A New Stock Buy: Raytheon

With the proceeds from Polaris and the profits from Tractor Supply which we discussed in our last article, we plan to buy Raytheon (RTN).

Raytheon Company is a technology and innovation leader specializing in defense, civil government and cybersecurity solutions throughout the world. Raytheon provides state-of-the-art missile defense, command and control, electronic warfare, sensor and imaging and precision weapons systems.The company develops integrated training, mission support and cybersecurity services for customers in more than 80 countries.

GLOBAL MARKET LEADER

Vannevar Bush, who would become dean of MIT's School of Engineering, Laurence Marshall, an engineer, and Charles G. Smith, a scientist who had done work on the electrical properties of gases, founded the American Appliance Company in 1922. Three years later, the company changed its name to Raytheon Manufacturing Company.

Their revolutionary innovation was the S gas rectifier tube, a device that eliminated one of the cumbersome expensive batteries that previously powered home radios. The tube transformed the radio into an affordable appliance that could be plugged into a wall socket.

During World War II, Raytheon supplied 80% of the magnetron tubes used in U.S. and British radars and developed parts for the crucial proximity fuse in antiaircraft shells. By the end of the war, every U.S. patrol torpedo boat was equipped with the Raytheon radar, allowing them to see at night and to search and destroy U-boats.

After the war, Raytheon began offering civilian products. The most famous wasthe microwave, originally called the “Radarange”. Raytheon engineer, Percy Spencer, discovered microwave cooking when he stood in front of an active magnetron, and a candy bar in his pocket began to melt. Intrigued, he placed kernels of popcorn in front of the tube, and they popped.

Over the following decades, Raytheon introduced the first missile capable of intercepting inflight objects; helped guide the Apollo 11 and transmit the TV signals back to Earth; and developed the Patriot missile defense system. Nearly a century after its founding, Raytheon stands as a global technology leader with 64,000 employees specializing in defense and homeland security.

SOLID GROWTH AND PROFITS

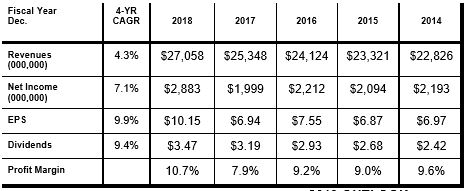

During the past five years, Raytheon has grown revenues at a steady 4.3% annual rate. During the same period, net income and EPS have compounded at striking 7.1% and 9.9% annual rates, respectively. Raytheon’s profit margin averaged more than 9% during the previous five years, including an impressive 10.7% during 2018. Return on equity has averaged more than 20% for the last ten years, demonstrating the company’s strong competitive advantages. In2018, return on shareholders’ equity rocketed to 25.4%.

GROWING DIVIDENDS

Raytheon has increased their dividend for 14 consecutive years with the dividend compounding at a 9.4% annual rate during the past five years. The firm’s capital allocation strategy is focused on creating value for investors through a sustainable and competitive dividend and a strategic share repurchase program. During 2018, Raytheon generated $2.7 billion in free cash flow and returned $2.3 billion to shareholders through dividends of $975 million and the repurchase of 6.7 million shares for $1.3 billion at an average cost of about $197.76 per share. Since 2007, Raytheon has repurchased shares each year reducing their share count by 35%.

Raytheon generated full-year 2018 bookings of $32.2 billion, resulting in a book-to-bill ratio of 1.19. The company ended 2018 with a record backlog of $42.4 billion. The company’s strong position in missiles and radars coupled with increased defense spending under the current administration provide a solid foundation for 2019. Management expects 2019 revenue to be in the range of $28.6 billion to $29.1 billion reflecting growth of 6.5% at the midpoint. Earnings per share are expected to grow 12% to 14% to the range of $11.40 to $11.60 on lower shares outstanding as the company anticipates repurchasing six to eight million shares during 2019.

The company ended the year with $3.6 billion of cash and $4.8 billion of longterm debt on its stalwart balance sheet. With 2019 cash flow from operations expected to be $4.0 billion, Raytheon has sufficient dry powder to execute its capital allocation strategy of targeted acquisitions, internal investments, dividend growth, share repurchases and pension contributions.

Long-term investors should place Raytheon on their radar, a HI-quality global market leader with growing dividends, solid growth, durable competitive advantages and profitable operations. Buy.

Disclosure: None.