Stronger China Trade Expected In 2022

As the global economy recovers, we should see stronger demand for goods, and therefore stronger international trade in China. The challenges will continue to be freight delays and semiconductor shortages.

ASEAN is the biggest trade partner in 2021

The China trade surplus was $676.2bn in 2021, an increase of 29% from 2020. December had the largest trade surplus of $94.5bn.

For the whole of 2021, ASEAN became China's biggest trade partner, followed by the European Union, then the US. This shows that Asia as a whole is now integral to the manufacturing supply chain, though it is also true that domestic demand from ASEAN is growing.

In terms of export products, steel increased the most at 80%, electronics, which is the largest in terms of value, rose near 30%. For imports, coal rose near 77% while the largest item, electronics, rose 20%.

Overall, this shows that China is still a very important manufacturing location for electronics.

Prospects in 2022

We believe that as the global economy continues to improve, there will be more demand for goods. This implies more international trade for China in 2022. Continued semiconductor shortages will be a challenge for manufacturers and exporters of many goods, from refrigerators to vehicles, not to mention smartphones and gadgets. This is not going to be solved instantly. As such, prices of these goods will either have to go up or the quality or functionality may have to come down.

Coal imports into China were strong in 2021. This could extend into 2022 before China beefs up its solar and wind power to replace coal. But bear in mind that China's roadmap is to have peak carbon emissions in 2030 before reducing them from there, to reach carbon zero by 2060. So, before 2030 we may continue to see a high volume of coal imports into China as China also starts to close down dirty coal processing lines.

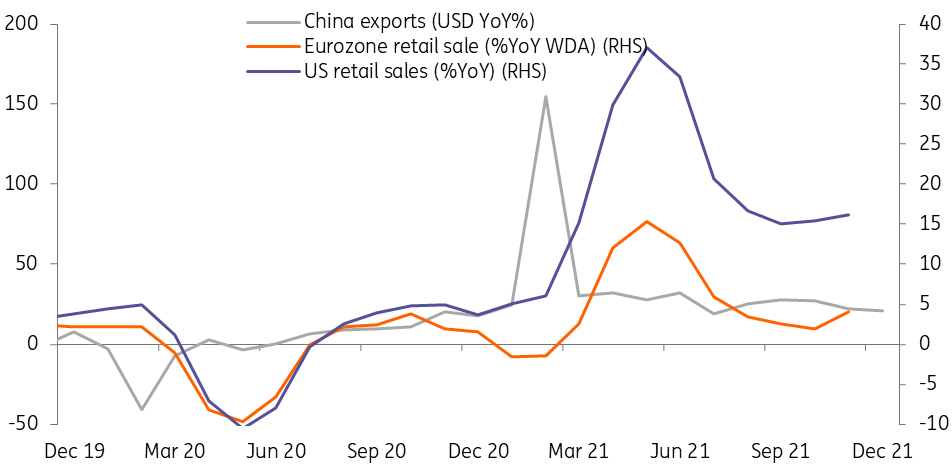

Demand from the EU and US lead China exports

The lag indicates the shipment time

Source: CEIC, ING

Covid could attack the ports from time to time

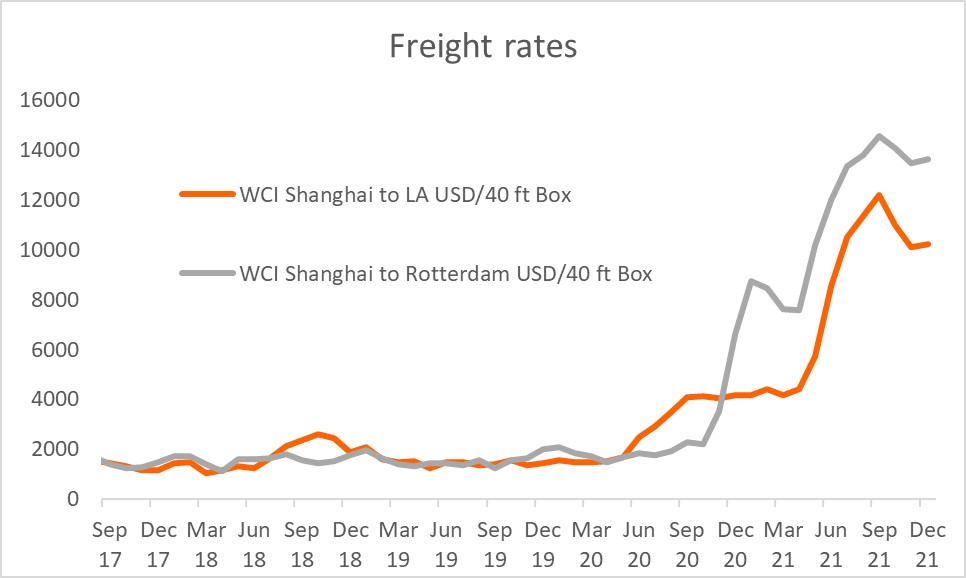

We have already seen how port operations can be affected due to workers catching Covid. We can't rule out more disruption in 2022. But this is not just a China problem, it's a worldwide problem. When either side of the freight line is suspended, even for a few days, freight rates rise and so does the cost of shipments.

This could be a potential factor for inflation. But we don't think this will derail trade growth in 2022.

High freight rates

Source: WCI, ING

A stable yuan is positive for trade

Exporters may not need to worry too much on the exchange rate risk in 2022 as the central bank has made clear that the yuan exchange rate should be stable for the year.

This should reduce the risk and the cost of hedging, which is good news for exporters. We forecast the USD/CNY to reach 6.5 by the end of 2022.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more