Tech Xmas Rally In Store?

PCOMING (MAJOR) U.S. ECONOMIC EVENTS...

* Wed. Dec. 11 @ 8:30 am ET ~ MoM & YoY CPI & Core CPI Data

* Wed. Dec. 11 @ 2:00 pm ET ~ FOMC Announcement + FOMC Forecasts and @ 2:30 pm ET ~ Fed Chair Press Conference

* Fri. Dec. 13 @ 8:30 am ET ~ Core Retail Sales & Retail Sales

* Thurs. Jan. 2 @ 2:00 pm ET ~ FOMC Meeting Minutes

* Fri. Jan. 3 @ 8:30 am ET ~ Employment Data

* Wed. Jan. 15 @ 2:00 pm ET ~ Beige Book Report

I last wrote about the FAANG stocks in my post of November 4.

It looks like FNGU did bite back and reached its next Fibonacci Retracement resistance level at 47.34. In fact it hit a high of 48.90 last week before closing at 47.72, as shown on the following weekly chart.

The Balance of Power has shifted from buyers to sellers last week from the prior week. It will be important for price to rally and hold above 48.90 to reverse this shift in sentiment.

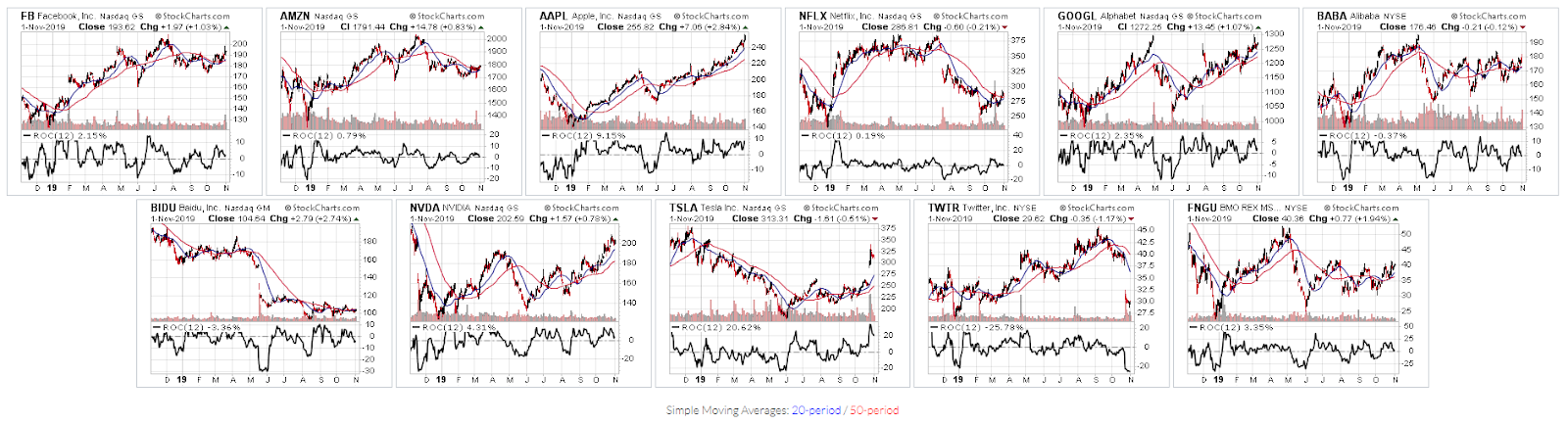

FNGU is comprised of the ten tech stocks shown on the following daily charts.

I had identified a few stocks to monitor in my post. AMZN and TWTR haven't done much of anything since then, while NFLX and BABA have had a decent rally, and BIDU had a brief spurt.

Keep an eye on all of these stocks and their price action around their 20-day moving average for signs of weakness or strength this coming week and leading up to Christmas, as well as their Rate of Change (ROC) (note that the ROC on AMZN and TSLA is below zero...hinting of further weakness unless it bounces and holds above zero). Furthermore, watch the Balance of Power level of 48.90 on FNGU to confirm weakness or strength in the underlying stocks.