Stocks, TIPS Tumble As Fed Abandons Bond-Buying "Due To Technical Difficulties"

Something odd happened today. Treasury 10- and 30-year TIPS fell to session lows after the Fed postponed Tuesday’s scheduled purchase operation targeting the 7.5- to 30-year sector until Wednesday.

“Due to technical difficulties, today’s Treasury outright purchase operation - scheduled for 10:10 AM in the TIPS 7.5 to 30 year sector for up to $1.075 billion - is being rescheduled,” Federal Reserve Bank of New York says.

“It is now scheduled to take place Wednesday, November 24, 2021 at 11:00 AM,” New York Fed says Tuesday on its website

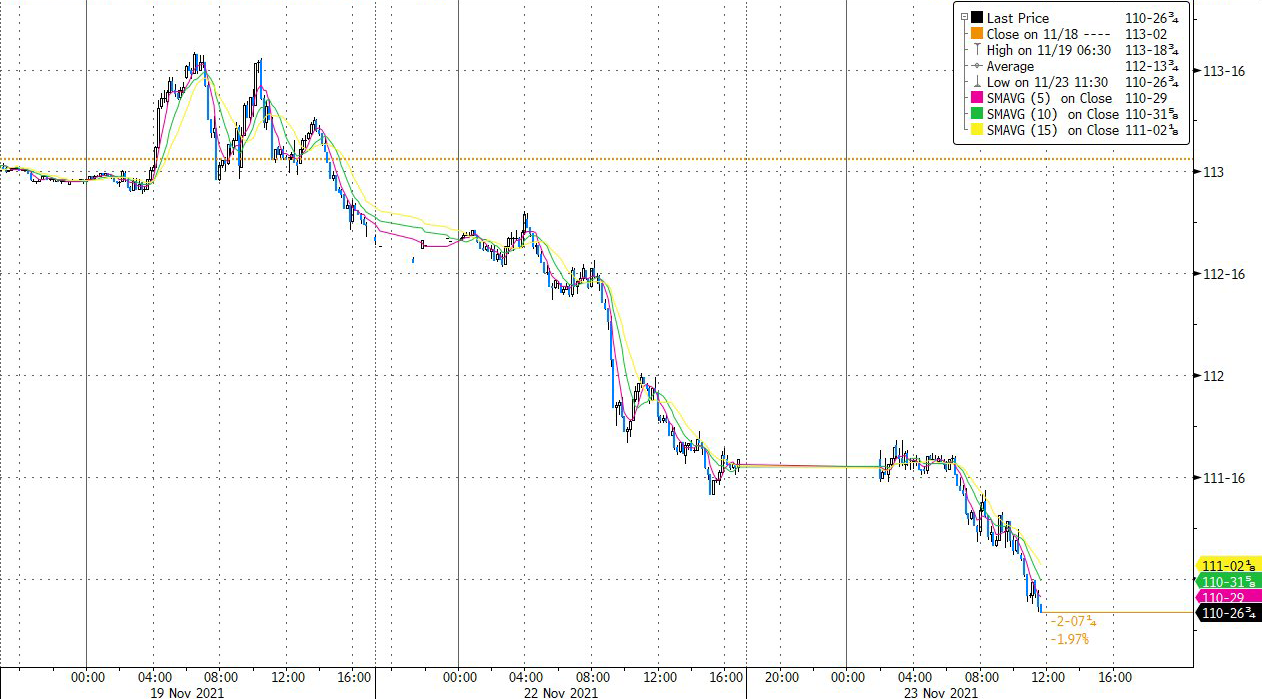

TIPS prices fell quickly on the news...

(Click on image to enlarge)

Sending real yields surging higher (as breakevens tumbled)...

(Click on image to enlarge)

Which in turn is crushing many other assets...

(Click on image to enlarge)

Interestingly, while Nasdaq is sliding, the Nasdaq-Small Caps pair has seen a notable regime-shift relative to real-yields...

(Click on image to enlarge)

One wonders just what the 'technical difficulty' really is. Is it more likely a bond market liquidity issue?

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more