Amazon.com, Inc. – Reaching New Highs

Amazon is, as expected, reaching new highs in each previous market rally. This is why fundamentals, supported by sound technical analysis, always produces superior profits. Finding these gems is not all that hard. It's fundamentals tell me that it should continue to do well until there is a major break in the general market. Yes, it is over-priced but it has been for many months.

You may want to review my articles on AMZN (just click) you will be provided with the exact history of the accuracy of my Forecasting / Formal Recommendations and much more.

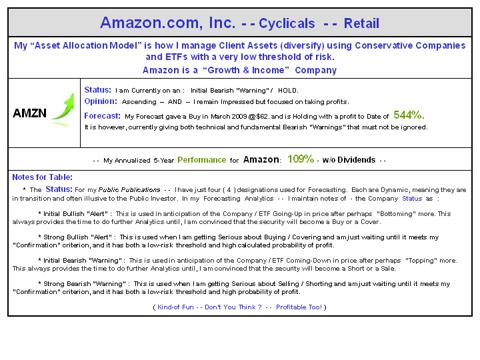

My Performance (my 5-Year Table) for Amazon.com, Inc. is available by clicking here. An annualized profit of 109% over the past few years ain't bad! I treat Amazon just like any other company, and my performance is an excellent credential that I will not hesitate to move my clients to cash when my forecast dictates.

My High Profile Cyclicals / Consumer Services / Internet Commerce Companies continue to be strong with few exceptions. Companies like Amazon have earned their strong position in the marketplace.

My management objective is to identify changing trends for my forecasting analytics. Simply stated, I want to have current notes to quickly refer to the anticipated direction of this sector and industry group.

Growth and (sometimes) aggressive growth investors - - As you know Amazon pays no dividend!

My Mission is to provide guidance and direction by conservatively providing consistent annual and superior profitable results for each formal recommendation I make to my clients.

Note: The difference between you and the pros: Clearly you should be profitable and making money by owning Amazon.com. Via my Eemails, I have found that many investors are struggling with other securities they are holding. I have offered direction to hundreds of Investors and can share with you why you are perhaps holding losing securities and provide a conservative and low risk remedy.

Forecast w/ Performance

Amazon.com, Inc. and other Retail/Internet Sector Companies are tracking well. My forecasts have been "on the button" even with the 20+% pull-back of late 2011. Re-buying after that was easy.

Note: The below table is for your review, questions and perhaps thoughts. If you are seeking to "Invest Wisely" in my "Growth and (sometimes) Aggressive Growth - Asset Allocation Model" - - please email me to open a dialog on how I go about providing super performance with a very low threshold of Risk.

My current forecast is even more bright as you may think - the only thing that can stop it is a general market that turns bearish!

If you own or are considering owning internet commerce companies, the securities require "selectivity" (see below). Amazon.com, Inc. is currently strong technically but I have reservations about my fundamental valuations, therefore I have placed it on an initial (very light - but increasing) bearish forecast - "warning." This is because I am a very cautious asset manager.

My current opinion is hold with modest caution !

Fundamentally - ( weighting - - 40% ), my valuations remain very strong but are producing some declining projections. Even with greatly superior earnings, when a decline begins, the price of the company most often follows.

Technically - ( weighting - - 35% ), my indicators have not started to break down, but they will in time. A re-bound rally is in force - the strength of which is very positive. I spent time looking back at the price movement and compare them with my fundamental valuation notes. (AMZN) is on or near its recent highs of $405. The current three week pull-back is going to do two things: a) be stronger than investors would like and b) tell us if the Top has been made.

Consensus Opinion - ( weighting - - 25% ): My third pillar of research is one that is always distorted to the positive by most all financial analysts. That's because they are afraid of being bearish. I am not. My articles on "reality" are supportive of the below 20 year Chart.

It has not always been like you are being told by so many who do not take the time to do their homework and "Invest Wisely." Amazon.com, Inc. like most all other quality companies, has taken some big hits over the years.

URL for (20-years of) (AMZN): http://stockcharts.com/h-sc/ui?s=AMZN&p=W&yr=20&mn=0&dy=0&id=p48666896104&a=311129746

Selectivity

"Selectivity" is what I preach (along with discipline and patience) and is what separates the average investor and mutual funds from the profits that come with long-hours / hard work and "selectivity."

I post every day at my blog, Investing Wisely. If I can be of help with guidance and direction for your portfolio(s) just email me. Serious Investors Only - Please!

Smile, Have Fun, "Investing Wisely,"

Dr. Steve

None.