TalkMarkets Tuesday Talk: Say "Some Stock Markets Seesaw On Somewhat Stormy Seas Sometimes"

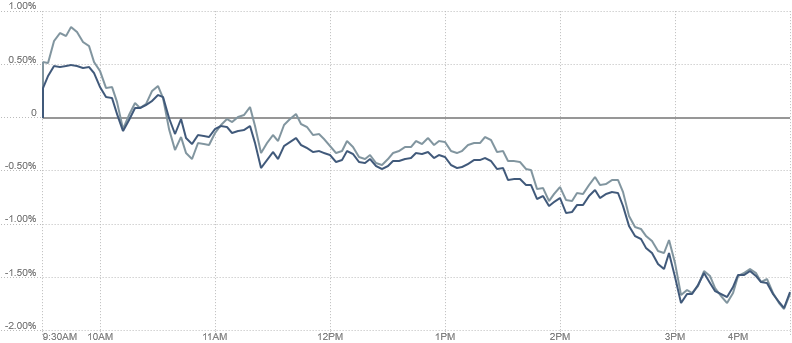

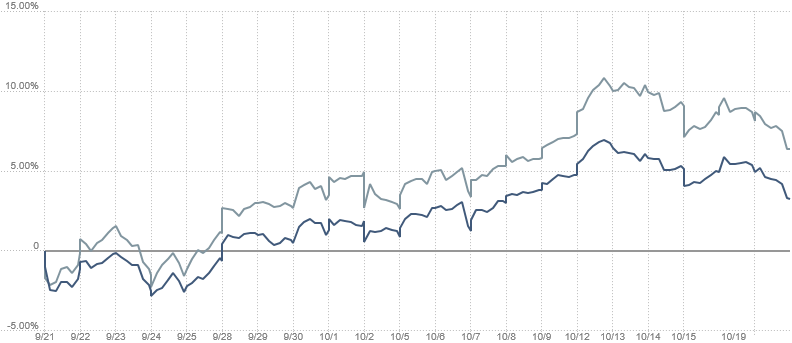

Good Morning. With just under two weeks to go till Election Day, the daily action in the stock market continues to seesaw back and forth while maintaining its upward trend, as reflected in the daily and monthly charts below.

Monday Activity - October 19 ![]()

Monthly Activity - Sept. 19 thru Oct. 19 ![]()

Charts: The New York Times

Following this pattern Market futures are rising this morning. S&P 500 futures are currently at 3,445, up .64%, Dow futures at 28,252 up .54% and Nasdaq 100 futures at 11,727 up .66%. Stocks in Asia closed the day mixed with the Shanghai Composite ending up and the Nikkei closing down. Currently markets in Europe are trading mixed.

TalkMarkets contributor David Templeton starts us off by taking a look at the performance of dividend ETFs over the course of the year in Dividend Paying Strategies Have Lagged This Year, Now An Opportunity?, noting that on a year to date basis, they were among the weaker performers in the market, but since the March 23, low have been keeping pace with the recovery in the broader market, and like value stocks, may provide good investment opportunity at this time. Make note of his comments and graphs below:

"The iShares Select Dividend ETF (DVY), the SPDR Dividend ETF (SDY), and the Proshares S&P 500 Dividend Aristocrats ETF (NOBL) were some of the weakest performing large-cap equity categories. The second chart below shows the dividend-paying categories have kept pace with the broader market since bottom in March."

Templeton adds: "As a note of caution, chasing yield in and of itself can be a recipe that leads to underperformance."

Seth Golden writing in a TalkMarkets exclusive, The Ebbs And Flows Of Markets Can Prove To Discombobulate Investors: Stay True To The Course, does a good job of helping to navigate current market seas. He offers the following key considerations with regard to Q4 2020.

-

"The (current) uncertainty will give way to greater certainty as event risks are realized for an outcome near-term.

-

Election risks remain but may prove overblown as polling is identifying a sizable decision from votes already cast.

-

Contested elections don't equate to never realizing an outcome.

-

COVID-19 infection rate rising is expected, but mortality rates have improved due to better medicines, therapeutics, and planning.

-

COVID-19 vaccine approval is likely to come soon after the November election

-

Economic growth scares are a constant part of the market calculus, but the economy and the market are not operating at the same time timeframe."

Golden's article is a thorough and deep dive and as such a recommended read. He ends with a seafaring inspired quip.

"Investors, like sailors, need to be mindful of the environment, taking risk when appropriate and trimming sails/taking profit when warranted."

Chris Calton in No, The Stock Market Isn't A "Leading Indicator" Of Economic Prosperity, reminds us that though politicians on boths sides like to tout market performance as a barometer for how well the economy is doing, "“STOCK MARKET UP ANOTHER 300 POINTS,” Donald Trump tweeted on October 12, with characteristic overcapitalization. “GREATEST LEADING INDICATOR OF THEM ALL!!!” President Trump’s use of the stock market as an economic indicator is hardly unusual. Democrats like to tout the stock market performance under Obama as a counterpoint to Trump’s boasting.", such talk can be misleading.

Calton states, "However, as a metric of the overall health of the economy, stock market performance is, at best, a misleading and unreliable indicator." He then goes on in a detailed but not overly complicated economics less to explain, why. He notes that the loose monetary policy of The Fed (and Trump's support of it) is responsible for much of the recent rise/recovery in the stock market and as such, " he (Trump) does deserve at least some credit for the rising stock market."

But Calton concludes where he started and says "the only gains that can come from his (Trump's) fiscal policies are the unhealthy, temporary gains that accompany the misallocation of resources prior to the corrective bust. To the degree that the stock market reflects this artificial growth—and it certainly does—it cannot serve as an accurate metric of economic health." Phew...

In, Not A Typical Manufacturing Recovery, the Staff at Upfina writes that excellent September report figures for consumer spending were offset by poor recovery numbers in manufacturing, and that there is some indication we should expect further weakening in October as many stimulus programs have now ended. Here are some of their observations:

- The September retail sales report completely destroyed estimates. Yearly growth excluding food services was 8.2% which was the highest growth since June 2011.

- Sporting goods growth was 5.75% monthly and 14.37% yearly as people are spending more time outdoors because of COVID-19.

- Food services and drinking had 2.07% monthly growth which only got it to -14.45% yearly growth.

- Monthly manufacturing growth was -0.3% which missed estimates for 0.8% and fell from 1.2%. It is down 6.3% from its peak. Yearly growth rose slightly from -6% to -5.7%.

There are several good charts in their article which illustrate these points. Upfina's concluding take is less than upbeat.

"The September retail sales report was great because of the extra jobless benefits. It might not be as strong in October because of the COVID-19 spike in the Midwest, lower unemployment benefits, and a weaker labor market...The industrial production report was bad. This isn’t a typical manufacturing recovery even though the regional Fed reports were strong in September. The ISM manufacturing report was closer than the regional fed reports as the PMI fell slightly and new orders fell sharply."

As noted in this column previously, the housing market in 2020 has been a consistent contrarian to other lagging sectors of the economy. Bespoke Investment in their article October Optimism For Homebuilders gives us charts which illustrate the light which continues to shine from this sector.

"Given housing inventories remain historically low thanks to still strong demand, homebuilders have plenty to be optimistic about. The National Association of Home Builders (NAHB) has continued to show this strength as its monthly sentiment survey set a record high for the month of October. Back in August, the index tied the previous record level of 78 from December of 1998. Over the past two months, it has only raised that bar, coming in at 85 this month; 2 points above forecasts and last month’s reading of 83.

The rise in the index comes on broad strength across each of the sub-indices. Present Sales, Future Sales, and Traffic all matched or made record highs in October."

That's a whole lot of hammering going on, for sure.

I'll leave you with the following two quotes, one somewhat witty and both somewhat wise:

"Just because you do not take an interest in politics doesn't mean politics won't take an interest in you." - Pericles

"A healthy democracy requires a decent society; it requires that we are honorable, generous, tolerant and respectful." - Charles W. Pickering

Have a good week.