Stocks Turn Higher As Investors Celebrate Vaccine Update

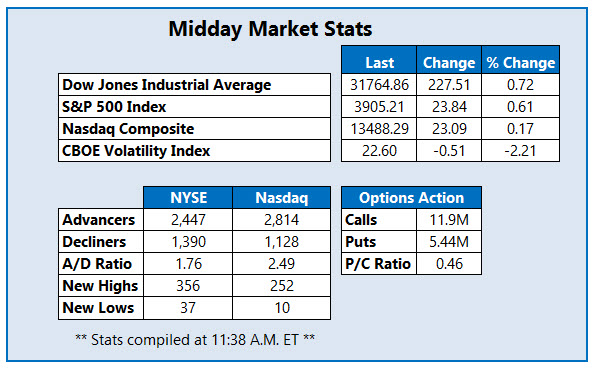

Stocks are attempting to overcome this week's carnage at midday, as both the Dow Jones Industrial Average (DJI) and the S&P 500 Index (SPX) claw their way back into the black. The former is now up over 227 points, buoyed by big gains from several blue-chip bellwethers, including Boeing (BA) and Caterpillar (CAT). The Nasdaq Composite (IXIC) has also turned positive, as investors set aside anxieties around rising bond yields, which cast a long shadow over Big Tech.

A vaccine update from Johnson & Johnson (JNJ) is certainly contributing to some of this optimism. Earlier today, the U.S. Food and Drug Administration (FDA) deemed its single-dose Covid-19 vaccine both safe and effective, clearing the path to approval.

Snap Inc (NYSE: SNAP) is seeing a surge in options-related activity today, specifically on the call side. So far, 191,000 calls have been exchanged -- double the intraday average, and nearly triple the 64,000 puts traded. The most popular is the weekly 2/26 73-strike call, followed by the 75-strike call in the same series, with new positions being opened at both. SNAP is up 0.4% at $70.71 at last check, but earlier hit an all-time high of $73.59, after the social media name forecast multiple years of 50% revenue growth. The announcement sparked price-target hikes from 17 analysts, including one to $95 from Pivotal Research.

One of the best performers on the Nasdaq today is Sypris Solutions, Inc (Nasdaq: SYPR). The stock was last seen up 91.7% at $5.10, nearly doubling on news that the company received a follow-on award from a U.S. Department of Defense (DoD) prime contractor. Sypris Solutions will be tasked with the manufacturing and testing of electronic power supply modules, starting this year. The security earlier hit a 13-year high of $7.89, just one day after it breached long-term support at the 20-day moving average. The stock has surged back above this level today and sports a 244.7% year-to-date lead.

One of the worst-performing stocks on the Nasdaq today is Briacell Therapeutics Corp (Nasdaq: BCTX). The equity was last seen down 38.1% to trade at $3.69, after the firm announced the underwritten public offering of more than five million U.S. units, at a price of $4.25 per unit, amounting to roughly $25 million. The security is trading dangerously close to its Oct. 12, all-time low of $3.25. Longer-term, BCTX has lost 78.1% over the past 12 months.

Disclaimer: Schaeffer's Investment Research ("SIR" or "we" or "us") is not registered as an investment adviser. SIR relies upon the "publishers' ...

more