Stocks Reacting More Positively To Earnings

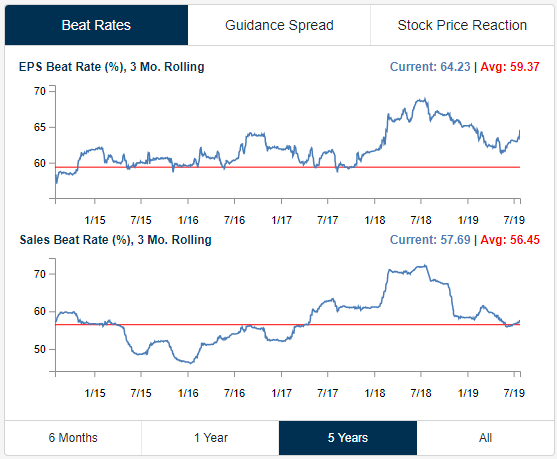

Below is an updated snapshot of earnings and revenue beat rates after factoring in the 600+ earnings reports that we’ve gotten over the last two weeks. The first chart in the snapshot below shows the rolling 3-month earnings per share beat rate over the last five years. You can see that more recently we’ve seen a bounce in bottom-line EPS beat rates. Over the last three months, 64.23% of companies reporting have beaten consensus EPS estimates, which is nearly five percentage points above the long-term average.

The second chart shows the rolling 3-month revenue beat rate, which currently stands at 57.69%. This is up ever so slightly over the last couple of months, but it’s just a bit above the long-term average and it’s well below the beat rate for EPS.

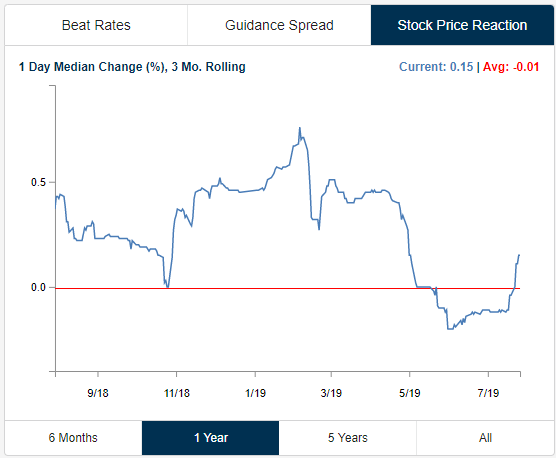

Stocks have been reacting a lot more positively to their earnings reports recently. Over the last three months, the median stock that has reported earnings has gained 0.15% on its earnings reaction day. While that’s not hugely positive on an absolute basis, it’s up big from the negative reactions we were seeing back in May and early June.

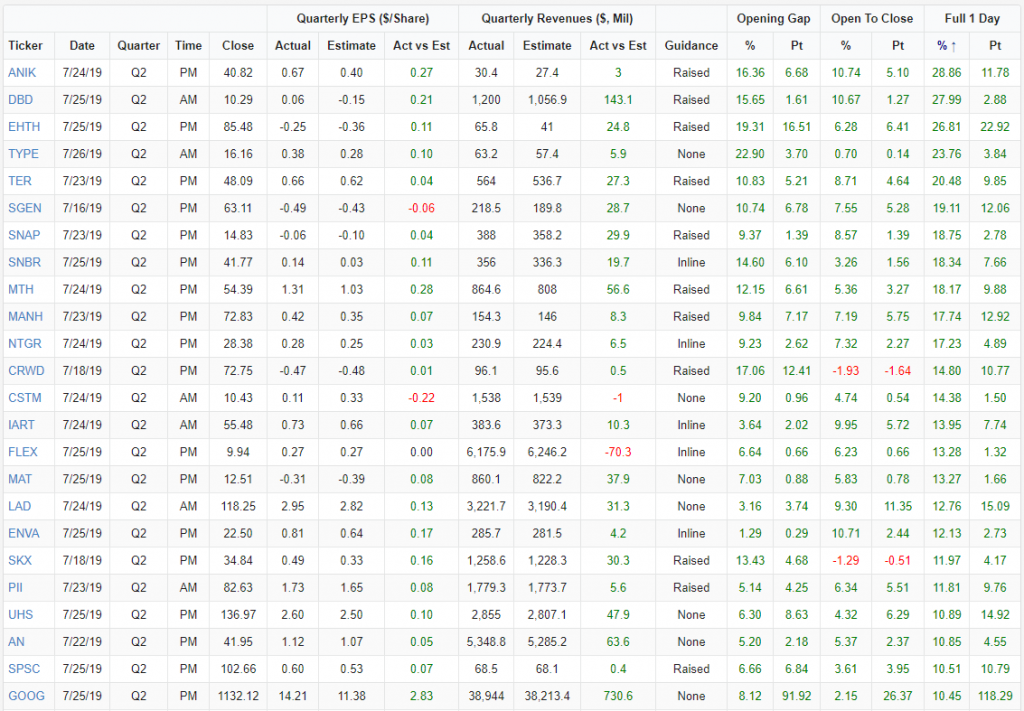

Below is a look at the stocks that have reacted the most positively to earnings over the last two weeks. ANIK has seen the biggest one-day gain on earnings this season with an upside move of 28.86% on July 25th (it reported after the close on 7/24).DBD ranks second with a one-day gain of 27.99%, followed by EHTH with a gain of 26.81%. Other notables on the list of big earnings winners include SNAP, MAT, and GOOG.

(Click on image to enlarge)

Disclaimer: Read our full disclaimer here.