TalkMarkets Tuesday Talk: Forecast Looks Choppy

It’s Tuesday morning, the Dow Jones closed up nearly 158 points on Monday, the Nasdaq 137 points and the S&P 25 points. Futures are currently around 500, 130 and 44 points higher, respectively, as I write. So more green, yes, but not without a fair churn of red as witnessed in yesterday’s trading. The Fed’s comments about purchasing corporate bonds helped buoy the boats yesterday, but the market seas remain choppy even as cities in Europe and states in the US continue to re-open. COVID-19 infection rates are still a source of concern around the globe. Here is what some of TalkMarkets’ contributors have to say.

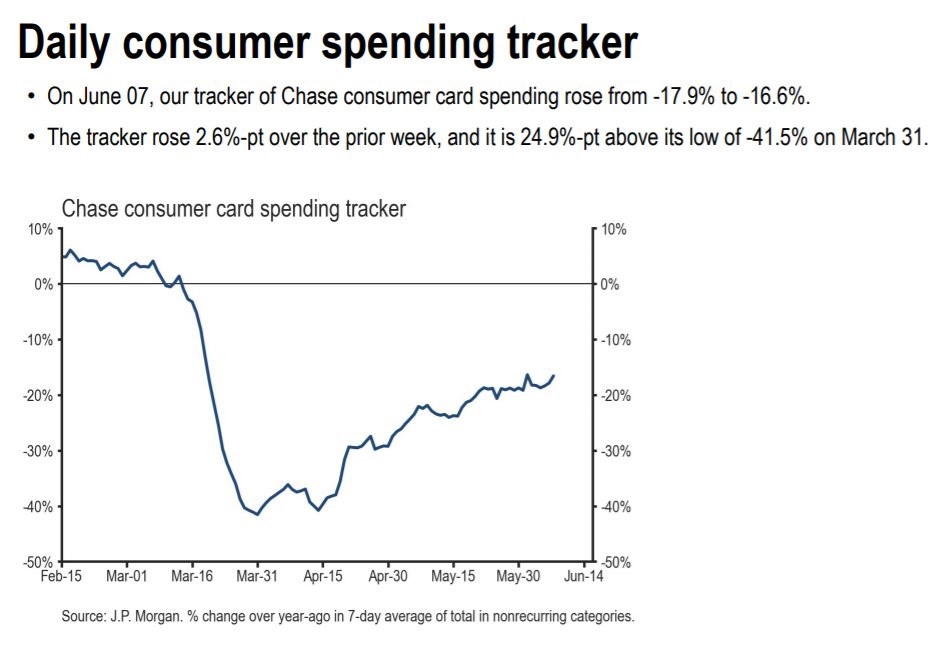

John Galt writing in Consumer Spending Growth Improves - Fastest Recovery Ever? , looks at the charts and while consumer spending is still in negative territory it is making an aggressive and steady climb out of the trough. See the following chart.

Galt, looking at the U. Michigan consumer sentiment chart (see his article), notes that, “This time the index was helped by the current and future categories. The current conditions index was up from 82.3 to 87.8 which was a 21.5% yearly decline. This improvement is in line with the Chase card spending reading. Similarly, the expectations index was up from 65.9 to 73.1 which was an 18.1% yearly decline. The consumer isn’t exactly optimistic; it’s just way less pessimistic than it was in April.

Consumer sentiment improved because of gains in the outlook for personal finances and the prospects for the national economy due to the reopening. The labor market is improving. Amazingly, more consumers expect a decline in the jobless rate than at any time in the history of this survey.”

John Galt says we might be in for the shortest recession on record, as long as the US does not experience a devastating second wave of COVID-19. Don’t take the life-jacket or your mask off, yet.

Sheraz Mian looks at the impact of COVID-19 on Q2 corporate earnings and future quarters to help assess where the economy and the markets are: 5 Charts That Tell The Coronavirus Corporate Earnings Story. He comments with the use of charts that, “On an annual basis, earnings expectations for this year (2020) have taken a big hit as a result of the pandemic, but the growth picture is expected to markedly improve as we look ahead to 2021 and beyond.”

I’ll just highlight his fourth chart which shows that, “growth is expected to resume next year, with full-year 2021 earnings for the S&P 500 index currently expected to be up +26.8% relative to the still-declining 2020 estimates.”

The concluding portion on his article is a look at Q2’20 earnings by sector. Not a pretty sight.

Ingrid Hendershot writing in Managing Through A Global Pandemic, looks at companies which should be able to provide some calm for investors navigating the trials and tribulations of investing during the pandemic. Notably, she likes Microsoft (MSFT), Google (GOOGL) and Cisco (CSCO). Hendershot is as an asset manager who believes that this is a time to invest in quality.

“Most HI-quality companies believe the worst will be behind them in the second quarter from the impact of COVID-19 on their operations. The pandemic will adversely impact second-quarter financial results. Growth should gradually resume in the second half of the year, although valid concerns about a second wave of infection exist. The management teams of our companies remain confident they will emerge from this crisis even stronger than before thanks to their strong business models and financial flexibility.”

The concluding portion of her article is a chart of companies she is watching. It is full of detailed comments and recommendations. Take a look.

Cathy Matheson takes a totally technical look at the S&P 500 (spx) chart, SPX: In The Jaws Of The Alligator, she is very straightforward in her assessment: “As of today's (Monday, June 15) close, the S&P 500 Index (SPX) is currently in the 'jaws of the alligator' -- Williams Alligator, to be precise, which is formed by three moving averages, each offset into the future -- as shown on the following daily chart.”

“Watch for the shortest MA (moving average) to curl upwards, then the other two, to support higher prices.”

Eric McCurdy also looks at the charts to give us a forecast in his, Short-Term Forecast For Monday, June 15, notes that the S&P 500 is “moving up toward previous highs of the uptrend from March. Technical indicators are neutral to slightly bullish overall, suggesting that direction is in question with a slight upward bias.”

McCurdy's technical chart analysis concludes with the following:

“Short-term Outlook

- Bullish Scenario: A rebound and close above the recent short-term high at 3,232 would reconfirm the uptrend from March and forecast additional gains.

- Bearish Scenario: A close well below the 200-day moving average at 3,015 would predict a return to the 50-day moving average at 2,914.

The bullish scenario is slightly more likely (~60 probable)."

Too much optimism? Charles Hugh Smith is not having any of it. In his blog piece, The Fed's Grand Bargain Has Finally Imploded, he says that The Fed has not just backed itself into the proverbial corner, “but to the edge of a precipice”. Smith is not looking at the charts, he is looking at what The Fed has been doing, and does not like what he sees.

“Yields will remain near-zero while all the asset bubbles implode, destroying tens of trillions of dollars in phantom capital. The Fed's grand bargain--offering inherently risky asset bubbles as a substitute for low-risk, high-yield bonds--has collapsed. Everyone with a stake in an asset bubble is about to have a Wile E. Coyote realization that the risk they thought had vanished has emerged as gravity.”

Tyler Durden, also notes that things are not so sweet, writing in, Global Sugar Consumption Declines For First Time In Forty Years. If you watch any Bloomberg TV, you have probably seen those commercials about diversifying your portfolio with commodities. Be that as it may, now is not the time to stock up on sugar, as Durden reports in his article that, “the virus-induced economic downturn has led to the first year-on-year decline in global sugar consumption since 1980, when sugar prices hit a high of 45c/lb.”

An interesting bit of research that Durden turns up in his article is from commodities analyst Ben Seed, who says that soft drink (sugar) consumption is higher outside of the home than in: “"If you go to the cinema, you would probably quite happily have a liter or maybe more of soda while you watch the film, whereas we just don't think people would drink a whole liter of soda while watching Netflix (NFLX)," Seed said.”

This translates into lower sales for Coca-Cola (KO) and Pepsi (PEP), (to encourage consumption, at the height of the pandemic I had two bottles of Coke left for me on my doorstep, courtesy of the local bottler).“Coca-Cola's sales volumes were down 25% during the month of April, and the company warned the economic downturn will weigh heavily in the second quarter. PepsiCo Inc was another that expects second-quarter revenue to slide.”

Bittersweet, regardless of your opinion about the merits of soda.

Aristotle Onassis, a tycoon and shipping magnate of another era, known famously as Jacqueline Kennedy’s second husband is quoted as having said, “We must free ourselves of the hope that the sea will ever rest. We must learn to sail in high winds.”

Till next time, try to keep a steady hand on the rudder.