Tariff Worries Cause Consumers To Become Less Optimistic

Conference Board Confidence Wanes

The University of Michigan consumer confidence index and the Conference Board index showed vast differences in August as the former was much more pessimistic than the latter. The two have converged in September as the preliminary University of Michigan index improved slightly and the Conference Board index cratered sharply. The August Conference Board reading was revised downwards slightly as it went from 135.1 to 134.2. The September reading vastly missed estimates as it was 125.1 instead of 133. The low end of the estimate range was 129.5. As you can see from the chart below, this was a 3 month low. The reading went from fantastic to great which is terrible in rate of change terms.

(Click on image to enlarge)

This reading is bad news for the labor market because this report is correlated with the labor market and the University of Michigan report is more correlated with financial markets. Let’s look at the details of the report. The Present Situation index fell from 176 to 169 and the Expectations index fell from 106.4 to 95.8. The report stated. “The escalation in trade and tariff tensions in late August appears to have rattled consumers. However, this pattern of uncertainty and volatility has persisted for much of the year and it appears confidence is plateauing.”

It’s not surprising confidence has been plateauing because it has been very high. It’s also not necessarily a bad thing that it didn’t increase for much of this year. The decline this month is obviously a negative though as it seems tariffs are hurting sentiment. It still remains to be seen if the decline in confidence leads to a decline in retail sales growth. If retail sales growth is weak, the trade war will get the blame. I’d need to see the numbers before ascribing a cause for the potential decline in growth.

It’s no surprise there was a lot of sequential weakness, particularly in the expectations categories, since the headline indexes declined. Those who stated business conditions are currently good fell from 40.9% to 37.3%. Those who said conditions are bad rose from 9.9% to 12.7%. As you can see from the chart below, net expectations for business conditions declined sharply. Those expecting business conditions to improve fell from 21.6% to 19% and those expecting business conditions to get a worse rose from 10.3% to 14.3%. This isn’t a huge surprise because the trade war transparently is bad for business.

(Click on image to enlarge)

Labor Market Weakness The Biggest Issue

The major problem with this report was the sentiment on the labor market. I’m still waiting for jobless claims to increase before I’m bearish, but the sequential weakness is notable in this report. Those saying jobs are plentiful fell from 50.3% to 44.8%. Those saying jobs are hard to get fell from 12% to 11.6%. Those saying jobs will be more plentiful in the next 6 months fell from 19.9% to 17.5%. Those expecting fewer jobs rose from 13.7% to 15.7%. The net expectations percentage fell from 6.2% to just 1.8%.

The weakness makes sense because the labor market is nearly full and the recent tariffs are making consumers less confident. It’s like if you’re at the top of a mountain and you see rocks below you crumble. Personally, my view differs from consumers. They might not see this, but employment growth has been falling for a while. If this slowdown doesn’t become a recession, we could easily see the slowdown end in early 2020. Growth could pick up with demand. That depends on numerous factors such as the trade war, global monetary policy, and the global economy. Just because my view isn’t in lockstep with consumers doesn’t mean I don’t review the data. It’s a negative that consumers finally see the decline in payroll growth.

Finally, consumers’ outlook on their income prospects also worsened as the percentage of consumers who expect an improvement in their income fell from 24.7% to 19% and the percentage expecting their income to fall fell from 6.3% to 5.6%.

Redbook Sales Growth Stays Solid

In the week of September 21st, Redbook yearly retail sales growth fell from 5.4% to 5.2%. That’s solid and signals good results from the September retail sales report. Obviously, the Redbook sales growth reading isn’t always accurate. It’s possible the Conference Board index could be correct in seeing retail sales growth weakness. It’s very difficult to tell because we don’t know which report is accurately portraying the effect of the trade war. I lean in the positive direction because I still don’t think the tariffs have trickled down to consumers. Prices probably aren’t a big problem. The only potential problem is sentiment impacted by new stories. Consumers haven’t slowed spending growth because of negative stories on the trade war yet. They were impacted by the stories on the government shutdown late last year and early this year.

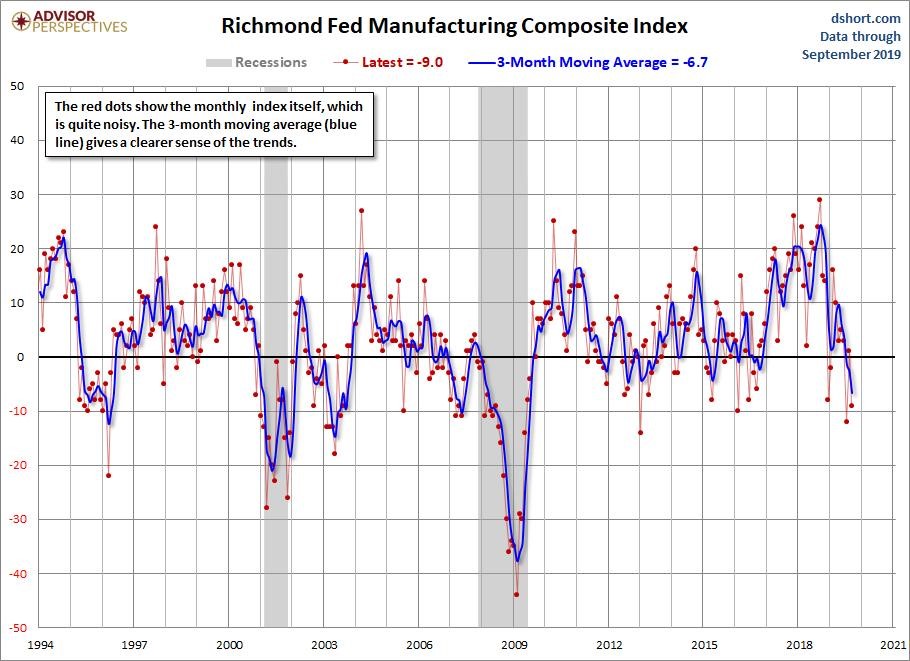

Weak Richmond Fed Manufacturing Index

As you can see from the chart below, the Richmond Fed manufacturing index fell sharply in September which is unlike the prior 2 regional Fed manufacturing readings. It declined from 1 to -9 which is the weakest reading since July when it fell to -12. As you can see, with those 2 weak readings the 3-month average fell to -6.7. Shipments and volume of new orders fell from 5 and 2 to -14. Local business conditions fell from -3 to -15.

The expectations category doesn’t have an index, but there was some weakness like the prior 2 regional Fed reports. Expectations for shipments and new orders fell from 18 and 31 to 15 and 22. Unlike the Empire Fed reading and like the Philly Fed reading, capex rose from 14 to 19. Equipment and software spending increased 3 points to 21.

(Click on image to enlarge)

Conclusion

The trade war hurt consumer confidence, didn’t impact the Redbook same-store sales reading, and may have impacted the Richmond Fed report. The manufacturing indexes are now a mixed bag. They signal a continuation of the slowdown. I actually expect a slight improvement in the ISM PMI since it was very weak and the Markit flash reading improved.

Disclosure: None.