Stocks Suffer Worst Week Of Year; Beans, Bonds, And The Buck Blitz'd

Tariffs, turmoil and tantrums ...

Since Powell dropped the "mid-cycle adjustment" mic, Bonds and Bullion have been bid, the dollar is practically unchanged and stocks have plunged (hurt more by Trump Tariffs)...

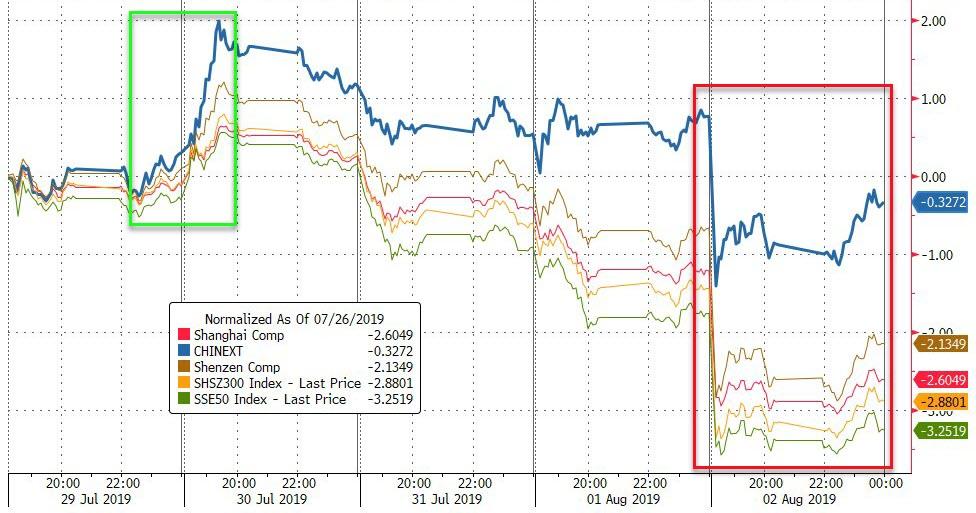

Chinese stocks were lower for the last three days with big caps worst and tech names the least bad... for now...

European stocks cratered today - the biggest single-day drop since Dec 2018 - with Germany and France leading the way lower on the week...

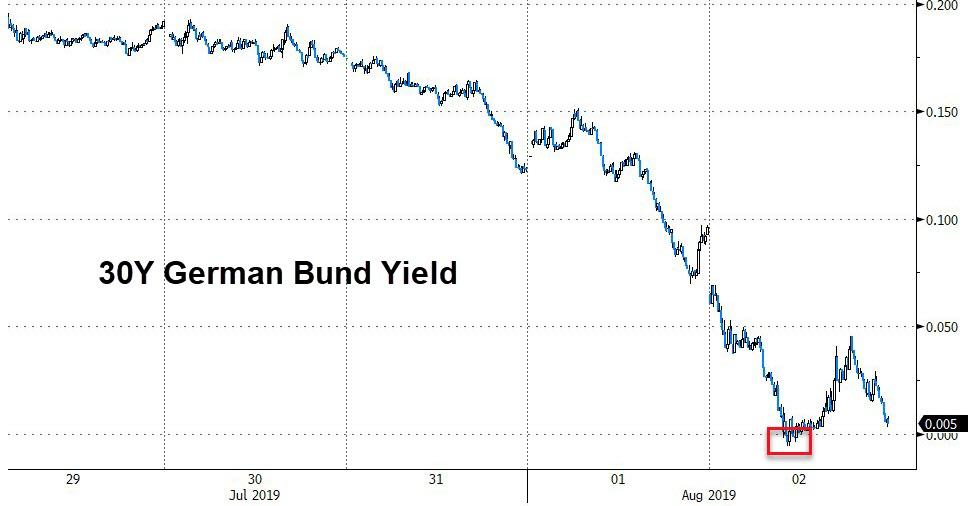

For the first time ever, Germany's entire yield curve (30Y) traded with a negative yield...

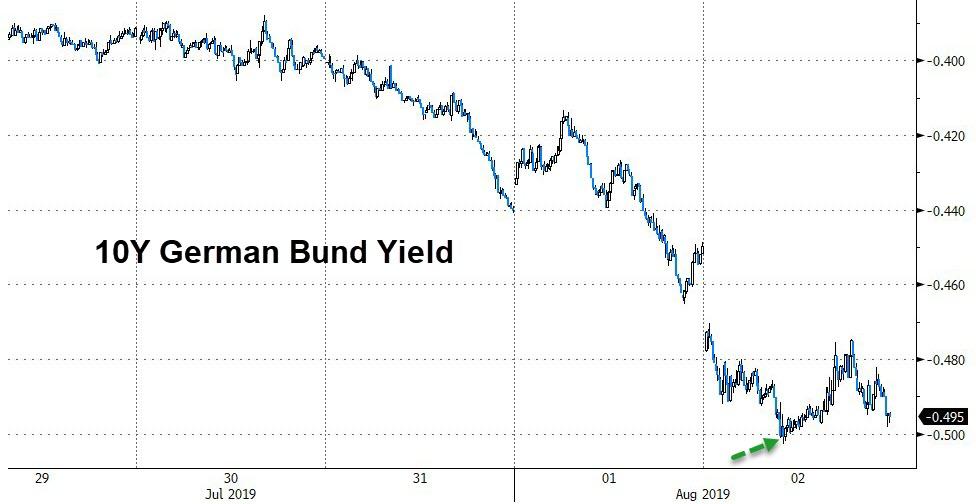

10Y Bunds hit -50bps today!!!!

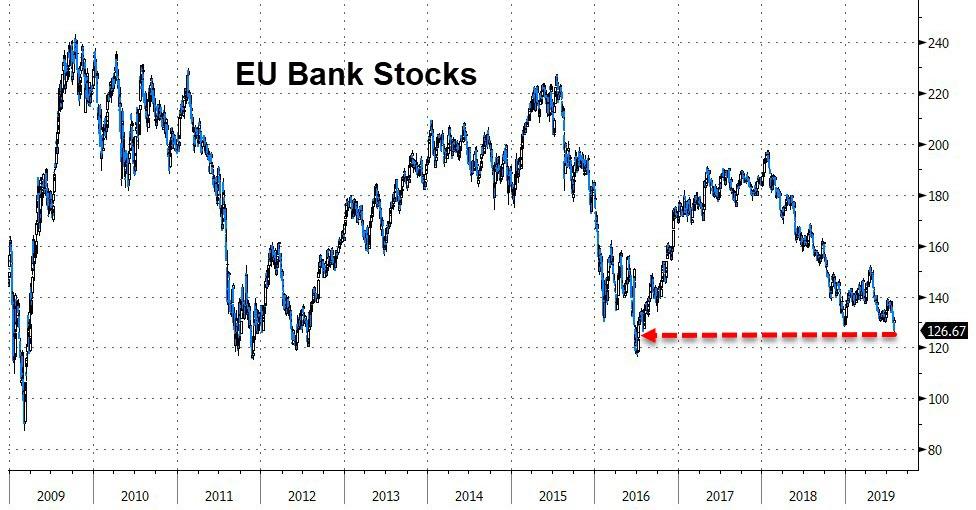

European banks crashed on the week to their lowest since Brexit vote (June 2016)

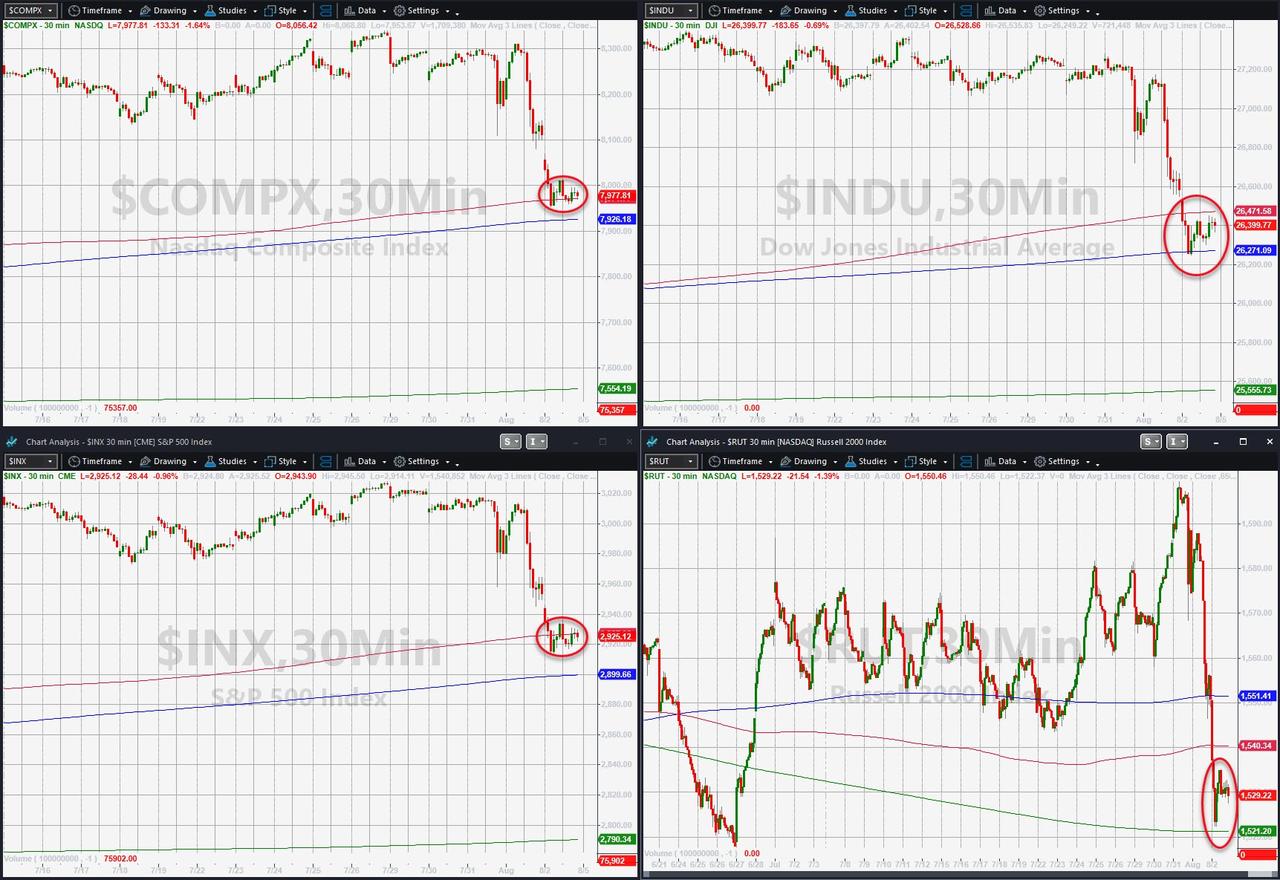

Broadly, this was the worst 3-day drop for US stocks since Christmas Eve and worst week of 2019... Stocks were - as always - bid in the last hour... until Trump said "he could raise China tariffs to a much higher degree." Nasdaq was the week's biggest loser (and Dow lost the least of the majors).

US equities plunged to critical technical levels:

-

S&P 500 tested its 50DMA (2927) and 100DMA (2900)

-

Nasdaq tested its 50DMA (7971) and 100DMA (7927)

-

Dow broke below its 50DMA (26472) and tested its 100DMA (26276)

-

Trannies broke below the 50DMA (10358) and 100DMA (10478) and tested its 200DMA (10281)

-

Small Caps broke below the 50DMA (1540) and 100DMA (1551) and tested its 200DMA (1520)

VIX topped 20.00 intraday today before fading back...

FANG Stocks were down every day this week (2nd worst week of the year)...

Cyclical stocks tumbled, their worst week of the year, dramatically underperforming defensives...

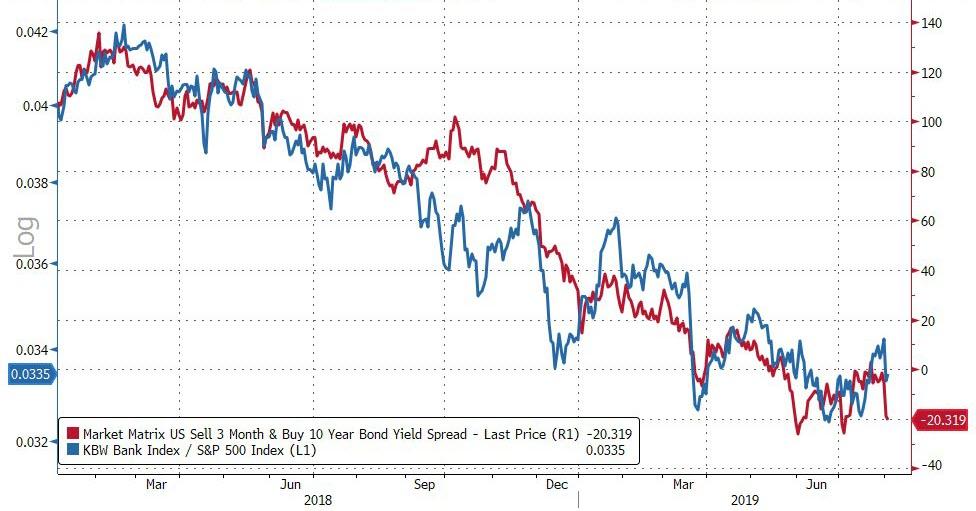

Bank stocks were battered, tracking the collapse of the curve...

Despite this week's carnage, bonds and stocks remain dramatically decoupled...

Credit spreads blew wider on the week...

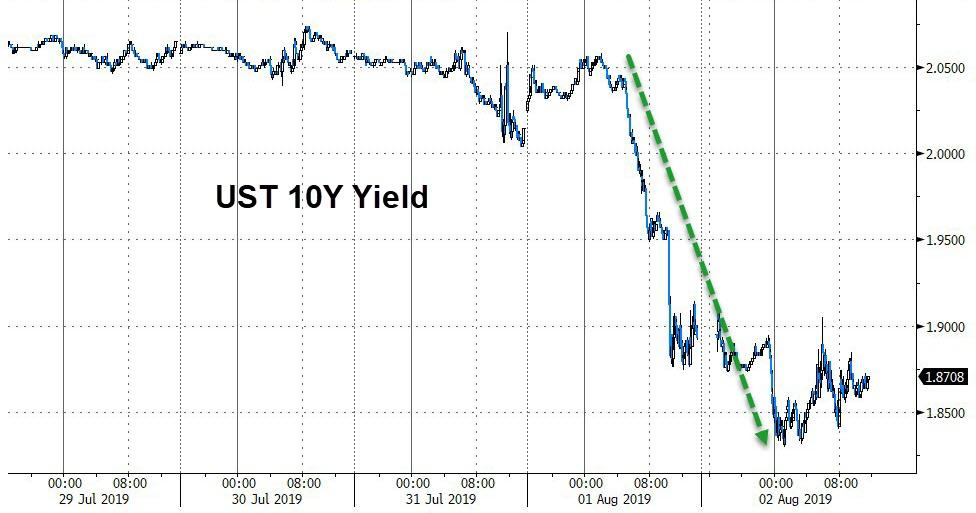

It was a bloodbath for bond bears this week (down 12-20bps across the curve with the long-end outperforming)...

10Y crashed to its lowest yield since before Trump's election...This was the biggest 10Y Yield drop in a week since Dec 2014.

2Y yields were even crazier - initially spiking on Powell then crashing on Trump...

30Y Yields are back at their lowest since Oct 2016...

The yield curve (3m10Y) crashed to cycle lows...

And finally, before we leave bond-land, longer-term inflation expectations have fallen the most in the past two days since 2016, based on 5-year 5-year forward breakeven rates... a total policy-failure

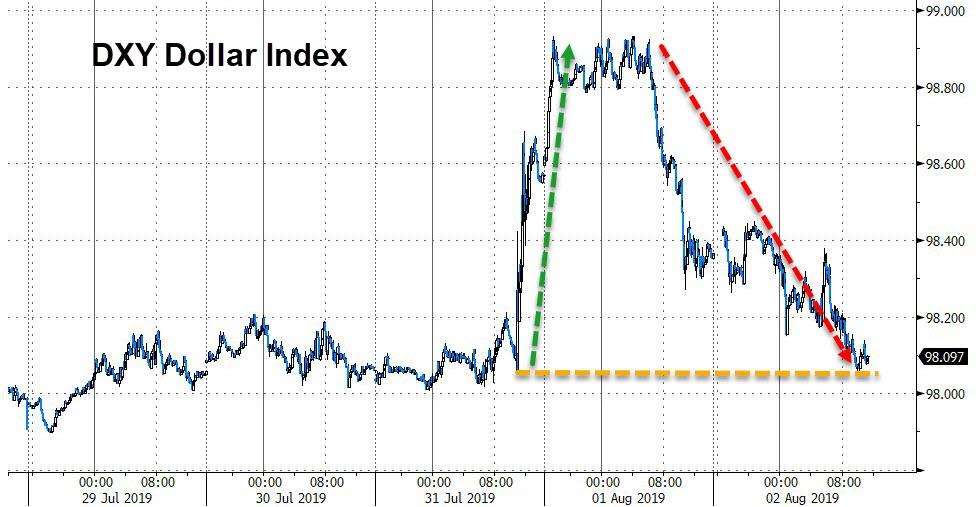

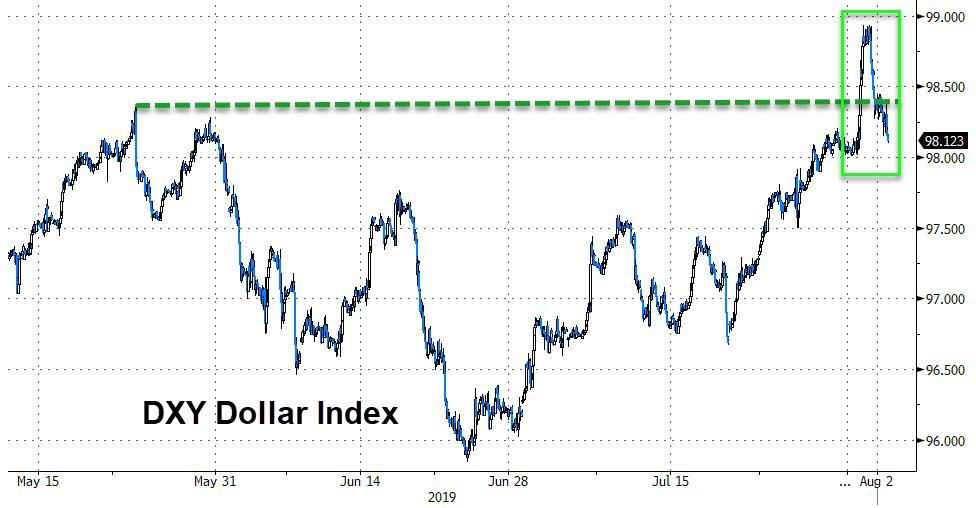

Amid all the chaos, the dollar index ended the week only marginally higher after a huge round trip the last few days

...After a false breakout to the highest since May 2017)...

Cable suffered one of its worst weeks since Brexit, dropping to its lowest weekly close since May 1985...

Yuan dropped five of the last six days closing the week at its weakest since Dec 2016 (Yuan has only closed weaker than this twice before... ever)

Emerging Market FX has really collapsed the last few days (Turkey surprisingly outperformed)...

The biggest 3-day drop since Aug 2018 to its lowest since May...

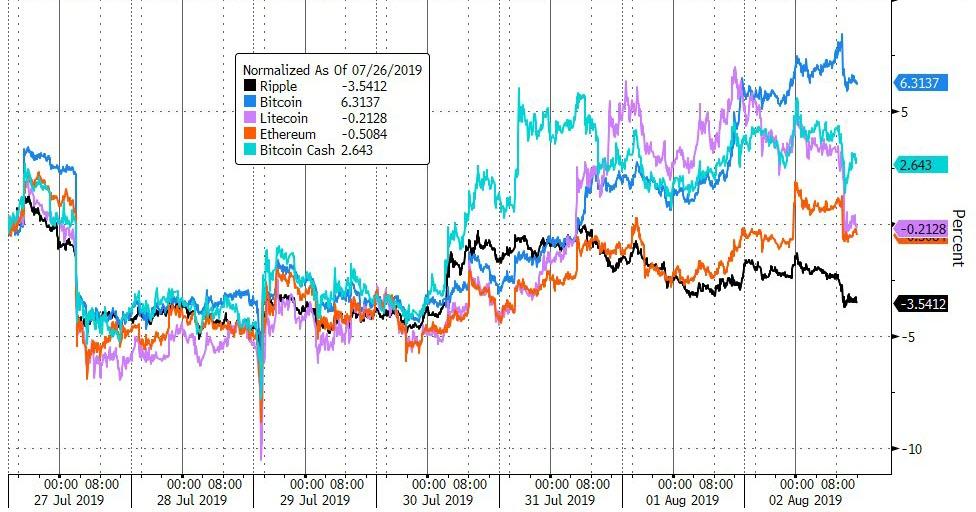

Cryptos had a mixed week - best gains since June for Bitcoin as Ether and Litecoin scrambled back to even...

Bitcoin surged back above $10,000 and extended gains...

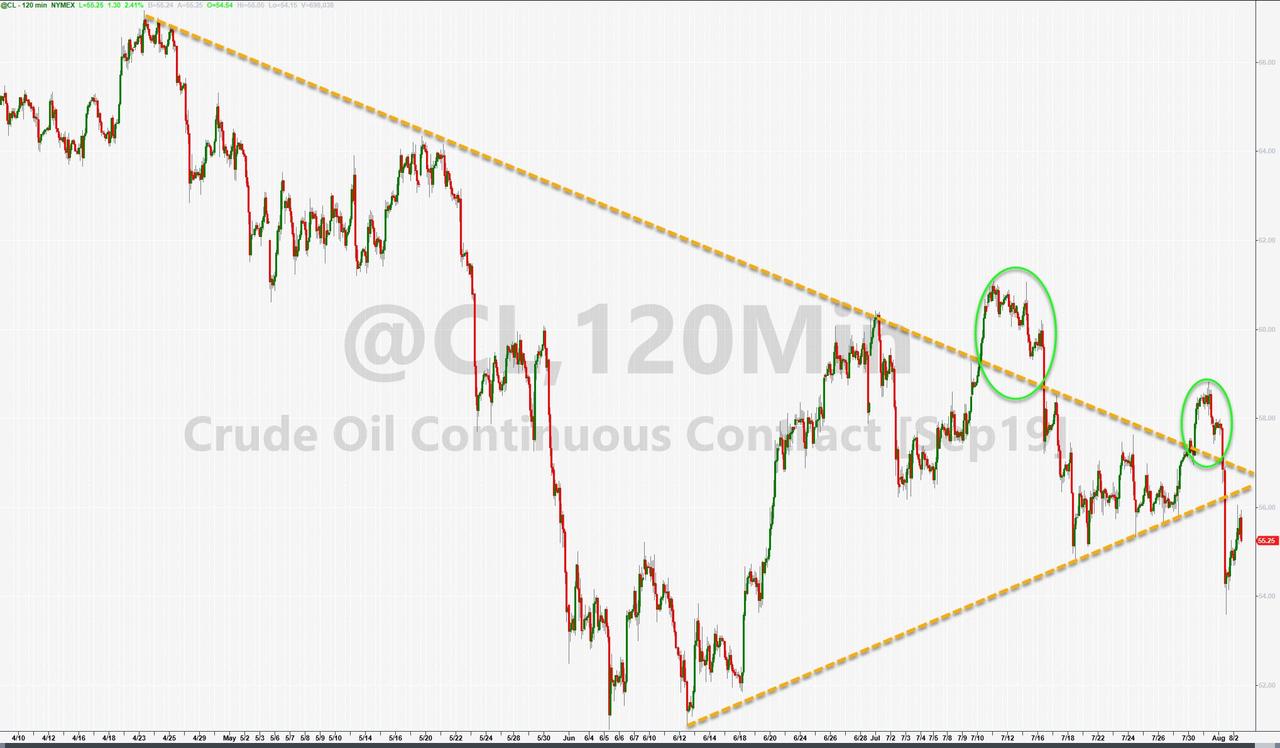

Copper was crushed on the week but Gold outperformed as crude rebounded after its worst day in years...

In fact, Dr.Copper has collapsed to two year lows... what does the PhD economist commodity know?

Ugly week for crude...

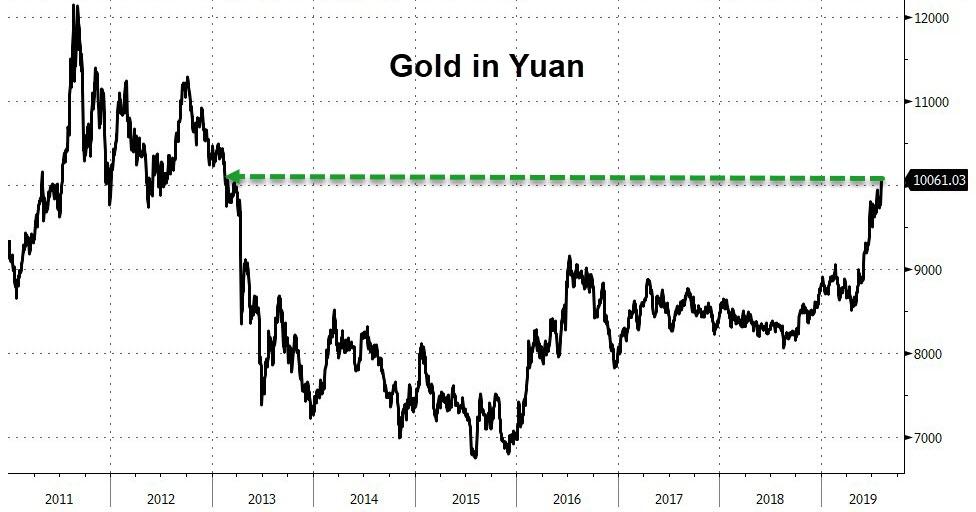

Gold topped CNH10,000 for the first time since Feb 2013...

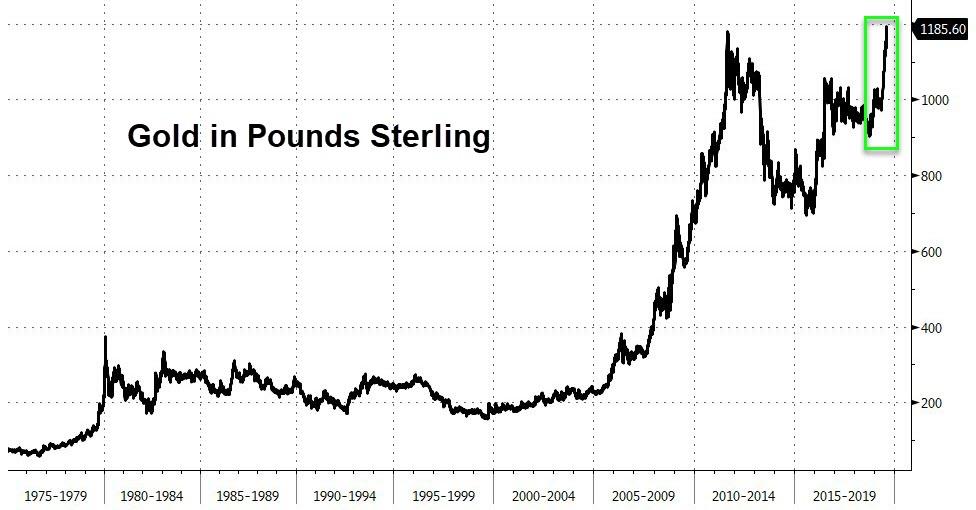

Gold reached a new record high against the pound sterling...

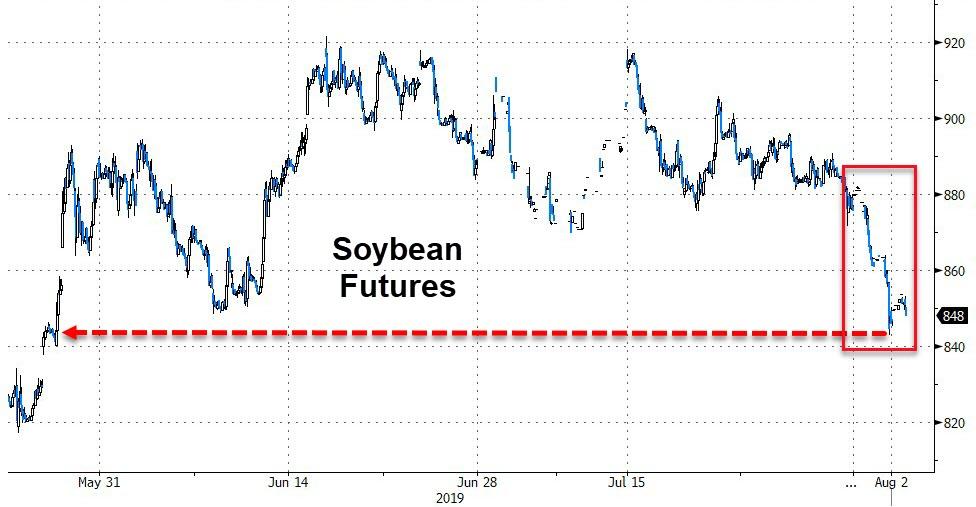

Soybeans were monkeyhammered (worst week since Aug 2018) to their lowest since May after Trump tariff headlines...

Finally, you are here...

It's different this time though - remember!

Different, because it's way more ridiculous (negative-yielding debt tops $14 trillion!!)

And gold and crypto appear to be where investors are going to hide from this policy-maker pandemonium!!

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more