ZNGA Stock Forecast: Avoid Investing In Zynga, It Has More Downside Risks

Summary:

- Zynga’s stock has a negative trend score from I Know First. Seeking Alpha’s Quant Rating for Zynga is Neutral.

- It is therefore wise for us to avoid going long on ZNGA. If we heed the sell signal from I Know First, we can also short ZNGA.

- The reason why Zynga warned of weaker Q3 and Q4 is because its regular players are now flocking to cryptocurrency-based Android/iOS games.

- I will only rate Zynga’s stock as a buy again after it comes up with its own answer to Axie Infinity. Cryptocurrency games can offset Apple’s restrictive app privacy rules.

- The play-to-earn cryptocurrency is the next growth driver for video games. NFT Gaming Tokens now touts combined market value of $13 billion.

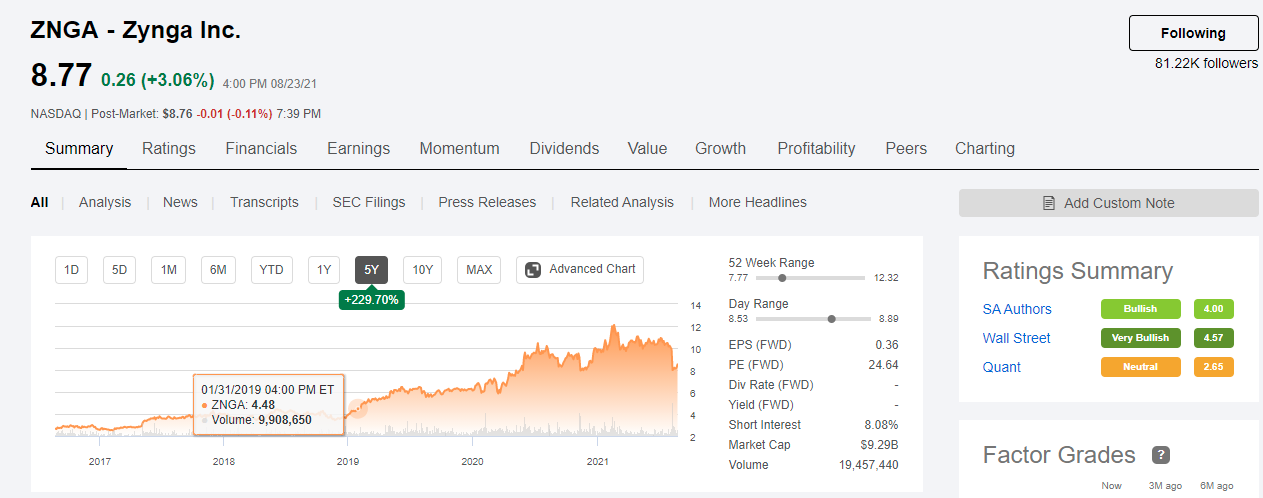

I endorsed Zynga (ZNGA) as a buy-in on January 31, 2019. ZNGA’s stock price back then was only $4.78. Even after its -30.13% 6-month decline, ZNGA is still trading above $8.70. Long-termers who held on to their ZNGA should cash out their winnings. There are better gaming-related stocks out there that deserve your money. Zynga’s management has cut its full-year guidance earlier this month due to the headwind from Apple’s (AAPL) more restrictive app privacy rules.

Like other game developers/publishers, a huge part of Zynga’s mobile advertising and in-app purchases revenue comes from iOS devices. The $307 million/year mobile advertising business of Zynga relies on gathering personal information from players of its mobile games. Unless it becomes a serious PC or console gaming publisher, Apple’s restrictive app privacy policy will persist as a headwind for Zynga.

My sell rating for ZNGA is more decisive against the Neutral outlook that ZNGA got from Seeking Alpha’s Quant AI. The headwind of Apple is why I believe ZNGA will have a hard time climbing back to its 52-week high of $12.32. Mobile advertising platforms and game developers are likely to monetize less because Apple is encouraging its iOS device customers to opt-out of data-gathering activities of third-party app developers. Of course, Apple also offers its own mobile app advertising platform. We can presume that Apple wants more mobile ad buyers to use Apple’s own Search Ads platform so they can circumvent the restrictive app privacy settings.

Apple’s self-serving moves is likely why I Know First has a -43.96 1-year trend score for ZNGA. The stock prediction AI of I Know First is semi-confident that ZNGA has more downside potential within the next 12 months.

The efficiency chart below shows ZNGA is not the best gaming-related stock to own right now. Its Piotroski score is only 2, making it a poor value investment. My takeaway now is to sell or short ZNGA. Go long instead on more efficient gaming stocks like Take-Two TTWO or Activision (ATVI).

NFT Cryptocurrency Gaming Is On The Rise

Aside from the headwind from Apple’s restrictive app privacy rules, Zynga’s mobile in-app purchases revenue stream is weakening because of NFT or cryptocurrency games. Zynga’s forever franchise games are losing players to NFT (non-fungible tokens) crypto games like Axie Infinity. The concept of tapping mobile gamers to mine and trade cryptocurrencies is the new growth driver for mobile gaming. Instead of people buying expensive PC processors and GPUs to passively mine cryptocurrencies, brilliant people came up with the idea of creating cryptocurrencies that could be mined through actively playing video games.

ZNGA’s future is not very promising because it is not yet among those companies involved in the $13 billion NFT crypto gaming.

The play-to-earn blockchain mining concept of Axie Infinity has recruited millions of mobile gamers around the world. Jobless people are now making good money playing Axie Infinity during this pandemic era. Axie Infinity’s crypto-economy has helped it earn $207 million in July. Without any prompt action from Zynga, its forever franchise titles Merge Dragons!, CSR Racing 2, Words With Friends, and Empires & Puzzles, will keep losing monthly active users. They will just go to play-to-earn NFT crypto games.

ZNGA Stock Forecast: My Recommendation

Zynga still has enough cash reserve to hire blockchain programmers. They can work with the game developers of Zynga to create a Zynga-branded NFT crypto game. Zynga can also hire the best Indian or Chinese blockchain coders to integrate NFT crypto-currency mining in Empire & Puzzles, CSR Racing, Zynga Poker, and Words with Friends. The Philippine government now wants to tax earnings from the $13 billion gaming tokens industry. This goes to show that mobile gamers are now making significant money from Axie Infinity and NFT games. Zynga should also make an NFT game as soon as possible.

Zynga still has $1.5 billion in cash. It can buy other NFT game developers. On the other hand, copying the concept of Axie Infinity and its AXS NFT token blockchain design might be quicker and cheaper. My fearless forecast is that Zynga can breach $13 if it comes up with a better-paying version of Axie Infinity. Zynga can call it Pets Infinity. People can earn money by first buying puppies/kittens for $10 each and trained them up for player-versus-player competition. Zynga can also create a cockfighting game for Asians. Instead of real money tender, NFT tokens will be used as bets in online cockfighting. Zynga Poker’s play money chips could also be reprogrammed to become NFT cryptocurrency money.

My point is that cryptocurrency-centric games could help improve the profitability of Zynga. The many acquisitions of Zynga are still not enough to make it profitable. The reason why companies buy other companies is to get fast inorganic revenue growth. Unfortunately, fast inorganic revenue growth is futile if it doesn’t lead to better profitability. As you can see, the chart below explains why I Know First has a negative one-year forecast for ZNGA. The continuing unprofitability of Zynga also explains why it has a very low Piotroski score of 2. Sell or short ZNGA because it is a low-profit video games stock. There are better-performing gaming stocks out there.

Without another hit mobile game soon, ZNGA will likely wrap up FY 2021 with a net loss. We should avoid investing in money-losing video games companies. Video games are high-margin products. Zynga has bought other people’s hit games and yet it is still a money-losing enterprise. Management’s reduced FY2021 projections align with the bearish monthly technical indicators for ZNGA.

Past Success With ZNGA Stock Forecast

I Know First has been bullish on ZNGA’s shares in past forecasts. On our January 31, 2019 premium article, the I Know First algorithm issued a bullish ZNGA stock forecast. The algorithm successfully forecasted the movement of ZNGA’s shares on the 1 year time horizons. ZNGA’s shares rose by 37.56% in line with the I Know First algorithm’s forecast.

Disclosure: This article originally appeared on Iknowfirst.com, a financial services firm that utilizes an advanced ...

more

1. Chartboost was purchased to go in house with over 700 million active users. This will cut expenses and work in favor of IDFA.

2. #Apple ($AAPL) and #Google ($GOOGL) have been caught with their pants down on the 30% cut on the App Store. Big win for gaming. South Korea first.

3. The Merge category has experienced competition and therefore Zynga needs to be much more aggressive with MD and MM.

4. Gram Games is paid off. No more contingency payments.

5. Zynga’s forecast was $2.8 billion and moved to 2.9$ billion after the first quarter. We are now at $2.85 billion.

6. Small Giants last contingency is in January. 4 months away.

7. Zynga said the 3rd quarter would send headwinds on IDFA and by the 4th quarter Chartboost will be in place.

8. Star Wars Hunter will be the first console game with CSR2 to follow.

9. Cash flow is strong and we just purchased in China. Short term we have a hiccup.

Long term, I think this company has huge growth.