Supply Strains Hold Back US Growth

Manufacturing output fell in June despite surging order books, which underscores the crippling effects of supply chain strains. Amidst robust consumer demand and record-low inventories, regional surveys show companies are increasingly raising their prices.

Manufacturing slides on auto component issues

US manufacturing output fell 0.1% in June versus the +0.4% consensus with the bulk of the weakness caused by a 6.6% plunge in auto sector output. It is important to remember that the weakness is a supply-side story and not demand-driven given surging prices for both new and used vehicles in Tuesday’s CPI report.

The lack of semi-conductor chips, which go in anything from brake sensors to satellite navigations systems, is really hampering output with chip producers warning that supplies could remain constrained well into 2022. Consequently, disappointing output and ongoing price pressures are likely to be a persisting theme.

Outside of autos, the news was slightly better with output excluding vehicles and parts rising 0.4%. However, machinery output fell 0.5%, which we also suspect was impacted by the global chip shortages.

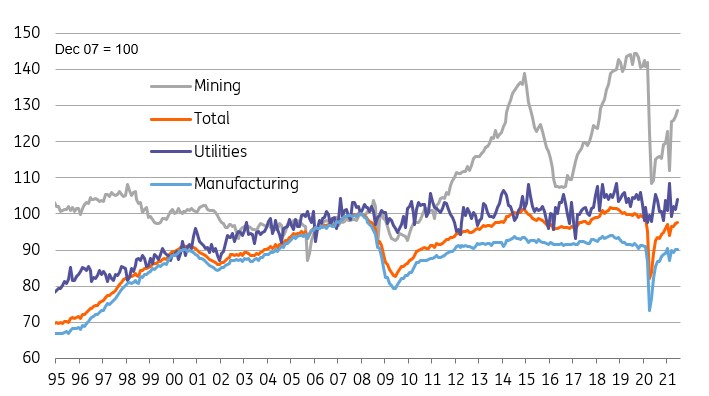

Elsewhere in the report, there was a 2.7% month-on-month jump in utilities output as record temperatures in many parts of the US led to increased usage of air conditioning and fans. Mining rose 1.4% as rising commodity prices stimulated activity. Putting it altogether industrial output rose 0.4% versus expectations of 0.6% MoM growth.

Industrial output levels

Source: Macrobond, ING

It is also important to remember that the sector still has a way to go before output is fully recovered with manufacturing still down 1.1% on February 2020 levels while mining is still 9.6% lower and total industrial output is 1.9% below pre-pandemic levels. Note too the long-term structural decline of US manufacturing with output down 9.8% on the 2008 peak level of output.

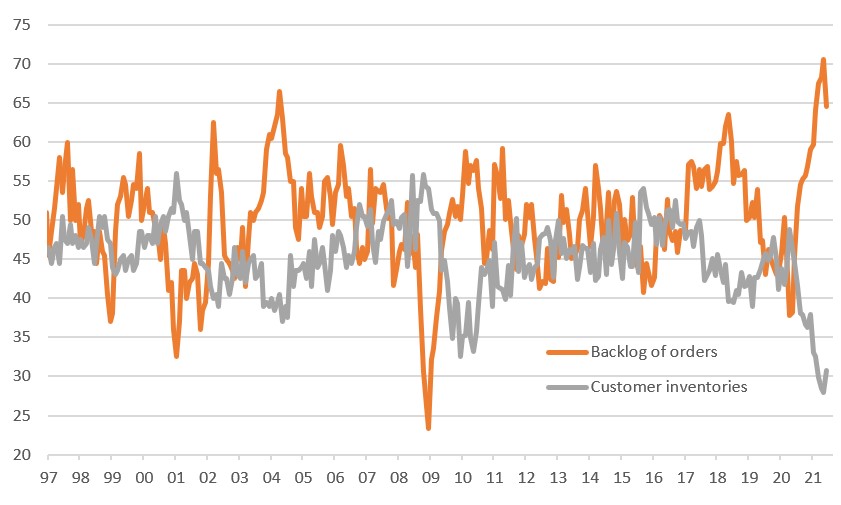

If it were not for the supply chain issues in the sector the output story would be significantly better. As the chart of ISM data below shows, order books remain close to record levels while customer inventories are close to record lows.

ISM reports strong order books while firms know their customers have low inventories

(Click on image to enlarge)

Source: Macrobond, ING

Supply chain strains imply more inflation risks

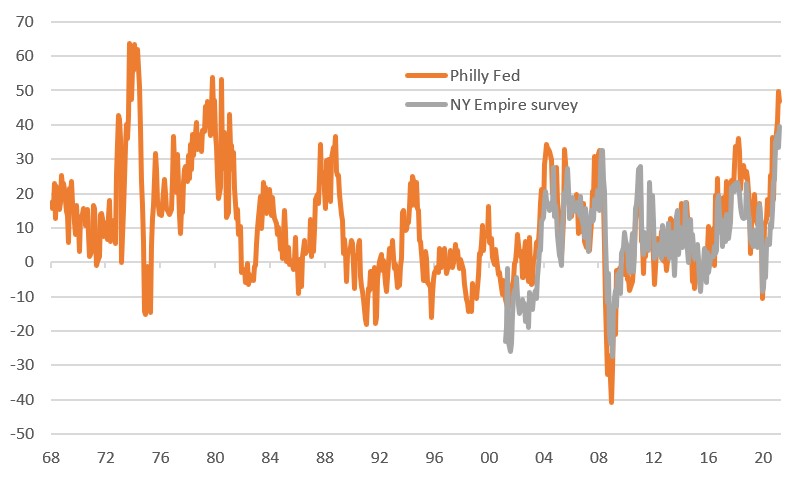

This combination of strong order books and low customer inventories mean that there is a growing sense of rising corporate pricing. With so many companies experiencing supply chain issues and higher costs, be it for components, energy, raw materials or workers, this means companies are increasingly able to pass them onto customers – as highlighted by today’s Philly Fed and NY Empire manufacturing surveys. This is another reason to believe that inflation could remain more elevated for longer than the Federal Reserve believes likely.

Fed regional manufacturing surveys suggest companies are raising prices at the fastest rate for 40 years - Price Received components

Source: Macrobond, ING

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more