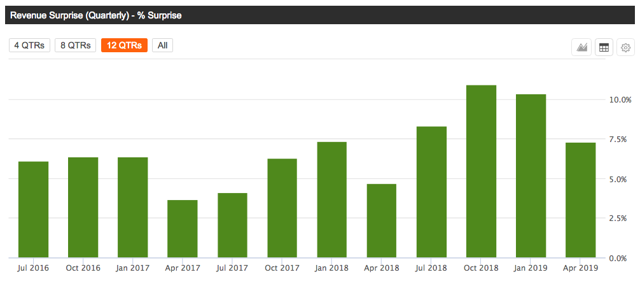

In green, we can see the percentage difference between expected and reported revenue for Splunk.

Source: Seeking Alpha Essential

Fundamental momentum can be a powerful driver for stock prices. When the company is delivering numbers above estimates and expectations about future performance are increasing, this generally means that the stock price has to increase too in order for the valuation to remain constant.

The chart compares the stock price for Splunk versus revenue estimates in both the current year and next fiscal year. Both the stock and sales estimates have significantly increased in recent years.

However, over the past several months, the stock is lagging behind sales expectations. This is arguably creating an opportunity for investors in Splunk in terms of valuation.

Data by YCharts

Good Timing

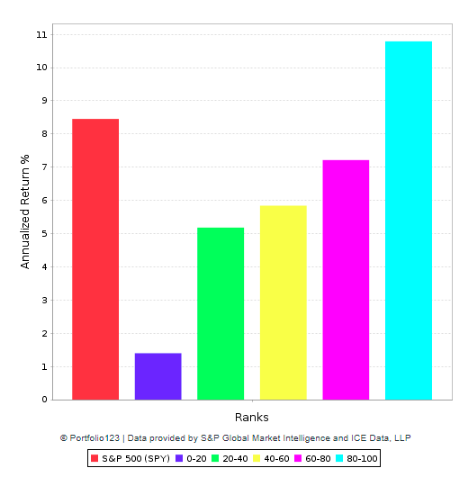

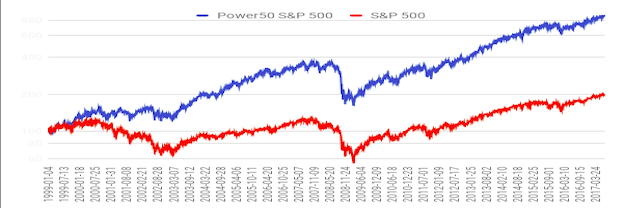

The Stocks on Fire system is a quantitative algorithm available in real time to members in The Data-Driven Investor. This algorithm is based on two main return drivers: price momentum and fundamental momentum.

Winners tend to keep on winning in the stock market, and money has an opportunity cost. You don't just want to buy stocks that are performing well, you want to buy the stocks that are also performing better than others.

The price momentum metric in the Stocks on Fire algorithm measures price performance over different time frames - the past three months, the 3 months period three months ago, etc. - in order to identify consistent price winners.

The price performance of a stock does not depend on the fundamentals alone, but the fundamentals in comparison to expectations. If the company is consistently outperforming expectations, chances are that the stock price will need to reflect this sooner or later. The Stocks on Fire algorithm measures fundamental momentum through the adjustment in sales and earnings expectations

The algorithm has delivered market-beating performance over the long term. The chart below shows backtested performance numbers for companies in 5 different Stocks on Fire buckets over the years.

Data from S&P Global via Portfolio123

Companies with high rankings tend to produce superior returns, and stocks in the strongest bucket materially outperform the market. This shows that the algorithm is not only effective but also consistent.

Splunk has a Stocks on Fire ranking of 97.6 as of the time of this writing, meaning that the stock is in the top 2.5% of companies in the US stock market based on a combination of fundamental momentum and price momentum.

Taking a look at the stock chart, shares of Splunk have been consolidating in a wide range over recent months, and the stock is not overbought at all at current prices. In fact, Splunk is more than 15% below its highs of the year and trading at price levels that are similar to those of June of 2018.

Source: Koyfin

The Bottom Line

Splunk is a risky proposition, no doubts about that. The company is still losing money, and it operates in a very competitive industry with an always changing competitive landscape. On the other hand, the recent weakness in the stock price does not make much sense from a long-term perspective.

Revenue is still growing at an impressive rate, and transitioning towards a business model based on recurrent revenue will ultimately make financial performance more stable and predictable. Valuation is relatively attractive, and the momentum indicators for Splunk stock look bullish over the middle term.

For investors who believe that Splunk is strong enough to deliver vigorous growth rates and expanding profitability in the coming years, the timing looks good to start building a position in Splunk stock.

Statistical research has proven that stocks and ETFs showing certain quantitative attributes tend to outperform the market over the long term. A subscription to The Data Driven Investor provides you access to profitable screeners and live portfolios based on these effective and time-proven return drivers. Forget about opinions and speculation, investing decisions based on cold hard quantitative data can provide you superior returns with lower risk. Click here to get your free trial now.

Disclosure: I am long CRM and WDAY.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more