Zynex - All-Time High

Summary

- 100% technical buy signals.

- 13 new highs and up 88.43% in the last month.

- 172.27% gain in the last year.

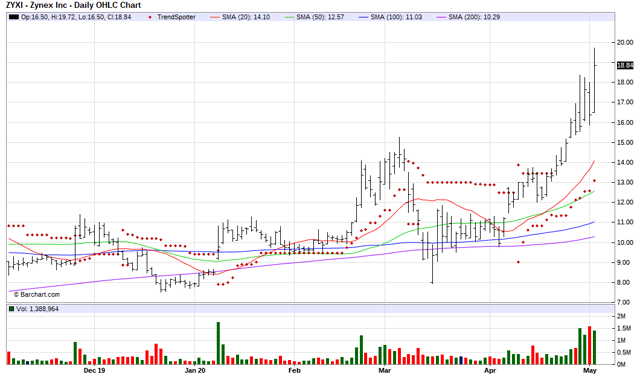

The Barchart Chart of the Day belongs to the medical equipment company Zynex (OTC: ZYXI). I found the stock by sorting Barchart's New All-Time High list first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 4/22 the stock gained 35.57%.

Zynex, Inc. engineers, manufactures, markets, and sells medical devices for the electrotherapy, and stroke and spinal cord injury rehabilitation markets primarily in the United States. The company primarily offers electrotherapy products for pain relief and pain management; and NeuroMove for stroke and spinal cord injury rehabilitation. The company's product lines are fully developed, FDA-cleared, commercially sold, and have been developed to uphold the Company's mission of improving the quality of life for patients suffering from impaired mobility due to stroke, spinal cord injury, or debilitating and chronic pain. Zynex markets its products through commissioned and independent sales representatives, as well as directly to end-users through advertisements and articles in relevant publications and on the Internet. The company is headquartered in Littleton, Colorado.

(Click on image to enlarge)

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can, therefore, change during the day as the market fluctuates. The indicator numbers shown below, therefore, may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 137.40+ weighted Alpha

- 172.27% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 88.43% in the last month

- Relative Strength Index 72.67%

- Technical support level at 15.49

- Recently traded at 18.38 with a 50 day moving average of 12.57

Fundamental factors:

- Market Cap $543 million

- P/E 58.87

- Revenue expected to grow 74.30% this year and another 47.80% next year

- Earnings estimated to increase 42.90% this year and another 77.50% next year

- Wall Street analysts have 4 strong buy ratings in place on this stock

- The individual investors following the stock on Motley Fool are split 14 to 14 that the stock will beat the market

- 2,046 investors are monitoring the stock on Seeking Alpha

Disclosure: None.