Stocks, Bonds, & Gold Gain As Easing Hopes Hide Global Risks

Another buyback-sponsored surge in stocks met with gains in bonds and bullion...

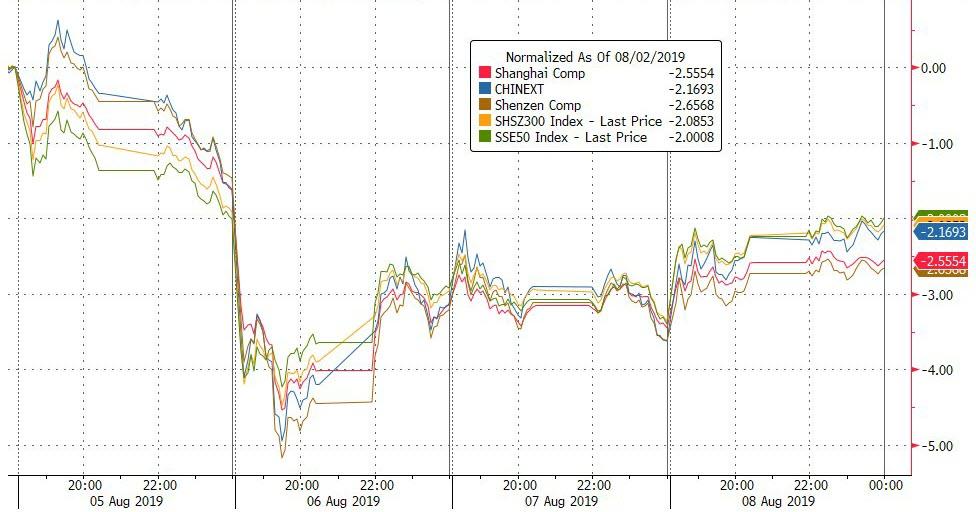

Once again all eyes were on the yuan fix overnight which was set weaker than 7/USD for the first time since 2008 but was slightly stronger than expected (and thus interpreted as China seeking stability)...

(Click on image to enlarge)

Chinese stocks managed modest gains only again after the fix (and better than expected trade data), but remain well in the red for the week...

(Click on image to enlarge)

Source: Bloomberg

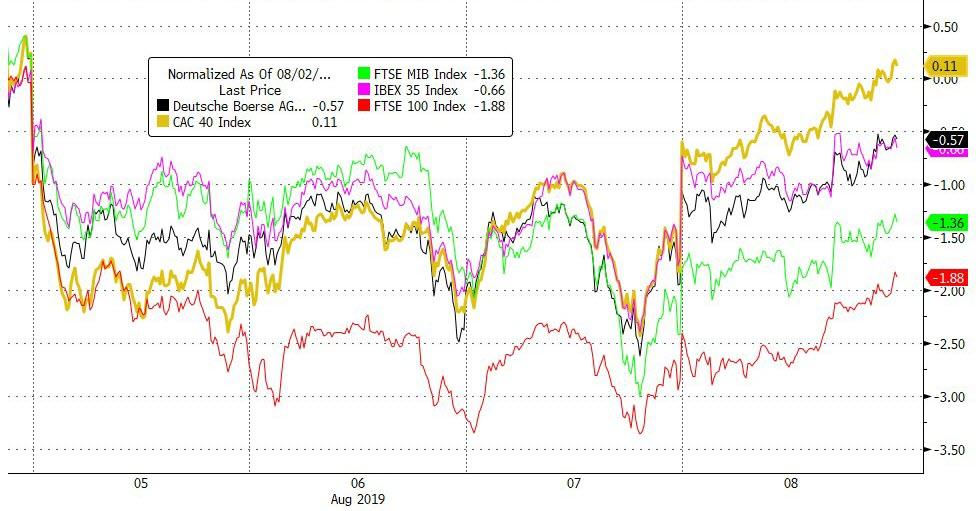

European markets surged intraday with France's CAC40 back into the green for the week...

(Click on image to enlarge)

Source: Bloomberg

Swissy was safe-haven bid against the Euro as Italian politics reared its ugly head again...

(Click on image to enlarge)

Source: Bloomberg

US Equity markets were ramped back to unchanged on the week...

(Click on image to enlarge)

Small Caps and Nasdaq outperformed on the day...

(Click on image to enlarge)

Dow futures have retraced Fib 61.8% of the post-Powell plunge...

(Click on image to enlarge)

3rd day of a huge short squeeze...

(Click on image to enlarge)

Source: Bloomberg

Kraft Heinz crashed to record lows...

(Click on image to enlarge)

Source: Bloomberg

BYND was battered back below its Secondary offering price

(Click on image to enlarge)

VIX dropped back to a 16 handle today...

(Click on image to enlarge)

Stocks and bond yields dramatically decoupled this afternoon...

(Click on image to enlarge)

Source: Bloomberg

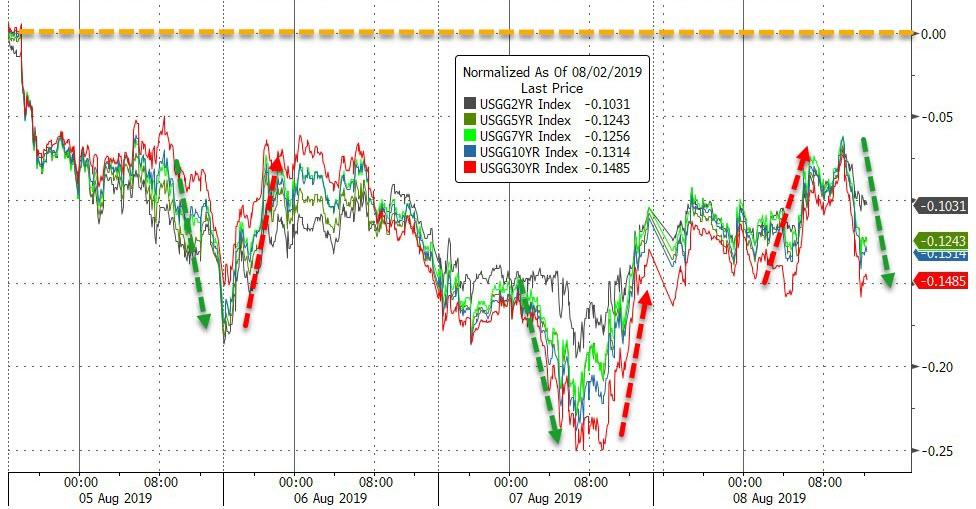

Treasury yields surged early on but between the Italian political news and better-than-expected tail in the 30Y auction, yield tumbled back lower in the afternoon... and are still dramatically lower on the week...

(Click on image to enlarge)

Source: Bloomberg

2Y underperformed, flattening the curve modestly (and a new cycle low in 2s10s)...

(Click on image to enlarge)

Source: Bloomberg

It was another large range day for bonds though (11bps in 30Y after the longest-duration auction ever)...

(Click on image to enlarge)

Source: Bloomberg

Mirroring yesterday's yield plunge and surge...

(Click on image to enlarge)

Source: Bloomberg

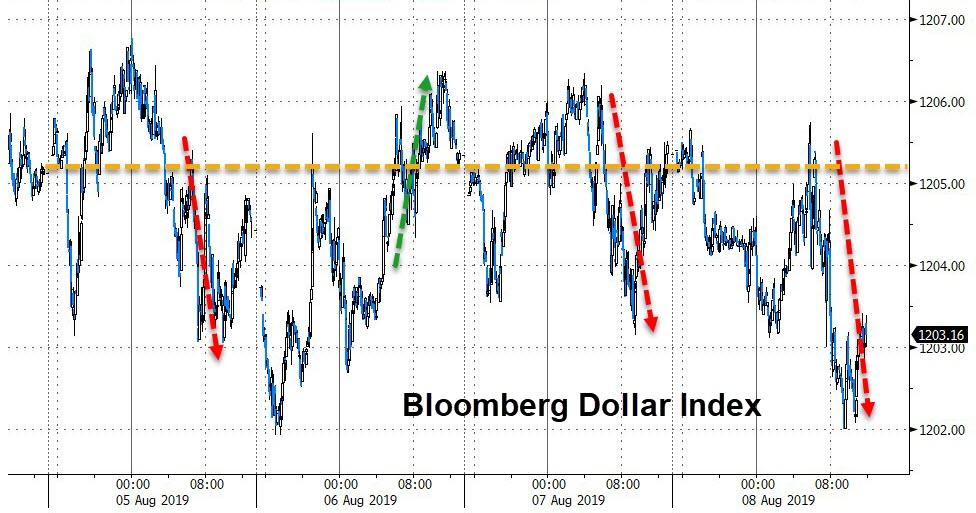

The Dollar Index ended the day lower but remained in the narrow range of the week...

(Click on image to enlarge)

Source: Bloomberg

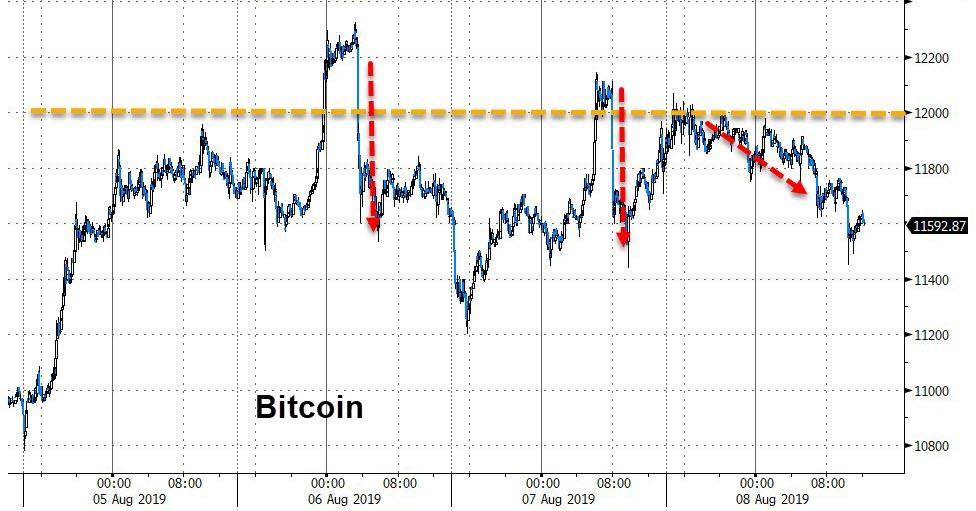

Cryptos were lower on the day with Bitcoin still the week's biggest gainer...

(Click on image to enlarge)

Source: Bloomberg

Another failed attempt at $12k overnight...

(Click on image to enlarge)

Source: Bloomberg

WTI bounced back today on the heels of more chatter from Saudi on stem price drops (and hope of another trade truce with China)...

(Click on image to enlarge)

Source: Bloomberg

Oil prices surged over 3% today, extending yesterday's Saudi bounce gains...

(Click on image to enlarge)

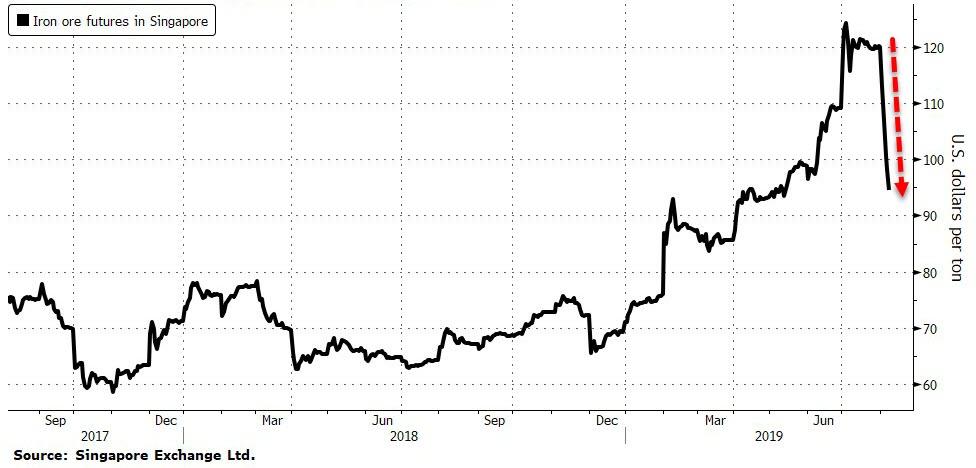

Iron Ore prices continue to plummet...

(Click on image to enlarge)

Source: Bloomberg

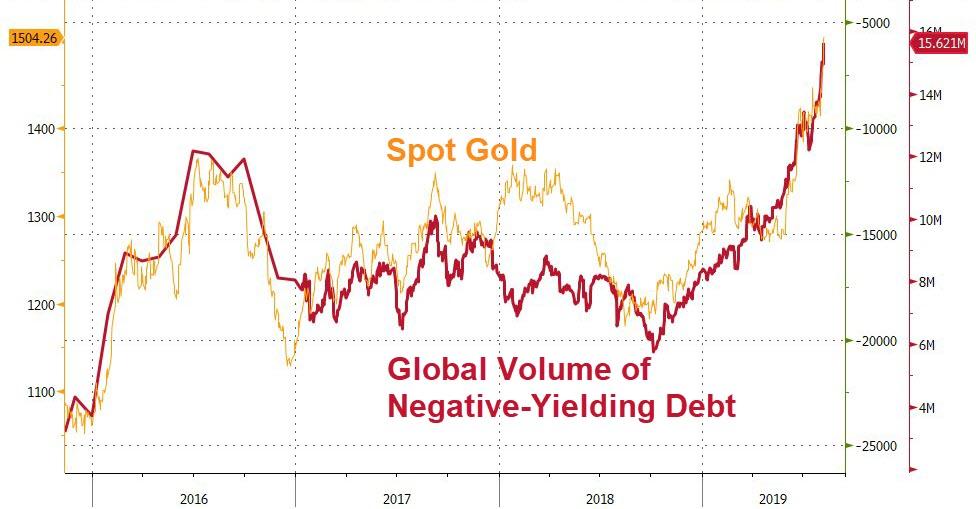

Gold managed gains as it surged back higher on the auction/Italian headlines...

(Click on image to enlarge)

And finally, with today's re-plunge in TSY yields (and the likely shift in Bund yields due to Italy crisis), negative-yielding debt debacles are leading gold higher...

(Click on image to enlarge)

Source: Bloomberg

And as a quick reminder, Gold remains the biggest winner since The FOMC meeting and stocks worst...

(Click on image to enlarge)

So on the week: Stocks are unchanged, TSY yields are down 14bps, Gold is up 3%, and the dollar is fractionally lower. One of these things is not like the other!!

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more